Overview

Background

The 3rd edition of the Confederation of Indian Industry's (CII) IFRS Summit 2011 (Summit) was held on 18 May 2011 at the Taj Mahal Palace, Mumbai. The Ministry of Corporate Affairs, Government of India (MCA) was the National Partner for this Summit, which was also supported by the Institute of Chartered Accountants of India (ICAI), the Institute of Company Secretaries of India (ICSI), the Institute of Cost and Works Accountants of India (ICWAI), National Stock Exchange of India (NSE), the Bombay Stock Exchange (BSE), National Institute of Securities Markets (NISM), The Chamber of Tax Consultants (CTC) and the Sales Tax Practitioners' Association of Maharashtra. KPMG was the Knowledge Partner for the Summit.

In accordance with India's commitment to converge with International Financial Reporting Standard (IFRS), the MCA issued a press release on 25 February 2011 notifying 35 Indian Accounting Standards converged with IFRS (referred to as Ind AS). Even though the final date of transition is yet to be announced by the MCA, notification of the final Ind AS is seen as one of the final steps towards IFRS convergence in India and thus the theme of the Summit - 'Final steps towards IFRS convergence'.

While finalising the Ind AS, the Indian standard setters have examined individual IFRS and modified the requirements wherever necessary, to suit Indian conditions. These modifications are routinely termed as 'carve outs'. Carve outs are generally perceived as non-desirable, since they would dilute the key purposes of converging with IFRS (for example, to have a common set of accounting standards across countries; enable Indian companies to raise capital in overseas markets in a seamless manner; provide higher level of comfort to overseas investors).

Several implementation issues have arisen during the process of operationalising Ind AS, including:

- Notification as to how income tax, including Minimum Alternate Tax (MAT) will be computed by companies that follow Ind AS

- Interactions and conflicts with provisions of the Indian Companies Act

- Impact on distributable profits

- Manner of quarterly reporting in the first year of convergence.

Objectives of the Summit

The objective of the Summit was to discuss the Ind AS implementation issues from the perspective of different stakeholders such as the MCA, ICAI, the International Accounting Standards Board (IASB), the Securities and Exchange Board of India (SEBI), National Advisory Committee on Accounting Standards (NACAS), the Ministry of Finance (MoF) and Indian companies. Specific matters addressed at the Summit were:

- Discussion on the issues and steps required to fully operationalise Ind AS

- Discussion on the impact of carve outs

- Discussion on how companies in India can choose the carve outs optimally to be compliant with Ind AS and yet have minimum departure from IFRS issued by the IASB

- Discussion on how reporting under Ind AS can become business as usual for Indian companies, and changes required in internal financial reporting framework and auditing processes

- Discussion on how Ind AS will impact cost of capital.

Next steps to implement Ind AS

A summary of next steps required to implement Ind AS is given below:

Notification of the new implementation dates Even though the final Ind AS standards were notified by the MCA in February 2011, the final date for adoption of Ind AS is yet to be notified. In its press release, the MCA stated that the implementation date will be announced later, once tax and other regulatory issues have been resolved. The regulators need to notify the new implementation dates and implementation approach.

One of the issues impacting the Ind AS implementation date relates to the impact of planned changes in IFRS. Over the next few months, significant changes are expected to IFRS. These changes (which include revised standards on revenue recognition, financial instruments, leases, insurance contracts and consolidation) are likely to become effective between 2013 and 2015. Thus, if India mandates implementation of the currently notified Ind AS prior to the date these changes in IFRS become effective, Indian companies would need to deal with another round of changes soon after implementing Ind AS. In such a situation, it needs to be determined whether Ind AS should be updated for the changes in IFRS; and the revised Ind AS implemented from a future date once the currently planned changes to IFRS are completed.

The U.S. and Japan are two major countries that are not yet fully converged with IFRS. However, both these countries have done significant work towards convergence.

The IASB and the U.S. Financial Accounting Standards Board (FASB) have been working together since 2002 to achieve convergence of IFRS and U.S. GAAP. Accordingly, a common set of high quality global standards remains a priority for both the IASB and the FASB. The staff of the Securities and Exchange Commission (SEC) has recently published a Staff Paper outlining a possible approach for incorporating IFRS into the U.S. financial reporting system. This approach would establish an endorsement protocol for the FASB to incorporate new or amended IFRS into U.S. GAAP. During a defined transition period (for example, five to seven years), the FASB would eliminate differences between IFRS and U.S. GAAP through standard setting. The Staff Paper notes that this approach is one of several ways that IFRS could be incorporated into the U.S. financial reporting system and that the SEC has not yet decided on the final approach to convergence. The SEC Chairman, Mary Schapiro, has indicated that the SEC expects to make this decision in 2011. Earlier in 2007, the SEC allowed foreign companies to prepare and submit financial statements without reconciliation to U.S. GAAP only if the financial statements are prepared using IFRS as issued by the IASB.

Similarly, the IASB and the Accounting Standards Board of Japan (ASBJ) have been working together to achieve convergence of IFRS and Japanese GAAP since 2005. This work was formalised in 2007 with the Tokyo Agreement. In December 2009, the Japanese Financial Services Agency (FSA) permitted certain qualifying domestic companies to apply IFRS for fiscal years ending on or after 31 March 2010.

Consideration needs to be given on whether implementation of Ind AS should be linked with the IFRS transition in the U.S. and Japan to better leverage from experiences of these large countries.

The risk with deferral of implementation dates is that the benefits of the signifi cant preparatory effort by various stakeholders would not be fully realised, and India may lose momentum in achieving its goal of converging with IFRS and the resultant benefits.

Notification of taxation approach

The MoF needs to determine how taxable profits, including MAT will be computed in the period subsequent to the transition to Ind AS. While there is significant international precedent around the approach of tax authorities to IFRS transition, the Indian regulators need to deal with certain unique issues due to the phased transition approach that is proposed in India; and also due to MAT provisions. While the MoF is currently addressing these issues, the taxation approach needs to be notified after holistically considering the following matters:

- Would the starting point for taxation be Ind AS or some other basis?

- If the starting point is not Ind AS, how should profits per Ind AS be reconciled to taxable profits? Where should the reconciliation be disclosed? How should the reconciliation be certified?

- If the starting point is not Ind AS in the initial years, should there be a plan to converge Ind AS and the taxable basis at some stage in the future?

- If taxable profits are computed on a basis other than Ind AS, how should MAT be calculated – based on Ind AS or after making some adjustments to the Ind AS profits?

- What is the impact of the phased approach to implementation of Ind AS, on the above matters?

- What is the impact of the Direct Tax Code on the above matters?

In several countries, companies are required to maintain separate records for taxation purposes, either based on local GAAP or based on separate taxation standards. For example, Germany adopted IFRS in 2005 for consolidated financial statements. However, German companies prepare their tax returns in accordance with the German Tax Code and not IFRS. On the other hand, companies in the UK have been given a choice of calculating tax either based on IFRS or based on local UK GAAP. Similarly, several countries have provided specific guidance on the treatment of one-time adjustments that arise from transitioning of the tax basis from one set of standards (local GAAP) to another (IFRS). For example, companies in Spain were permitted to consider the impact of these adjustments over a period of 5 years, for tax purposes.

Amendments to the Companies Act

In addition to amendments to the general provisions relating to the accounting standards to be used for preparation of financial statements, several specific provisions of the Companies Act will need to be amended. For example, under Section 391- 394 of the Companies Act, it is a common practice in India for courts to approve schemes of amalgamation and mergers, and as part of this approval, define the accounting treatment. Such an accounting treatment may not be in line with the requirements of Ind AS. Similarly, Section 78 of the Companies Act permits companies to use the securities premium account to charge-off certain issue expenses on debentures. However, under Ind AS, these expenses would need to be charged-off to the income statement. The regulators need to comprehensively identify all such confl icts and make the necessary amendments.

The regulators also need to determine the manner in which distributable profits would be calculated subsequent to the transition to Ind AS. For example, Ind AS profits would include several unrealised gains (for example, unrealised gains on derivatives and trading investments); and Ind AS reserves would include similar unrealised reserves (for example, onetime revaluation of fixed-assets and periodic mark-to-market on certain investment securities). Ind AS comprehensive income would also include items reported as Other Comprehensive Income. The impact of all these items on distributable reserves needs to be notified. Several countries have restricted such unrealised items from being available for distribution as dividends.

Determination of the approach to be followed by regulated entities

Banks, insurance companies, power distribution companies and similar regulated entities are required to follow specific financial reporting principles. The relevant industry regulators need to address the conflicts between Ind AS and such industry-specific financial reporting principles.

The Reserve Bank of India (RBI) and the Insurance Regulatory Development Authority (IRDA) have formed working groups to determine the impact of Ind AS convergence on banks and insurance companies respectively.

Determination of the approach for reporting to SEBI

Currently, SEBI permits listed companies to adopt IFRS as issued by the IASB and report consolidated results under IFRS. Some companies have already elected this option and are currently reporting under IFRS. SEBI needs to determine whether this option will continue to be available subsequent to implementation of Ind AS. Further, SEBI needs to determine whether quarterly reporting would be in accordance with Ind AS. Lastly, SEBI also needs to determine whether companies can voluntarily early adopt Ind AS for consolidated financial statements, prior to the mandatory implementation by the MCA.

Carve outs and their impact

Ind AS include certain modifications from IFRS as issued by the IASB. These modifications are routinely termed as 'carve outs'. Carve outs in India have largely been a result of the discussions between the regulators, Indian companies and industry associations; and have largely been incorporated to ease the transition process. For example, certain exemptions such as the option to carry-forward the Indian GAAP carrying value of property, plant and equipment as deemed cost, would significantly ease the transition process for Indian companies.

However, carve outs dilute the credibility of financial statements and their comparability on a global basis. Carve outs also raise issues on the acceptance of local financial statements for raising capital in the global capital markets, and may thereby prevent a company from realising the full benefits of the transition to IFRS. Accordingly, carve outs are generally perceived as undesirable by international stakeholders. For example, the IASB strongly recommends the 'Adoption of IFRS' approach rather than 'Convergence with IFRS' approach as the Adoption approach ensures that the end objective of developing a single set of global accounting standards is met. The Convergence approach dilutes this objective as countries tend to introduce carve outs that deviate from IFRS.

Given the carve outs in Ind AS, international stakeholders may have the following concerns, which need to be addressed:

- What is the technical basis for each carve out?

- Is there a rigorous process for determining the carve outs with open meetings and a published basis of conclusion?

- Who finally decides on the need for carve outs?

- Are the users of the financial statements (including investors or analysts) fully involved in the process?

Addressing the above concerns in a structured manner would provide a reassurance to international stakeholders on India's standard setting process. Further, this would also ensure that India's views on specific provisions of IFRS are shared with international stakeholders, which may act as a trigger for future changes to IFRS itself. This approach would also increase India's participation in the IFRS standard setting process. Thus, where the IASB is debating on two alternate choices for a certain accounting treatment, India's support towards one of the views could influence the final choice. For example, countries like Malaysia and Sri Lanka have been actively participating in international discussions on topics such as revenue recognition by real estate developers and agriculture accounting respectively.

One of the other ways to address concerns around carve outs is to provide a choice to Indian companies to fully adopt IFRS issued by the IASB voluntarily whereby the carve outs can be made optional. Voluntary adoption of IFRS is allowed by certain other countries such as Japan and the U.S. (for foreign companies). This approach would ensure that companies that seek to fully comply with IFRS have the option to do so, and investors and other stakeholders can influence the decisions of companies to follow IFRS or the alternate policies under Ind AS. Even as Indian regulators and standard setters seek to deal with the above concerns, it is important to start the process for implementing Ind AS (which have been notified after significant deliberations over an extended period). To ensure that convergence is a continuous process, the notified Ind AS can be subsequently amended based on the results of deliberations on the above issues (including discussions with the IASB).

Nature of carve outs

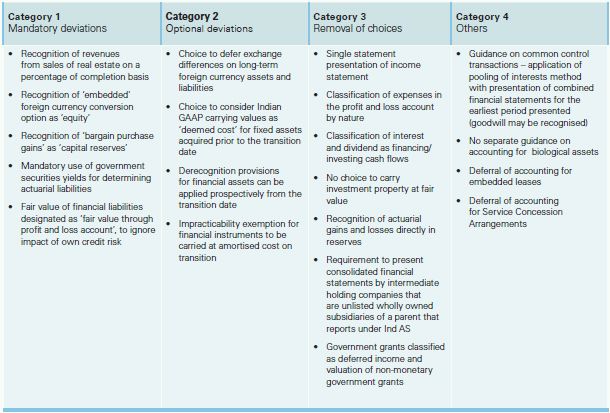

Carve outs included in Ind AS can broadly be categorised as:

- mandatory deviations from IFRS

- optional deviations from IFRS

- removal of choices given under IFRS

- others.

The mandatory deviations from IFRS may impact a relatively smaller number of companies. Optional deviations from IFRS can be avoided if a company does not adopt the diluted options given under Ind AS. The removals of existing choices under IFRS do not result in non-compliance with IFRS. However, they may impact comparability with global peers. Apart from these, there are certain accounting standards that have not yet been issued under Ind AS or will become applicable at a date subsequent to the transition date.

A summary of the key Ind AS carve outs is presented in the table below.

How can Ind AS become 'business as usual'?

Background

Many countries have already made a transition to IFRS. Their experience highlights the importance of investing time and effort early, to achieve the end goal of making IFRS 'Business As Usual' (BAU). The transition to Ind AS will not only impact the financial statements and financial reporting process, but also have entity wide implications for people, processes and systems.

The experience of many first-time adopters in India and abroad highlights that while the first-time transition may require significant time and efforts, a structured approach can result in embedding the new reporting, and significantly reduce the time and efforts required for reporting in subsequent periods.

Role of the management

For Ind AS to become BAU, companies would need to change their mindset and approach. The entire process of transition would necessitate a steep learning curve involving unlearning the current principles and learning the new principles. Following are some of the considerations in making Ind AS into BAU:

- Top management to set the tone on transition to IFRS; devise a detailed strategy for the process; and provide continuous support.

- " Identify a mentor for the entire process of transition and set up a steering committee.

- Before identification of GAAP differences, companies should spend time to fully understand their existing financial reporting principles and policies.

- The transition process could span a period of several months and would need involvement of people from various departments of the company. The project should not be restricted only to the accounts department.

- Companies would need to understand the impact of the transition in relation to requirements of resources, and changes to the operating and IT processes.

- There could be an impact on the Management Information Systems (MIS) reporting, budgetary processes and senior management compensation. Business and marketing departments would need to understand the impact of the transition and how the changes could impact key performance indicators.

- Companies should be cautious about the impact of transition to Ind AS on the key ratios such as current ratio, debt service coverage ratio and fixed assets coverage ratio, and the corresponding impact on debt covenants

- Proactively involve the auditors to avoid last minute surprises.

- Resources across the company would need to be trained, and would need to be aware of the impact of the transition on their respective areas of activities. It could take substantial time and effort to train resources across the company.

- After identification of the GAAP differences, evaluate the complexity of the transition; identify the in-house capabilities; allocate jobs; determine the need for assistance from external specialists; and assess whether IT systems need to be modified, re-mapped, re-configured or updated.

- Identify how to reduce human intervention and make the new financial reporting requirements more automated. The new reporting process could have a significant impact on the IT systems - core systems, finance systems and reporting systems. Companies would need to understand the impact of the transition on their IT systems, and also determine how the changes in the information requirements would be incorporated into the IT systems.

- Preparation of draft financial statements through iteration process and parallel runs.

- Review the entire process continuously with the end goal in mind.

- Remember that Ind AS is not static. The transition plan should be flexible to address any changes occurring in Ind AS.

Role of governing body and auditors

The process of transition would have an impact on various stakeholders (Audit Committee, Board of Directors and external auditors), and companies should try to engage with such stakeholders through the transition process. Stakeholders will need to be informed and educated to enable them to understand the impact of the transition on the company. In this process, some of the important considerations are:

- Though transition to IFRS is the management's responsibility, the process would require thoughtful and ongoing oversight by the audit committee and the board of directors.

- Initially, audit committees and boards will need to focus on the major elements of this journey. What are the implications of making the transition to Ind AS? Are critical milestones being met in the process of transition to Ind AS? How can the audit committee gain comfort that everything is or will be in place?

- Due to the significant judgment involved in application of Ind AS, it would be imperative for the auditors to better understand the business of the company. This would be essential to ensure that the Ind AS have been correctly applied in the context of the company.

- Auditors would be required to upgrade their knowledge and skills sets for understanding the new framework. Further, over time auditors would be required to upgrade their processes and devise new audit procedures to ensure that appropriate audit evidence is obtained.

Impact on investors and cost of capital

Transition to Ind AS would also have an impact on investors and potentially the cost of capital. Important considerations include:

- Companies would need to spend time to educate analysts and investors on the impact of adoption of Ind AS. International analysts might have experience and knowledge of IFRS based on their dealings with international companies. However, many analysts may not have such experience. Retail investors would also need to be educated since the adoption of Ind AS could pose a major concern for the retail investor community

- Although the companies should move forward based on their own strategy and initiative, there could be peer pressure as investors would compare how different companies are progressing

- Even though Ind AS may not directly affect underlying business economics, it may have an impact on the way financial information of the company is analysed and assessed

- Transition to Ind AS is likely to be welcomed by investors and analysts due to the following reasons:

- Integration with global norms increases comparability

- Clearer performance and risk measures

Additional disclosures

- Changes in measurement basis - fair value versus the historical cost method

Substance over form.

- A study done by the Association of Chartered Certified Accountants (ACCA) UK, noted that in countries where equity-based financing dominates and where corporate disclosure quality is already high (for example UK); there was a significant reduction in the cost of equity capital following the implementation of IFRS. Transition to Ind AS may generally lead to higher price earning multiple, which could result in a lower cost of capital.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.