The new German Capital Investment Act (Kapitalanlagegesetzbuch, "KAGB") enters into force on July 22, 2013. The KAGB will replace the Investment Act (Investmentgesetz, "InvG") and is supposed to regulate, for the first time, the entire German investment law. While the AIFM Directive ("AIFMD") aims at creating a harmonized regulatory framework and an internal market for the managers of alternative investment funds, the German legislator implemented the AIFMD in the KAGB thereby creating a cohesive set of rules for all openand closed-end funds and their managers in Germany. Unlike other European legislators such as the Luxembourgian, the German one goes beyond the goals of the AIFMD and provides for a comprehensive regulatory framework for all domestic fund products. In addition to the KAGB, the Commission's Delegated Regulation (EU) No 231/2013 of December 19, 2012 applies. As a Level 2 measure it supplements the AIFM Directive. Further Level 2 measures will become effective by July 22, 2013, which is the latest date on which the member states must have implemented the AIFMD (Art. 66 AIFMD).

Sphere of Application

The KAGB applies when there is an "investment undertaking" as laid down in Sect. 1 para. 1 KAGB. The investment undertaking, therefore, is a central concept of the future German investment law. In accordance with Art. 4 para. 1 (a) of the AIFMD, the KAGB defines investment undertakings rather broadly: An investment undertaking is "any entity for collective investment which collects capital from a number of investors in order to invest it following a defined investment strategy for the benefit of these investors, and which is no operating company outside the financial sector."

The recently published paper of BaFin from June 14, 2013(http://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Auslegungsentscheidung/WA/ae_130614_Anwendungsber_KAGB_begriff_invvermoegen.html) indicates how BaFin will interpret the individual elements of this definition.

The term "entity" comprises all legal forms (partnerships, companies limited by shares, funds), regardless of the type of investor participation (equity instruments, participation rights, or bonds). However, individual relationships (such as they exist in managed accounts) or parallel participations of investors that do not have an organizational relationship with each other (such as club deals) are not included.

The expression "for collective investment" means that the investor participates (also to a limited extent) not only in the profits but also in the losses of the invested assets. Instruments granting a fixed claim to payment or an unconditional claim to capital repayment must be differentiated from this (for instance, bonds or deposits). "Collecting capital from a number of investors" comprises not only direct and indirect steps to raise capital from one or more investors, but also any commercial communication aiming at raising capital. A "number of investors" is already given if the number of investors is not limited to one investor (Sect 1 para. 1 sentence 2 KAGB), even if there is in fact only one investor. Furthermore, the entity must invest the collected capital "following a defined investment strategy". This requires that the criteria according to which the capital is supposed to be invested are more specific than a general company strategy or the financing of a general business activity. The opportunities given to the management company must be restricted in the investment conditions, the articles of association or the partnership agreement.

The interpretation of the investment attribute "for the benefit of the investors" still needs clarification. From BaFin's perspective, this attribute is not fulfilled if the monies collected are used in-house. This is the case if, among other things, the issuer is not obliged to invest in assets based on an internally generated index or reference portfolio, or if the interest of the repayment amount is determined or calculable by a formula or a composition of the underlying assets on which the provider has no more leeway in decision-making after the transfer of the monies. Additionally, this interpretation provides for numerous questions of definition, for instance how to include swap-based ETF in the concept of investment undertakings when the issuer does not invest in the index values and has no influence in the composition of the index.

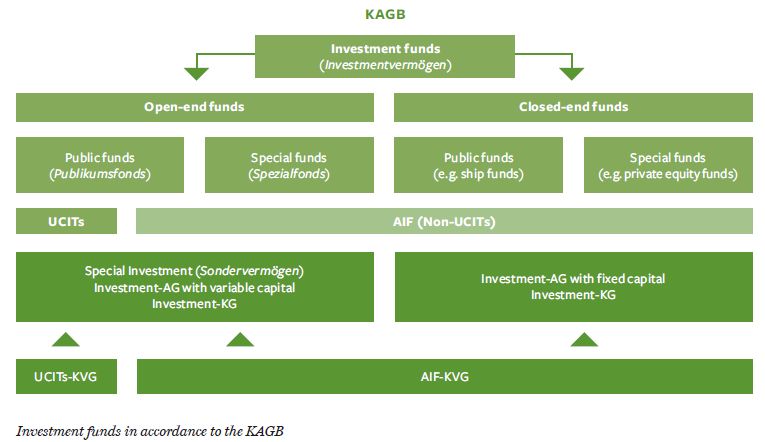

The negative defining attribute that the entity may not be "an operating company outside the financial sector" is, in a way, the backside of the attribute "defined investment strategy". It allows companies that operate facilities for renewable energy without outsourcing them, run a business (e.g., a hotel) situated on a land plot, or store raw materials to be exempt from the KAGB. Based on this defining attribute, the question must be answered whether or not real estate corporations and REITs can be considered investment undertakings in accordance with Sect. 1 para. 1 KAGB. BaFin answers this in affirmative with regard to German REIT corporations. Within the concept of investment undertakings, the KAGB differentiates between entities for the collective investment in securities (UCITS) pursuant to the UCITS-IV Directive (Sect. 1 para. 2 KAGB) and all other investment undertakings which are referred to as "Alternative Investment Funds" ("AIF") (Sect. 1 para. 3 KAGB). AIF, again, can be open or closed investment undertakings (Sect. 1 para. 4 and 5 KAGB). What distinguishes them is whether or not investors may return their shares at net asset value at least once a year.

Important for product regulations and distribution specifications are further differentiations between public investment undertakings and special AIF, whose shares may be held only by semi-professional and professional investors (Sect. 1 para. 6 KAGB). With regard to the term "professional investor", the KAGB refers to Attachment II of the Directive on Markets for Financial Instruments (Sect. 1 para. 19 no. 32 KAGB), which specifically covers credit institutions, investment firms, insurance companies, investment corporations, large companies as well as governments and supranational institutions.

The concept of semi-professional investors refers to each investor who either

- invests at least EUR 200,000 and who, as certified by the capital investment company (Kapitalverwaltungsgesellschaft, "KVG") or the placement agency, has the necessary experience to understand the investment risks or who

- invests at least EUR 10 million.

While the repealed Investment Act (Investmentgesetz, "InvG") was based on a formal investment concept according to which this Act only applied if the fund types provided for in the InvG were managed but all other fund products were permitted, the KAGB introduces a substantive investment concept. Consequently, the management of AIF that do not comply with the requirements of the AIFMD is inadmissible. But as the legislator also lays down restricting product regulations for AIF with regard to the available legal forms and the investment policy, the management of investment undertakings which do not comply with the requirements of the KAGB becomes an illegal investment transaction (see Sect. 15 para. 1 KAGB).

Entities explicitly exempt from the KAGB are holding companies, institutions providing for occupational pension schemes, certain state institutions and special purpose vehicle companies (Sect. 2 para. 1 KAGB). The KAGB does not apply, either, to family offices, insurance agreements, joint ventures and group-internal investment undertakings (Sect. 2 para. 3 KAGB).

Licensing requirements

Each company with its head office and central administration in Germany whose business activities aim at the management of investment undertakings on its own responsibility (not acting as an outsourcing company) is considered a KVG and requires approval by BaFin (Sect. 17 para. 1 KAGB). Depending on the type of managed investment undertaking, the KAGB differentiates between UCITS-KVG and AIF-KVG (Sect. 17 para. 1 KAGB). The KVG can be designated either as external KVG by or on behalf of the investment undertaking, or the investment undertaking manages itself autonomously as an internal KVG (Sect. 17 para. 2 KAGB). An investment undertaking is managed if at least the portfolio management or the risk management is rendered for an investment undertaking. It then requires an authorization. However, the authorization as a KVG cannot be granted if, among other things, the company renders the portfolio management, but does not render the risk management, or vice versa (Sect. 23 no. 10 KAGB). For the management of UCITS or AIF individual admission procedures are provided for as a KVG; however, reliefs apply if both admissions are aimed at (Sect. 21 para. 5 KAGB).

The legislator arranged the content of the applications for authorization for UCITS-KVG and AIF-KVG almost identically. This concerns aspects such as proof of initial capital, information on the managing directors and owners of important participations, presentation of a business plan including a description of the organization and control procedures, and a presentation of the company agreement of the KVG (Sect. 21 para. 1 and Sect. 22 para. 1 KAGB). Moreover, an AIF-KVG must provide comprehensive information on its outsourcings, remuneration policy, depositary, its investment strategies and the managed AIFs (Sect. 22 para. 1 no. 8 et seq. KAGB). Despite the requirement to hand in extensive documentation, the review period of BaFin is generally three months for a complete application for an AIFKVG, while it is six months for an UCITS-KVG (Sect. 21 para. 2 and Sect. 22 para. 2 KAGB). For AIF-KVG, a two-step procedure is possible: While permission can be granted to the AIF-KVG already upon completion of the information on the KVG or investment strategies (Sect. 22 para. 3 KAGB), the management of AIF may be started no earlier than one month after the subsequent submission of AIF-specific and other documents (Sect. 22 para. 4 KAGB).

It must be clarified how this two-step procedure impacts on the requirement to approve the investment conditions of newly launched AIF: While the investment conditions of public AIF must be reviewed within four weeks (Sect. 163 para. 2 KAGB), the investment conditions of special AIF only require submission to BaFin, i.e., they do not have to approved (Sect. 273 sentence 2 KAGB). This contradiction could be resolved in a way that the one-month waiting period associated with the two-step procedure only applies to first-time AIF that must be allocated to a specific investment strategy.

BaFin specified in a bulletin the individual documents for an AIF-KVG, particularly as regards the suitability of the managing directors. However, there is no indication whether the managing directors of closed fund vehicles have the necessary expert knowledge for a position as a managing director of an AIF-KVG. Until now, they were usually not employed by a regulated company. In these cases it seems appropriate that the application for admission contains a plausible explanation by the managing directors how they will acquire the necessary theoretical and practical skills in the first time of their employment; this, however, should not be a hindrance to granting the approval as an AIF-KVG for closed AIF. The so-called "small KVG" does not require approval, but only registration (Sect. 44 para. 1 KAGB). They comprise, inter alia, those KVG that (i) manage exclusively special AIF and whose managed investment undertakings (incl. leverages) do not exceed EUR 100 million or (ii) whose assets (without leverage) do not exceed EUR 500 million and which do not grant their investors any return rights within the first five years (Sect. 2 para. 4 KAGB). This also concerns KVG that manage exclusively domestic closed AIF and whose assets (incl. leverage) do not exceed EUR 100 million (Sect. 2 para. 5 KAGB).

Supervisory requirements on the KVG

The KAGB imposes a great number of ongoing supervisory requirements on the KVG regarding their organization and conduct, parts of which correspond to existing specifications to capital investment companies in accordance with the repealed Investment Act and the Investment Conduct and Organization Directive (Investment-Verhaltensund Organisationsverordnung, "InvVerOV"). Particularly the unregulated managers of closed fund vehicles (with the exception of small KVG) face a considerably increasing intensity of regulation. The supervisory requirements apply equally on UCITS-KVG and AIFKVG. The supervisory requirements on AIF-KVG are specified in the EU Regulation. Each KVG is obliged to perform its tasks solely in the interest of the investors and independent of the depository (Sect. 26 para. 1 KAGB in conjunction with Art. 18 EU Regulation).

The content of this principle and the provisions resulting from it concerning diligence, special knowledge, a fair treatment of investors and maintaining the integrity of the market are identical with the previous provisions laid down in the repealed Investment Act and the InvVerOV. A new factor is the legal emphasis that a misuse of market practices (e.g., late trading or market timing) must be prohibited (Sect. 26 para. 6 KAGB in conjunction with Art. 17 EU Regulation). Regarding the choice of assets, stricter requirements going beyond the provisions of the InvVerOV apply to the investment in restricted liquid assets, for instance that a business plan or investment plan must be drafted, the term of the assets must be in accordance with the duration of the funds, and the transaction must be analyzed in advance regarding its risks and all legal, tax, financial and other value related factors and potential sales options (Art. 19 EU Regulation). For KVG of closed AIF, this results in an increased documentation and review effort prior to the actual investment. To protect the investors, the KVG must take any measures to identify, prevent, settle and monitor all conflicts of interest (Sect. 27 para. 2 KAGB in conjunction with Art. 30 et seq. EU Regulation).

The regulations basically correspond to the provisions applicable to capital investment companies laid down in the repealed Investment Act and the InVVerOV, but they are more detailed. Express provisions regarding the treatment of conflicts of interest in connection with the return of shares to AIF are new (Art. 32 EU Regulation).

The organizational tasks of KVG comprise an appropriate risk management and complaint system, the necessary resources, provisions on personal businesses, an extensive documentation, and appropriate control procedures, including the development of an internal audit and a compliance function (Sect. 28 para. 1 and 2 KAGB in conjunction with Art. 57 et seq. EU Regulation). In this regard as well, the requirements correspond to the core of the previous provisions laid down in the repealed Investment Act and the InvVerOV. An organizational focus of the KVG is the development of a risk management system and a risk controlling function which is independent of the operational area and must be separated from it (separation rule).

The risk management system must be capable of identifying, measuring, controlling and monitoring the essential risks of each investment strategy (Sect. 29 para. 2 KAGB). Thus, there are no significant differences from the obligations arising from the repealed InvG and the InvVerOV. Furthermore each managed AIF is required to have an appropriate liquidity management system (with the exception of closed AIF without leverage) (Sect. 30 para. 1 KAGB). The KVG must monitor the liquidity risks to ensure that the liquidity profile of the investments is in line with the underlying liabilities of the investment fund in consideration of the investment strategy and the principles of return; this must be ensured by stress tests (Sect. 30 KAGB in conjunction with Art. 47 et seq. EU Regulation). This requirement is also already known from the repealed InvG and the InvVerOV. Also, AIF-KVG have to define a remuneration system for their managing directors and for employees whose activity has a considerable influence on the risk profile (risk bearers), who exercise a control function or whose total remuneration is equivalent to that of the managing directors and risk bearers (Sect. 37 para. 1 KAGB). This measure aims at replacing remuneration systems enabling shortterm profits by accepting high risks with remuneration systems that have a long-term orientation.

The remuneration system may not offer incentives for taking risks that are incompatible with the risk profile and the investment conditions. Attachment II of the AIFMDprovides further detail on the requirements on the remuneration system, inter alia, with regards to the long-term orientation, the relevant remuneration factors, and the arrangement of variable remuneration components. As a result, the KVG must adapt themselves to a remuneration system similar to that laid down in the InstitutsVergV for credit und financial services institutions. The KAGB also provides for extensive provisions for the assessment of assets for all types of investment undertakings and requires the development of internal valuation guidelines (Sect. 168 et seq. KAGB in conjunction with Art. 67 et seq. EU Regulation, Sect. 271, 278, 286 KAGB).

The valuation can be done by an independent, external evaluator or – if the evaluation is done functionally independent – by the AIF-KVG itself or the depository (Sect. 216 para. 1 KAGB). The proposal made by the Bundesrat (German Federal Council) to consider committees of experts as evaluators in accordance with the provisions of the repealed Investment Act, was rejected by the Bundestag. With regard to closed public AIF, stricter requirements apply for the first evaluation of assets. In these cases, it is mandatory that the evaluation is done by an external evaluator. The purchase price of tangible assets may not or only marginally exceed the established value (Sect. 261 para.s 5 and 6 KAGB). The requirements applicable on UCITS and AIFKVG regarding the outsourcing of tasks to another company (outsourcing companies) have been increased, compared to the requirements laid down in the InvG (see Sect. 16 InvG) (see Sect. 36 para. 1 KAGB in conjunction with Art. 75 et seq. EU Regulation).

The KVG must particularly be able to justify its entire outsourcing structure based on objective reasons (Sect. 36 para. 1 no. 1 KAGB). Compared to the previous legal situation, the KVG will face a higher documentation effort: on the basis of criteria such as the optimization of business functions, cost savings, specialist knowledge of the outsourcing company and/or specific relationships and approaches of the outsourcing company, it must provide a detailed description and proof of its reasons for outsourcing (Art. 76 EU Regulation). The EU Regulation contains specific requirements on the resources of the outsourcing company and the experience and reputation of the persons entrusted with the outsourced tasks (Art. 77 EU Regulation). Contrary to what was laid down in the repealed Investment Act, outsourcing must now be previously announced to BaFin (Sect. 36 para. 2 KAGB). Specific requirements apply when portfolio management and risk management are outsourced (Sect. 36 para. 1 no. 3 and 4 KAGB).

They may by no means be outsourced to the depository, subdepository or another company having a conflict of interest (Sect. 36 para. 3 KAGB). They only can be outsourced if the outsourcing company is admitted or registered to render asset management or financial portfolio management and is subject to a supervisory authority, or – if the outsourcing company does not comply with these requirements – if BaFin approves the outsourcing nonetheless.

As a consequence, particularly UCIT management companies, external AIF-KVG, credit institutions and investment companies being authorized to render portfolio management may be considered as outsourcing companies (Art. 78 para. 2 EU Regulation). Outsourcing is not possible in an extent that the KVG becomes a letter-box company and cannot be considered as a management company any longer (Sect. 36 para. 5 KAGB). By listing specific circumstances, the EU Regulation attempts to specify the threshold above which an inadmissible outsourcing has to be assumed. These circumstances include, e.g., a missing specialist knowledge and resources for an effective monitoring of the entrusted tasks, the loss of the management function or the contractual rights to inspection, access or instructions, or a clear exceedance of the entrusted tasks compared to the tasks remaining with the KVG (Art. 82 EU Regulation). Nevertheless, considerable uncertainty remains in practice on the question whether previously successful business models such as the German Master-KAG (Master Capital Investment Company) can continue to exist on the same basis.

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

To view the full article click here

© Copyright 2017. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.