To date, acquisitions of banks by private equity sponsors have been rare in Ger- many. One of the reasons may be that, as a result of the financial crisis, obtaining the required regulatory approval has become more complex and time-consuming and thus a decisive factor in the course of a transaction. The regulatory require- ments for the design and implementation of such transactions and the approval practice of the supervisor shall be highlighted and discussed in the following.

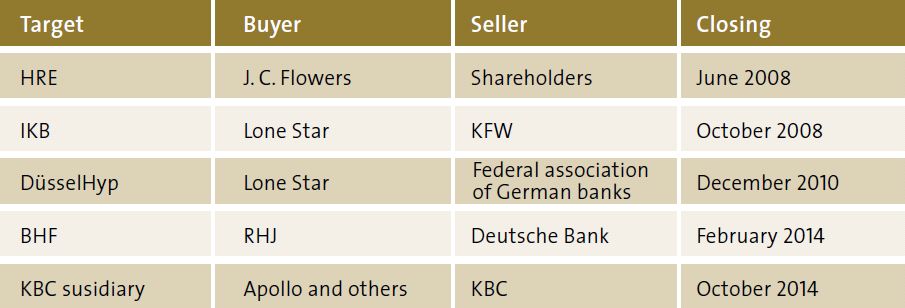

Following earlier cases of investments in (partly non-performing) banks (for example the investment by J.C. Flowers in HRE, the acquisition of IKB by Lone Star in 2008 or the purchase of the Düsseldorf mortgage bank DüsselHyp also by Lone Star in 2010) there have been a few examples in 2014, namely RHJ's acquisition of BHF Bank (meanwhile sold on to Oddo) and the acquisition of the German KBC subsidiary by a consortium of the Teachers Retirement System of Texas, Apollo Global Man mercial Real Estate Finance as well as Grovepoint Capital.

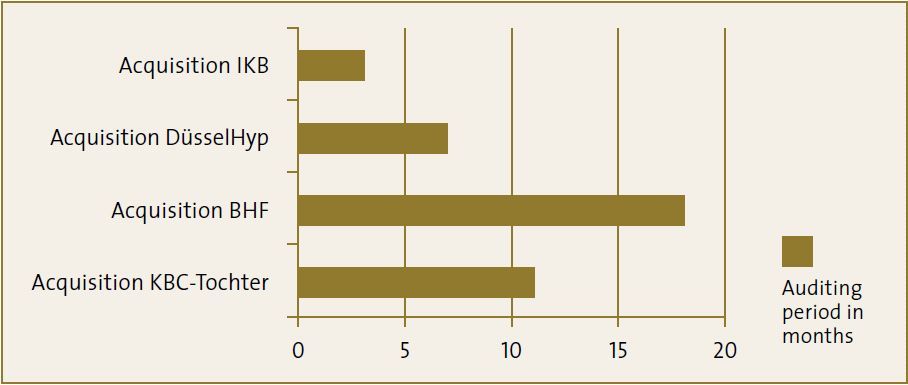

It is noteworthy here that the supervisory approval have over time become increasingly complex and time-consuming.

Duration of BaFin Auditing Proceedings

In case of private equity transactions, the reason for this may be the particular- ly burdensome transparency requirements, which may extend not only to direct and indirect shareholders and investors, but also to other portfolio companies of the sponsor. Moreover, it may be difficult to align the investment approach typi- cally taken by private equity sponsors with the requirement to commit to a sus- tainable long-term business and risk plan which meets the expectation of the su- pervisor, possibly combined with the requirement to show a general willingness to provide additional equity and liquidity in the event of a crisis. Nevertheless, in view of the existing consolidation pressure in the banking sector, it is quite con- ceivable that private equity sponsors will be more inclined to invest in this sector.

Regulatory requirements for private equity investors

The regulatory requirements for bank acquisitions present particular challenges for private equity investors due to their organizational structures and their typi- cal investment approach. The transparency requirements, commitments to bind- ing long-term business plans, as well as equity and liquidity requirements are particularly noteworthy in this regard. These challenges do not only occur as part of the Ownership Control Procedure in a regulatory context, but also arise where the target bank is a member of the German Depositary Protection Fund and its ongoing membership therefore requires a separate control procedure by the auditing Association of German Banks (Prüfungsverband deutscher Banken e.V.).

To view the article in full click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.