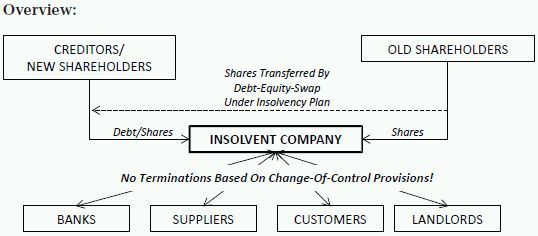

We would like to introduce you to a great new feature of the revised German Insolvency Act which makes debt-equity-swaps in Germany (e.g., as part of loan-to-own transactions) a lot more attractive. It eliminates troubles caused by change-of-control provisions in agreements between an insolvent company and third parties.

Introduction: Debt-Equity- Swaps Now Possible Under German Insolvency Act

Effective 1 March 2012, the "Act for the Further Facilitation of the Restructuring of Companies" (Gesetz zur weiteren Erleichterung der Sanierung von Unternehmen, ESUG) significantly improves the position of creditors in insolvency proceedings over the assets of German companies.

Among other things, the revised German Insolvency Act (Insolvenzordnung) opens up the opportunity to force a debt-equity-swap against old shareholders by an insolvency plan. It gives creditors the chance to exchange their debt against the insolvent company for shares in that company.1

What is the New Feature of Debt-Equity-Swaps Under the Insolvency Act?

Change-of-control provisions are blocked by a debt-equity-swap under the German Insolvency Act!

What is a Change-of- Control Provision?

It is common practice that companies are subject to so-called change-of-control provisions in various agreements with banks, suppliers, customers, landlords etc. In sum, change-of-control provisions grant a counterparty the right to terminate an agreement if the shareholdings in the company change. The change-of-control events vary from a transfer of 30 percent to 50 percent of the shares or of the voting rights.

What are the Usual Impacts of Change-of-Control Provisions?

If material agreements include change-of-control provisions the respective counterparties are usually required to obtain consent before a change of ownership may be effected. This avoids undesirable terminations of such agreements. This avoids undesirable terminations of such agreements. First, the respective change-of-control provisions must be indentified in all material agreements. Then, various counterparties must be convinced to grant their consent. Finally, if the counterparties are willing to grant consent, it may still be a lengthy (and expensive!) process until the signatures have been obtained.

What Does the New Insolvency Act say About Change-of-Control Provisions?

Pursuant to Section 225a (4) of the new German Insolvency Act:

- Third parties may not terminate/ withdraw from agreements with the insolvent company

- Based on corporate measures taken with respect to the insolvent company (including debt-equity-swaps)

- If such measures are effected by an insolvency plan

The law blocks change-of-control provisions in connection with debt-to-equity swaps. This includes change-of-control provisions as well as any other provisions enabling a counterparty to terminate/withdraw from an agreement with the insolvent company because of corporate measures in an insolvency plan. Contrary provisions are void. Termination rights based on a breach of other contractual obligations are not affected.

How Does This Support a Successful Restructuring?

If a creditor uses a debt-equity-swap under an insolvency plan, it must not worry about counterparties terminating agreements with the company based on the change of ownership. Thus, there is no need to contact counterparties to obtain consent. A new shareholder may focus on restructuring the insolvent company and may rely (at least from a legal perspective) on the continuation of existing business relationships.

What About a Group of Companies?

The current German Insolvency Act applies on an entity-by-entity basis, i.e., there is no "group insolvency" yet. Change-of-control provisions are blocked to the extent a termination right would be exercised against the insolvent entity that is subject to a debt-equity-swap. This may only be avoided if insolvency plans are introduced on the level of each operating entity that might be subject to change-of-control issues. The German government is currently working on further revisions whereby it might be possible to apply insolvency proceedings on a group of companies in the future (Konzerninsolvenz.)

Footnote

1. For a general overview of the ESUG, please see Latham & Watkins LLP Client Alert No. 1257 dated 14 November 2011. It is available online at www.lw.com (under Resources / Firm Publications.)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.