Merger Control ‑ Procedural Aspects

Merger control issues should be considered early in any transaction timetable. Early consideration allows the parties to identify potential obstacles to the transaction – and possible solutions – early on and is also helpful in cases that clearly do not raise competition concerns, to ensure that the necessary clearances are obtained prior to the expected completion date.

Approximately 100 countries operate merger control regimes. Many of these merger control regimes are mandatory with strict tests to determine whether a merger must be notified, in most cases based on the parties' turnover or on shares of supply/market shares.

Parties should seek advice for all jurisdictions where the merger may produce a change in the status quo. Failure to notify a merger can result in the transaction being void as well as in fines1 . Fines can be substantial, e.g. the European Commission can fine companies up to 10% of their worldwide group turnover for merging without notifying the Commission.

This briefing sets out the thresholds for notifications in the EU and Germany and provides an introduction to EU and German merger control procedures. It does not deal with substantive aspects of merger control, namely whether any merger that needs to be notified may give rise to competition concerns.

EU Merger Control

The European Commission has exclusive jurisdiction under the EU Merger Regulation (the "EUMR")2 to investigate mergers and joint ventures within the EU which fulfil the filing requirements under the EUMR.

When is a filing required?

The EUMR applies to concentrations with an EU dimension. There are two elements to this test: (1) is there a concentration? and (2) does it have an EU dimension?

A concentration arises where there is a change in control on a lasting basis. This includes a change in the quality of control (e.g. where one jointly controlling shareholder exits a joint venture). Temporary changes of control will not meet this test, although the Commission has found joint ventures lasting no more than eight years to be concluded "on a lasting basis".3.

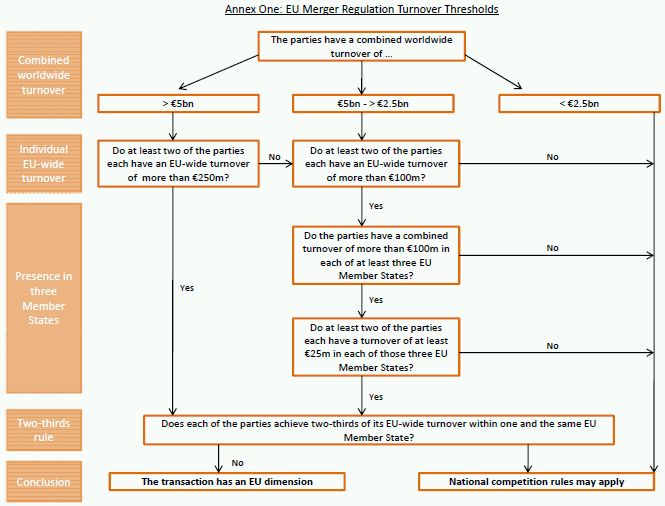

Whether a concentration has an EU dimension is determined by the parties' turnover (see Annex One for a detailed guide to the turnover test under the EUMR). As a starting point, though, a merger will not have to be notified to the European Commission unless the merging parties have:

- a combined worldwide turnover of more than €2.5bn; and

- at least two of the merging parties each have a turnover exceeding €25m in each of at least three EU Member States.

If sole control is acquired, the acquirer's group turnover and the turnover of the target (including any subsidiaries) will count, whereas the seller's turnover is not relevant. In cases involving joint control, however, the turnover of a jointly controlling parent company will also be taken into account. Accordingly, joint ventures are more likely to meet the notification thresholds than other transactions.

Because of the exclusive jurisdiction of the European Commission, mergers that meet the EU notification criteria only need to be notified to the European Commission and not to the competition authorities in any of the EU Member States. If the EUMR does not apply, notification requirements in the Member States need to be assessed. The parties may request that the merger is reviewed by the Commission if the merger meets the notification requirements in three or more Member States. Similarly, a merger that is notified to the European Commission may be wholly or partially referred back to national authorities where the merger will affect competition in a distinct market in a particular Member State.

Procedure

The parties acquiring control are responsible for ensuring that an EU merger is notified to the Commission. Notification is by way of a so‑called "Form CO", which is a detailed questionnaire requesting information on the parties, their customers and competitors, and the affected product markets and geographic markets.

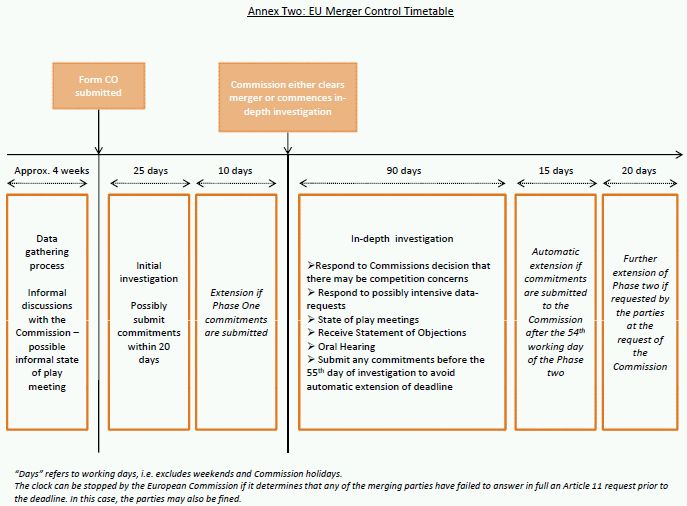

There is no formal deadline for submission of a Form CO, although parties may not complete a concentration with an EU dimension without clearance from the Commission. As a matter of best practice, the Commission should be contacted as soon as possible when a transaction is sufficiently defined and in any event immediately following the public announcement of a proposed merger. Draft Form COs are usually sent to the Commission prior to notification to ensure that the final version submitted is considered complete.

There are two phases to an EU merger investigation. Phase 1 starts the day after the submission of a complete Form CO. This phase runs for 25 working days4 and can be extended by a further 15 working days if commitments are submitted by the parties. The merger may be cleared by the Commission within the Phase 1 period. If the Commission has "serious doubts" about whether the merger would "significantly impede effective competition", the Commission will open an in‑depth Phase 2 investigation. The Phase 2 investigation lasts for 90 working days and can be extended to up to 125 working days (see Annex 2 for a detailed timeline).

During that Phase 2 investigation, the Commission will decide whether the merger would significantly impede effective competition. If so, the Commission will either block the merger or approve the merger subject to commitments that address the Commission's concerns.

German Merger Control

The German competition authority is the Federal Competition Authority (Bundeskartellamt). It has jurisdiction to review transactions that fall under the criteria set out in the Act Against Restraints of Competition (Gesetz gegen Wettbewerbsbeschränkungen, GWB), provided that the transaction does not trigger the exclusive jurisdiction of the EU Commission as set out above.

When is a filing required?

A transaction is notifiable in Germany if: (1) it is a concentration under merger control rules; (2) certain turnover thresholds are exceeded; and (3) no exception applies. In Germany, a relevant concentration may exist without a "change of control", as the rules are wider than the EU merger rules. A concentration arises if any of the following applies:

- the acquisition of all or a substantial part of the assets of another undertaking;

- the acquisition of direct or indirect control over another undertaking or parts thereof;

- the acquisition of shares if the resulting shareholding of the acquirer exceeds 25% or 50% of the share capital or voting rights of the target (irrespective of control);

- any other combination of undertakings whereby a competitively significant influence over another undertaking is obtained. Note that this means that a concentration can arise even if only a minority shareholding of less than 25% is acquired.

A concentration is only notifiable if certain turnover thresholds are exceeded, namely if in the last business year before the merger:

- the parties' combined world‑wide turnover exceeded €500m; and

- one of the parties had a German turnover of more than €25m; and

- another party to the merger had a German turnover of more than €5m.

As under the EU rules, the turnover of the acquirer's entire group will have to be included into the calculation. In principle, the turnover of the target, including any subsidiaries, will count whereas the seller's turnover is not relevant. However, in cases involving joint control, the turnover of a jointly controlling parent company will also be taken into account. And, differently from the EU rules, the group turnover of a seller or other shareholder retaining a non‑controlling stake of at least 25% of the shares or voting rights will also be included in the calculation. Specific rules for the calculation of turnover exist for specific sectors, namely trade, press and banks/financial institutions.

As an exception, transactions do not need to be notified if:

- a company which is not part of a larger group and has a turnover of less than €10m is sold to or merged with another company, or

- the transaction only concerns a market which has a size of less than €15m and which has existed for more than five years.

Procedure

The obligation to submit a notification is on all parties, but only one notification is required. In practice the notification is in most cases agreed by all parties and submitted by the acquirer. The parties can decide when to submit a notification, but clearance must be obtained before closing. A notification can be made as soon as the parties have an intention to enter into a transaction, i.e. before signing of the relevant agreements. However, in confidential transactions a notification should not be made too early, because the fact that a notification was made will be published on the Federal Cartel Office's website.

There is no mandatory form for a notification. Certain minimum information on the transaction, the parties and their respective groups, their turnover, and their market shares is required by law. Apart from that, the level of detail can be adapted to the case at hand. Pre‑filing contacts with the authority are not required but can be helpful in difficult cases or where the parties would like to request guidance with regard to specific questions. Pre‑filing contacts will remain confidential.

German merger investigations can have two phases. Phase 1 starts with the submission of a complete notification and may take up to one month. Transactions that do not raise competition concerns are cleared during Phase 1.

Before the expiry of Phase 1, the Federal Cartel Office can inform the parties that it will conduct a Phase 2 investigation, which is an in‑depth investigation of cases that may raise competition concerns. Phase 2 investigations may take up to four months from the initial date of submission of a complete notification. The parties may agree to extend the deadline.

During both phases, the Federal Cartel Office may request additional information. Such information requests generally do not stop the clock, provided the initial notification was complete. A delay in answering may, however, have the consequence that the transaction is not automatically deemed to be cleared after the expiry of the relevant investigation deadline as would otherwise be the case.

The substantive test is whether or not the proposed transaction will create or strengthen a dominant position on any relevant market. If this would be the case, the transaction would either be blocked or would only be cleared under commitments that address the competition concerns.

Legislative reform

A draft bill amending the Act Against Restraints of Competition has been published that includes amendments to the merger control rules. The amendments are still under discussion and not expected to enter into force before 1 January 2013, but we will be happy to provide details, if this is of interest.

Should you like to discuss any of the issues raised in this briefing, please contact a member of our Competition, Regulation & Networks team, or your regular contact at Watson, Farley & Williams.

Footnotes

1. E.g. the German Federal Cartel Office recently imposed a fine of €206,000 for failing to notify an acquisition of control

2. Council Regulation 139/2004/EC.

3. Note that transactions that do not qualify as a "concentration" under EU rules may be notifiable in individual member States where a concentration can be defined differently.

4. "Working days" does not include weekends or Commission holidays. Commission holidays are listed here: http://ec.europa.eu/competition/ mergers/information_en.html.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.