Authored by Iain McKenny General Counsel of Disputes, Vannin Capital

In this edition of Who Wins, Where and Why?, I have the privilege to write about my adoptive home – Paris, France. I have had the benefit of living in this wonderful city for nearly 10 years, having arrived in 2008 from my other adoptive home of over 10 years – London, England. Living and working as a disputes lawyer in these incredible cities has allowed me to be part of two extremely close and ever so different disputes markets. Having focused on the London disputes market in an earlier edition of Funding in Focus1 and having recently looked at the disputes market in Stockholm, Sweden2, it is about time that we turned our focus to Paris, France and ask the questions; Who wins, where and why?

During Paris Arbitration Week (PAW) in April, I was invited to speak on a panel discussion entitled "A tale of two cities" hosted and organised by Freshfields' Noah Rubins and Gisele Stephens. The purpose of the panel was to consider the trials and tribulations, the strengths and weaknesses and myths and truths surrounding these two exceptional legal jurisdictions. Representing Paris was Freshfields' own Elie Kleiman, a long standing partner in Freshfields' Paris office, revered in the legal community as a fierce advocate and for developing and leading a premiere practice in both litigation and international arbitration. Representing London was George Spalton, a barrister from 20 Essex Street chambers, an excellent, seasoned advocate, highly respected at the Bar, with a diverse practice and enviable reputation both at home and abroad. My contribution was to draw on disputes experiences in both cities and to explain from my five years of working with Vannin, the third-party funders perspective of these two markets.

It was an engaging debate and although I took no convincing about the strengths of London's disputes market from a thirdparty funding perspective, a market with which I am intimately familiar, I confess that Mr Kleiman opened my eyes to the strength and depth of the French legal system explaining why the legal community in Paris has embraced thirdparty funding. This is a development underscored by Vannin's own Yasmin Mohammad (in collaboration with August Debouzy and Paris I Panthéon Sorbonne) who demonstrated in a debate and soiree during PAW held at the Sorbonne, that the appetite for third-party funding in Paris is plentiful. Furthermore, the Barreau de Paris also during PAW gave its unconditional support for third-party funding3. All in all this is good news for lawyers, claimants and professional third-party funders alike.

But let us dig a bit deeper into the disputes market in Paris. What changes, if any, have been made to make this civil law jurisdiction a flourishing disputes market so attractive to third-party funders? Who are the firms?, and peeling back the brand, who are the practitioners making the difference? Above all, what is the fundamental difference between the Paris disputes market and the London disputes market and what does that tell us about the sectors, industries and types of commercial disputes available for funding in Paris today?

LITIGATION

There are three standard dispute resolution mechanisms available for commercial disputes in France, as you would expect to find in most sophisticated legal markets:

- Court proceedings;

- Arbitration proceedings; and

- Mediation.

In respect of court proceedings, most business disputes are handled by experienced commercial courts. However, commercial court judges are elected by the local business community that from a common-law perspective is a noticeable difference from the UK. This may very well explain why foreign companies typically turn to arbitration to avoid the perceived 'partiality' of those judges. A perception that is perhaps unwarranted but clearly felt. The Civil Procedure Code provides that before a dispute is started in court, the claimant must demonstrate that attempts were made to resolve the dispute amicably. This is not too dissimilar to the pre-action protocol in the courts of England & Wales and is seemingly the codification of a long history of encouraging negotiated settlement in France. Indeed, both international and domestic arbitration is a dispute resolution mechanism that French law and French courts have for a long time systematically favoured and supported. A concept that has made France one of the most arbitration friendly jurisdictions in the world as encapsulated in the French Arbitration decree of January 2011 (more on that below).

In order to make its legal system more competitive, France has after long and arduous debate decided last year to reform its contract law in the French Civil Code. Ordinance no. 2016-131 on contract law reform was adopted on 10 February 2016. The reform's stated aim is to adjust "the law to the needs of individuals and businesses" – to engage more with the commercial realities of the modern business environment. Among civil law jurisdictions this places France at the forefront of leading reform, a reform that many civil law jurisdictions are yet to make and is a long awaited and welcome change.

French contract law comes from the French Civil Code of 1804. Over the last two hundred and more years, the needs and interactions of modern businesses have changed dramatically which has given rise to a need for a modern contract law. In 2015, the French government started a public consultation yielding over 300 contributions from practitioners and academics a like, all for the stated purpose of modernising French contract law. The result of which is not unlike that of the Woolf Reforms in England in the late 1990s except instead of grappling with justice and proportionality as the overriding objective, the focus in France has been on:

- Legal security;

- Efficiency; and

- Protection.

The point of legal security is to allow companies to have a better, clearer understanding and thus greater accessibility to contract law. This is similar to the emphasis on transparency of the Woolf Reforms, though admittedly that is procedural where as the reforms in France go to substantive law. Athough in that too there has undoubtedly been a recognition that certain procedural mechanisms needed to be made more efficient and modified to this end, but without losing sight of the fact that in France the court's systems and procedures are designed to protect the weaker party to a contract – an attractive attribute for third-party funders assisting David and Goliath claims. An easily identifiable modification that seeks to aid transparency and efficiency is that the articles laid out in the French Civil Code have been restructured making them more accessible and transparent by bringing them more in line with the life cycle of a typical commercial agreement: the conclusion of the agreement, the performance of the obligations and the termination of a contract. These are all positive developments that not only allow greater clarity for claimants, but also allow professional third-party funders to develop risk profiles on a case by case basis with greater certainty, making available to claimants of French litigation the ability to transfer the risk of the cost of running and enforcing their claim on to a third-party.

Vannin's experience in respect of French litigation has for the most part been about supporting asset tracing and enforcement of judgment debts and awards rendered outside of France. To this end, France has proven to be a most advantageous jurisdiction to the successful claimant. There are a raft of tools available from extensive powers of bailiffs (huissiers) that allow claimants to identify specific assets including bank accounts to ex parte applications for freezing injunctions that effectively prevent assets from being moved without the respondent being notified in advance. The French courts have proven to be swift and effective. France is an excellent jurisdiction for enforcement action.

MEDIATION AND SETTLEMENT

There is an undeniable focus in France on the value of reaching either negotiated or mediated settlement. It necessarily compels a claimant to settle for less than what they want and a defendant to give more than what they feel they should but in so doing recognises the inherent risks and costs of progressing to formal dispute resolution proceedings. It is such a defining feature of the French legal system that judges often invite the parties to a commercial dispute to engage in conciliatory efforts and often appoint a "conciliator" to assist the parties. Under such circumstances, if an agreement is reached it becomes the basis of a binding and confidential agreement between the parties, and the judge merely issues a judgement stipulating that the dispute was resolved. If no agreement is reached, then the judicial proceedings are resumed.

Achieving settlement through mediation is a very popular method of dispute resolution in France. It is a flexible mechanism to which no specific legal regime is applicable. Around this dispute resolution mechanism has sprouted various institutions with the raison d'être of organising and facilitating mediation proceedings, such as the Centre de Médiation et d'Arbitrage de Paris (CMAP). Most of the lawyers we have spoken to in Paris place a premium on the value of mediated or negotiated settlement as a means to facilitate resolution though no one would call it non-adversarial. It is less formally adversarial obviously but settlement agreements are hard fought and won. Experienced and professional counsel with an in-depth knowledge of the consequences of not reaching settlement and the ability to convey this message sternly but diplomatically is essential. Settlement agreements may take place at any time before, during and even after a court action. Although the scope for settlement in London is often significantly shaped by the legal fees incurred and thus the longer the dispute rages the harder it becomes to settle, in France, owing to lower legal fees for litigation, this is arguably less of a decisive factor and so the scope for settlement discussions to run in parallel to a more formal dispute resolution process is perhaps a more common practice. A settlement agreement has the same effect as a court decision in France and when a settlement is approved by a court decision, it is automatically enforceable under French law.

INTERNATIONAL ARBITRATION

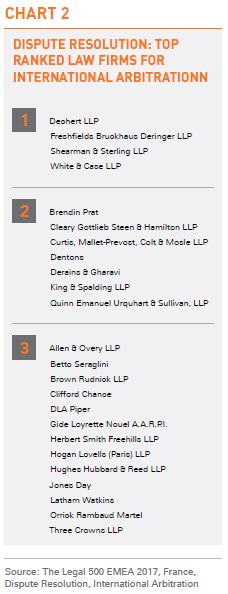

Vannin's main involvement in France has been in respect of supporting meritorious claimants in international arbitration, and for that Paris is and remains a power house. Paris is home to a huge array of top arbitration practices which has long been the case.

The court of arbitration of the International Chamber of Commerce (ICC) was founded in Paris in 1923. It has played a major role in the promulgation of the Geneva treaties and of the New York Convention and has been at the forefront of developments in international arbitration ever since. According to the Queen Mary University of London report in conjunction with White & Case4, international arbitration is still the number one preference for dispute resolution for companies doing business in France.

France, too, is a popular seat and is one of Paris' newest arbitration centres recognised "safe seats"5. The reasons for this are simple. Paris is a seat:

- That is a signatory of the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards.

- Whose laws favour arbitration and whose courts actively support, rather than interfere with, the arbitral process.

- That respects the parties' intentions regarding their choice of procedure and applicable law.

- That has the required professional and structural resources for a rapid, legally secure and efficient process.

Choosing Paris as the seat of the arbitration means French arbitration law will apply, which offers an arbitration friendly environment if problems arise. Judges in the jurisdiction of the seat may be called upon to intervene in the arbitration proceedings either at the stage of the constitution of the arbitral tribunal, or later to decide certain matters or to order interim and provisional measures before the arbitral tribunal is constituted and after the award is rendered. Furthermore, it is as we all know the law of the seat that will determine what legal means are available to challenge the arbitral award. France doesn't just agree to stay out of the way of arbitral proceedings it actively seeks to promote and protect it. The Paris civil court (Tribunal de Grande Instance) has a specialised judge who, on the rare occasion that it is required, will hear all applications relating to the appointment of arbitrators and the implementation of the arbitral proceedings. This specialised judge's mandate is to actively support the arbitral process.

SO WHAT?

Although France arguably became the friendliest arbitration jurisdiction in the world on January 13, 2011, when the new decree amending the provisions of the French Code of Civil Procedure pertaining to arbitration came into being, what is the value in doing so? It is clear to anyone who has considered the changes, as cited to briefly above, that a fundamental purpose of the Decree was to introduce progressive provisions in order to attract even more arbitrations to French seats even if the case has no connection with France. Has it worked?

According to the statistics from the ICC, it has worked extremely well with a notable long-time source of disputes that continue to pour into the Paris disputes' market. Last year, the ICC in Paris announced record figures for new cases filed for administration under the ICC rules – 966, involving 3,099 parties from 137 countries. This was the highest number of disputes ever recorded in a single year for the ICC. Interestingly, the majority of new claims appear to be coming from Francophone Africa and the dispute teams at international and local law firms have been and continue to reap the rewards owing to a shared language and common or compatible legal systems.

According to the ICC, both North and Sub-Saharan Africa (mostly Francophone Africa) saw a 50% increase in the number of parties participating in ICC administered arbitrations.

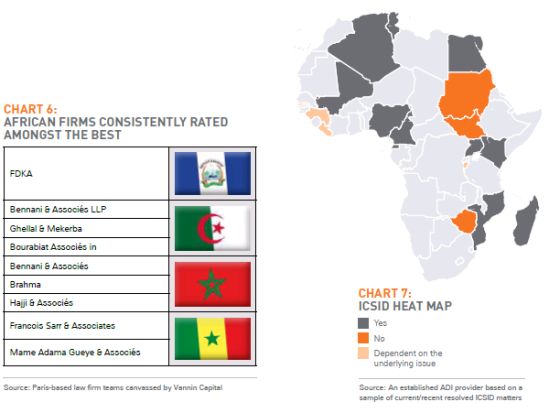

Francophone Africa is not only amongst the largest disputes markets in Africa, it is also among the fastest growing disputes markets in the world based on the number of new arbitrations registered from this region with the ICC just last year. These disputes predominantly come from industries and sectors around mining, energy and infrastructure. Big ticket arbitrations and smaller satellite litigations provide work across the entire spectrum of firms in the Paris legal market. Every dispute team we spoke to in the Paris market from the top international teams to the boutique law firms in some form or another were active in the African disputes market (primarily focused on energy, mining and infrastructure) and it was apparent that forming alliances with key local firms was essential. Of those Paris teams canvassed the following local firms were consistently rated amongst the best (see Chart 6).

But if the Paris disputes market is being fed by disputes in Africa, how many of these are funded or rather, considered to be fundable? In reality, not that many. This is largely due to a perceived risk of enforcement. But how real is that perception? A simple way of testing this is to determine whether award default insurance is available against the country in question. Interestingly, the vast majority of African countries are on the 'green' list, meaning that award default insurance is available against those countries. Although ADI is in respect primarily of investment treaty arbitration this may very well suggest that the perception of enforcement risk in Africa may not be quite as dire as many of us in Europe believe it to be. Indeed, like any specialist area, it appears that local knowledge is the key and it is the relationship with key local African law firms that appear to make the difference. A difference that Paris disputes practices have been careful to cultivate and seem set to continue to dominate this lucrative disputes market. But for more, let us turn to those practitioners in the Paris market who are making the difference...

WHAT THE EXPERTS SAY

1. ELIE KLEIMAN, PARTNER AND SHAPARAK SALEH, COUNSEL, FRESHFIELDS BRUCKHAUS DERINGER LLP

"Over the last 15 years we (and some other large international law firms) have never ceased to be active in the African market, whether it is oil and gas, mining, infrastructure or telecoms. Our approach is to work hand in hand with our "stronger together" firms in the region. Our view is that no one understands the judges and the culture better than the strongest local firms."

2. CHARLES NAIRAC, PARTNER AND CHRISTOPHE VON KRAUSE, PARTNER, WHITE & CASE LLP

"With the combined effect of the post-Arab spring and decrease of oil prices in North Africa, coupled with the increasing number of investments and commercial transactions in sub-Saharan Africa, we have seen an increase of complex international arbitration disputes in francophone Africa. There is also a strong push towards developing international arbitration in the region as a means to settle disputes and further stimulate economic growth."

3. JOSÉ MANUEL GARCÍA REPRESA, PARTNER AND XAVIER NYSSEN, PARTNER, DECHERT (PARIS) LLP

"It is well known that Africa's economy is growing at a pace well beyond developed economies and driven mostly by its natural resources and infrastructure needs (transport, telecoms, airports, ports...). So is the number of international arbitrations involving one or more African parties, not only before the major institutions administering arbitral proceedings (notably the ICC and LCIA), but also before limited but rapidly expanding local African arbitration institutions. In Frenchspeaking and parts of Lusophone Africa, the OHADA (with 17 member states) plays a key role thanks to its common commercial code, its arbitration rules and its supranational court: the Common Court of Justice and Arbitration. There are also local arbitration centres such as the Kigali International Arbitration Centre in Rwanda or the LCIA-MIAC centre in Mauritius. In addition, many African states have taken or are taking steps to align themselves with the international approach by ratifying the New York Convention, which is now ratified in 35 out of Africa's 54 jurisdictions. These are encouraging trends and the Paris Bar is seeing a steady flow of arbitrations involving African interests, including with States or State instrumentalities as claimants. There remain, however, significant challenges, notably the limited number of African arbitrators appointed in international arbitration and the interference of local courts in the arbitration process."

4. CLAUDIA ANNACKER, PARTNER AND JEAN YVES GARAUD, PARTNER, CLEARY GOTTLIEB STEEN & HAMILTON LLP

"The real challenge in the arbitration market in Africa will be how tribunals manage to deal with corruption issues. Corruption issues are coming up as central arguments in more and more cases. Tribunals are ill equipped to investigate those issues and Judicial courts reviewing an award in annulment or enforcement proceedings are exercising deeper and deeper control over these issues."

5. STÉPHANE BRABANT, PARTNER AND LAURENCE FRANC-MENGET, OF COUNSEL, HERBERT SMITH FREEHILLS PARIS LLP

"States in Africa, and especially in Sub- Saharan French-speaking countries, can take unpredictable decisions which may have an impact either on contracts performed in the State or on foreign investors' activities on the ground. This can give rise to crisis that may degenerate into a dispute. In view of the significant economic and/or social interests at stake for both States and private parties, settlement negotiations to resolve those disputes are often preferable. Starting arbitration, when available, is obviously a strong incentive for seeking a settlement if no amicable solution can be reached immediately or in case of lack of trust in first instance. Although not necessarily the first option to be considered, arbitration proceedings is, should the dispute continue, the most appropriate forum to settle as it allows the selection of practitioners for their strong knowledge both of legal issues but also of the business peculiarities and the political and geographical African context. Globally, to find out the most efficient and appropriate manner to settle disputes in French-speaking Africa, strong contextual knowledge is essential, as is local law firm involvement – especially when international legal teams have no strong or clear experience on the ground in Africa. Our Paris team has international lawyers experienced in disputes in Africa; practitioners with special expertise with the continent, working hand-in-hand with local lawyers, which is one key to successful outcomes in management of crisis and disputes settlement in French-speaking Africa."

6. MICHAEL OSTROVE, PARTNER AND THÉOBALD NAUD, COUNSEL, DLA PIPER PARIS LLP

"Over the past years, leading arbitral institutions have reported a significant rise in the number of international arbitration cases involving African parties. Mining, energy and infrastructure have been key sectors in this development. Foreign direct investment in Africa continues to grow, including with respect to major energy and infrastructure projects, so we expect this trend to continue. One of the most striking developments in this sense has been the increase of investment in francophone West Africa – and the rise of the disputes that inevitably follow. The Paris legal market is ideally placed to service all stakeholders in these projects, and not only when disputes arise. Many West African countries have adopted civil law systems modelled on France's own legal system. In this respect, as well as linguistically, French-qualified lawyers hold a competitive advantage on their counterparts elsewhere. The key challenge, however, lies in increasing the involvement of African-based colleagues in all aspects of projects (transactional and contentious). The development of the legal market locally will help ensure the stability of the local markets and will reinforce working partnerships between European and African law firms."

7. HAMID GHARAVI, FOUNDING PARTNER AND MELANIE VAN LEEUWEN, PARTNER, CABINET DERAINS & GHARAVI

"The growing number of investment arbitrations against Francophone African States is attributable to large investments made in these States, but also and more importantly, to the increased awareness among investors of the existence of the many national investment laws, as well as bilateral and multilateral treaties containing arbitration clauses signed by African States. This includes the Agreement on Promotion, Protection and Guarantee of Investments among Member States of the Organisation of the Islamic Conference signed by a number of Francophone African States but which has until recently been largely ignored. It is on the basis of that treaty that we recently secured an award against Gabon. Similarly, the Foreign Investment Law of the Democratic Republic of Congo is widely ignored but contains an ICSID arbitration clause that has allowed us to secure an award against the country."

8. THIERRY LAURIOL, PARTNER AND CAPUCINE DU PAC DE MARSOULIES, SENIOR ASSOCIATE, JEANTET

"In the thirty years that I have been involved in international arbitration cases in Africa, both as a lawyer and as an in-house counsel, I observed a clear development of arbitration throughout the continent. Today, this alternative dispute resolution method is widely admitted by all economic agents and, most notably, by governments. Even if consent on a general basis (i.e. law, community law or BITs) is not widespread, governments are much less reluctant than in the past to grant it on an individual basis. French law firms benefit from a privileged position when intervening in French-speaking African countries in arbitration or enforcement proceedings. This can be explained first by the historic ties with the continent and the long-standing practice that a handful of French firms, including Jeantet, developed in the last decades. Also, the cultural heritage – and proximity—and the shared legal system and language undeniably play an important role to the advantage of firms based in France. I believe that local knowledge represents an important differentiating factor."

9. JACQUESALEXANDRE GENET, FOUNDING PARTNER AND EMMANUEL KASPEREIT, COUNSEL, ARCHIPEL

"Many French firms have in-house knowledge of the African market and its key players, and they have had that for years. Even those firms that do not have a dedicated Africa desk or equivalent will have had exposure to commercial disputes in Africa. That gives them (us) a head start in African dispute resolution, but firms from other countries might quickly come into the market, possibly by buying the specialist knowledge they still lack."

10. ERWAN POISSON, PARTNER AND MARIE STOYANOV, PARTNER, ALLEN & OVERY LLP

"There has been a huge push towards a more arbitration-friendly stance across the African continent, with arbitration law reforms, the creation of local and regional arbitration centres and increased sophistication in the courts' approach towards arbitration. In parallel, investment treaties are also in the process of being modernised. This does not, however, entirely shield our clients from surprise interlocutory or criminal proceedings – this leads us to become increasingly involved in African Court proceedings and even argue before local francophone African Courts."

Footnotes

1 Funding in Focus, Issue 3, July 2016: http://vannin.com/downloads/funding-in-focus-three.pdf

2 Funding in Focus, Issue 4, January 2017: http://vannin.com/funding-in-focus/

3 Paris Bar approves third-party funding, 4 May 2017, GAR: http://vannin.com/press/article/219/2017-05-04/paris-bar-approves-third-party-funding

4 2015 International Arbitration Survey: Improvements and Innovations in International Arbitration: http://www.arbitration.qmul.ac.uk/

5 Model Clause: http://delosdr.org/delos. aspx?mid=4&id=19

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.