BACKGROUND

Debt has traditionally been a tax efficient way of financing business operations. However, tax developments are such that businesses financing their operations through back to back debt, may be subject to certain risks and challenges.

In light of the above and in an effort to reduce the discrepancy in the tax treatment between debt and equity financing, Cyprus introduced a new tax incentive, the so called, "Notional Interest Deduction" or "NID".

The NID enhances the tax benefits of financing business operations through equity and offers a tax efficient alternative to debt financing.

LEGAL FRAMEWORK

On 16 July 2015, the Cyprus Income Tax Law was amended, with the introduction of Article 9B, titled, "deduction on new equity". According to this new Article, with effect from 1 January 2015, Cyprus tax resident companies and Cyprus permanent establishments (PEs) of nontax resident companies are entitled to a notional interest deduction (NID) upon the introduction of new equity employed in the production of taxable income.

As the provisions of Article 9B of the Income Tax Law (ITL) are broad, on 18 July 2016, the Cyprus Tax Authorities issued Circular 2016/10, providing clarifications regarding the application of the law as well as practical examples with regards to the calculation of the NID.

Below, we summarize the main provisions of Article 9B of the ITL as well as details of the relevant Circular.

NID CALCULATION

The NID is effectively a notional interest tax deductible expense that arises upon the introduction of new equity employed in the production of taxable income by a Cyprus company, or an overseas company with a Cyprus PE.

The fact that it is a notional expense, it means it does not trigger any accounting entries and therefore it does not affect the accounting profit/loss.

The NID is equal to the new equity multiplied by the relevant reference rate and it is subject to a cap equal to 80% of the taxable profit (as calculated prior to the NID), arising from the new equity. As corporate profits are subject to income tax at the rate of 12.5%, a taxpayer claiming NID can achieve an effective tax rate of up to 2.5% (=20% x 12.5%).

NEW EQUITY

New equity is equity introduced in a company as from 1 January 2015 in the form of paid-up share capital and share premium. New equity includes shares of any class, including ordinary, preference, redeemable and convertible shares, paid either in cash or in kind.

The Circular clarifies that unpaid share capital, in respect of which a corresponding claim has been recognized which gives rise or is deemed to give rise to interest which is subject to income tax, shall be considered as paid-up capital for the purposes of Article 9B of the ITL.

Furthermore, the Circular clarifies that the following may qualify as new equity:

- Loans payable and other debt instruments converted into issued share capital;

- Shareholders' credit balances converted into issued share capital;

- Non-refundable capital contribution converted into issued share capital;

- Realized reserves created after 1 January 2015 converted into issued share capital;

Realized reserves existing on 31 December 2014 ("old equity") that are converted into issued share capital, may only qualify as new equity, to the extent that it can be substantiated that the old equity was previously employed in assets which were not used in taxable activities and upon conversion it was employed in taxable activities.

Finally, the Circular provides guidance in determining the level of new equity in a number of cases including:

- A non-Cyprus tax resident company with a Cyprus PE issuing new equity;

- A non-Cyprus tax resident company transferring its tax residency to Cyprus;

- A non-Cyprus tax resident company with a Cyprus PE transferring its tax residency to Cyprus;

- A Cyprus tax resident company or a PE of a non-Cyprus tax resident company reducing its equity, following the introduction of new equity.

REFERENCE RATE

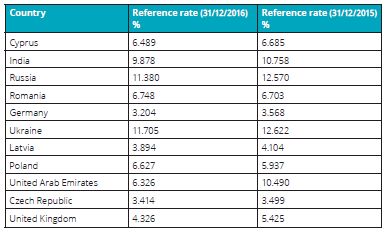

The reference rate is the yield of the 10- year government bond (as at 31 December of the prior tax year) of the country where the funds are employed, plus a 3% premium, subject to a minimum rate, equal to the yield of the 10-year Cyprus government bond plus a 3% premium.

The Tax Department publishes the 10- year government bond yields for selected countries on an annual basis through which one can derive the relevant reference rate.

In the absence of published guidance on behalf of the Tax Department, the relevant yield should be obtained from Bloomberg.

NID CAP CALCULATION

The NID is capped to 80% of the taxable profit, generated from the new equity and calculated before allowing for the NID. Where a taxpayer invests the new equity in a number of different assets generating taxable income, the Circular introduces a scheduling method for the purpose of calculating the applicable NID cap.

In this respect, taxpayers would need to be able to allocate new equity between the various assets/activities of the taxpayer as follows as well as to be able to determine the taxable profits generated from each asset/activity.

First, identify new equity that directly financed specific assets (the 'matching concept'). Then allocate any remaining new equity to non-business assets and assets not generating taxable income. Finally, apply a pro-rata allocation to the remaining assets of the taxpayer.

EXAMPLE

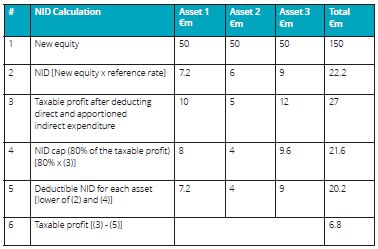

The Circular provides seven practical numerical examples of NID calculations including the following: Cy Co issues new equity amounting to €150m and received funding of equal value. Cy Co decides to use these funds to purchase three assets in three different countries as follows:

The maximum NID which may be claimed by Cy Co is the lower of (4) and (5), i.e. €20.2m. It is worth noting that the example assumes that the new equity funding was available for the whole tax year of assessment and that the relevant reference rates for each asset were as follows: asset 1: 14.4%, asset 2: 12%, asset 3: 18%.Furthermore, the example assumes that the taxable profit produced by each asset could be accurately determined.

ANTI-ABUSE PROVISIONS

The law provides for a number of specific anti-abuse provisions as well as a general anti-abuse provision.

CONCLUSION

A Cyprus company/PE can take advantage of this new tax incentive in a number of different ways taking always into account the relevant anti-abuse provisions.

We are at your disposal to discuss with you the relevant tax implications upon issuing new equity and/or restructuring existing financing arrangements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.