A. INTRODUCTION

The Tax Department has announced in February 2017 its intention to terminate the current tax practice in relation to the minimum acceptable margins on loans granted to related parties.

The decision to abolish this long established practice was driven by the necessity of the Cyprus tax system to be fully compliant with the current international tax developments (OECD/G20 initiative - BEPS) as well as a review from an EU State Aid perspective.

Based on the announcement, the existing practice with the minimum acceptable margins will apply up to 30th June 2017, and from 1st July 2017 any loan transactions between related parties should satisfy the arm's length principle and be based on current market conditions.

B.THE CURRENT PRACTICE

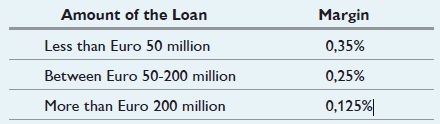

In an attempt to provide guidance and clear any ambiguities in relation to what was considered by the Tax Department as the minimum acceptable interest rate margin (i.e. the difference between the lending rate and the borrowing rate) on intra group back to back loans, the Tax Department issued in 2011 a letter with which it laid down the conditions which a financing arrangement had to meet in order to qualify as an intra group back to back loan and concluded that for such loans the minimum acceptable net margins for tax purposes were:

This letter provided a lot of comfort to investors who used Cyprus structures extensively as vehicles to provide financing to their groups.

C.THE NEW PRACTICE

Following the recent announcement, the above practice will be valid up until 30th June 2017. From the 1st of July 2017, all intra group loans should follow the arm's length principle and the interest rate used should be based on market conditions.

The Tax Department goes further and states that any such loan transaction should be supported by a Transfer Pricing Study prepared by independent experts based on the relevant OECD standards.This Study should provide justifications as to the correctness of the interest rate used in the specific financing transaction.

In addition, any Tax Rulings relevant to the minimum acceptable margins on intra group loans previously issued, or those that will be issued up to 30th June 2017 will cease to be applicable.

D. OUR COMMENTS

It worth mentioning, that currently the Tax Laws of Cyprus do not include any detailed Transfer Pricing provisions and therefore further guidance is expected on the matter either in the form of a circular or though the introduction of detailed transfer pricing provisions in the current Tax legislation.

Further, given that the new practice will be applicable in the middle of the tax year ending 31 December 2017, means that companies will need to calculate the relevant taxable profits for 2017 once based on the old provisions from 1st January up to 30th of June, and once based on the new set of rules from 1st July until 31 December 2017.

E. CONCLUSION

The new procedure introduced is expected to affect a significant number of companies operating in Cyprus, as Cyprus entities were widely used as back to back financing vehicles. Nevertheless, with the recent tax reform and the introduction of the Notional Interest Deduction on new capital introduced, the negative taxation effects of this change may be, to an acceptable degree, controlled.

It is therefore imperative for all companies affected by the change, to thoroughly review their existing financing structures, evaluate the impact on their taxable profits and take whatever suitable corrective actions accepted by the law in order to be in line with the new requirements.

F. HOW KINANIS LLC CAN ASSIST

Kinanis LLC is in a position to assist you with the provision of the following services:

- Reviewing your existing financing structures and report with suggestions on the implication of the new procedure.

- Provide assistance in the preparation of the Transfer Pricing Studies required by the new procedure.

G. DISCLAIMER

This publication has been prepared as a general guide and for information purposes only.

It is not a substitution for professional advice. One must not rely on it without receiving independent advice based on the particular facts of his/her own case. No responsibility can be accepted by the authors or the publishers for any loss occasioned by acting or refraining from acting on the basis of this publication.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.