Greek tax residents can benefit from a reduced tax rate of 2,5% on dividends received from Cyprus.

According to the provisions contained in the Greek-Cypriot Double Tax Treaty (DTT), dividends paid by a company that is a tax resident of Cyprus to a shareholder tax resident of Greece may be taxed in Greece.

However, according to Article 21 of the relevant tax treaty, credit is granted in Greece against tax payable in Cyprus. If the income relates to ordinary dividend paid by a Cypriot tax resident company, the tax credit shall take into account both the Cypriot tax withheld from the dividend (if any) and the Cypriot tax payable on the paying company's profits.

The term "Cypriot tax payable" is interpreted to include the Cypriot tax which is withheld (if any) from any dividend paid out from the company's profits. In case of payment of ordinary dividend, the credit of the Cypriot tax against the Greek tax on this dividend should take into account both the Cypriot withholding tax in relation to the dividend (if any) and also the Cypriot corporation tax payable by the Cyprus company on its profits or the corporation tax that would have been applied but was not paid because of the exemptions provided under the Cyprus tax legislation.

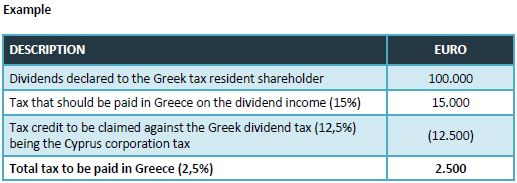

Since the Cypriot corporation tax is 12,5% and no taxes are withheld on dividend payments made to non-Cypriot tax residents shareholders, the estimated tax credit that could be claim by the Greek shareholder should amount to 12,5%.

Consequently this means that that the Greek shareholder should only pay a 2,5% tax on the gross dividend received represented by the difference of the Greek tax rate applicable to dividends of 15% less the Cypriot corporation tax rate of 12,5%.

The above tax treatment has also been confirmed through a relevant Circular issued by the International Economic Relations Directorate of the Ministry of Finance of Greece which provided clarifications on the provisions contained in Article 21 of the Double Tax Treaty between Greece and Cyprus.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.