Keywords: China Insurance Regulatory Commission, CIRC, Permitted Investments, Insurance,

Overview

The China Insurance Regulatory Commission (CIRC) issued the Circular on Issues relating to Investment of Insurance Funds in Equity and Real Estate (the 2012 Circular) on 16 July 2012 and has issued two other rules, all of which facilitate a more diversified range of investment options for insurance companies.

The 2012 Circular amends certain provisions of the Interim Measures on Investment of Insurance Funds in Equity (Equity Regulations) and the Interim Measures on Investment of Insurance Funds in Real Estate (Real Estate Regulations), promulgated by CIRC in 2010. For more background information, please refer to our Legal Update: CIRC Permits Insurance Companies to Diversify Their Investments into Private Equity and Real Estate Sectors.

Major Changes under the 2012 Circular

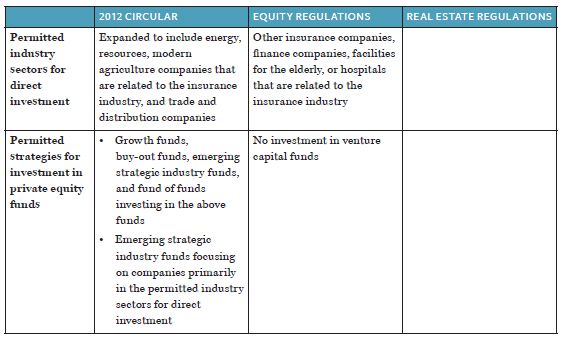

The following table shows the changes introduced by the 2012 Circular

The 2012 Circular also significantly lowers the qualification requirements for insurance companies that seek to make equity or real estate investments by:

- removing the requirement that an insurance company must be profitable in the preceding year;

- lowering the solvency adequacy requirement from 150% to 120%; and

- changing the asset requirement to RMB 100 million in net assets for the preceding year (as compared to RMB 1 billion in net assets under the Equity Regulations, and RMB 100 million under the Real Estate Regulations).

The 2012 Circular has the effect of facilitating equity and real estate investments by insurance companies and encouraging insurance companies, as institutional investors, to participate in private equity funds, which is very important for the development of the private fund industry in China. Meanwhile, the permitted equity investment industry sectors also align with the government's desire to develop certain strategic industries.

Other New CIRC Rules

The CIRC also issued two other rules in July 2012: the Interim Measures on the Administration of Entrusted Investments of Insurance Funds, which permits insurance companies to retain external asset managers to manage investments on behalf of insurance companies; and the Interim Measures on Investment in Bonds of Insurance Funds, which reduces restrictions on investments by insurance companies in bonds.

These new rules represent a concerted effort of the CIRC to remove restrictions on investments by insurance companies and to diversify the range of investment options.

Previously published on 20 August 2012.

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2012. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.