Introduction

This memorandum examines the use of Cayman Islands off-balance sheet financing structures. There are several types of transactions that would call for an off-balance sheet structure, the two most common of which would be structured finance transactions and asset finance transactions. The off-balance sheet structure is designed to isolate the underlying assets from the control, and hence the bankruptcy risk, of third parties (eg the originator in a securitisation transaction or the airline in an aircraft finance transaction).

Structured Finance Transactions

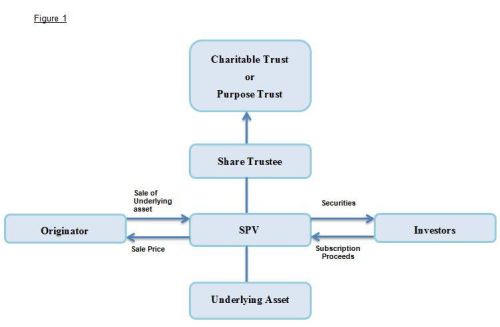

The essential element of a structured finance transaction is the conversion of certain assets into marketable securities. Typically a Cayman Islands' special purpose vehicle ("SPV") will be set up to purchase an asset (or pool of assets). The SPV funds the purchase of such asset by the issue of notes or preference shares ("Securities"). The asset (or pool of assets) acquired by the SPV will generate a cash flow which is used to pay interest on the Securities. The payment obligations of the SPV under the Securities will be secured by the purchased assets and the accompany cash flow. The arranger will also use part of the proceeds of the issue of the Securities to pay all fees and expenses on behalf of the SPV and the SPV will receive a small fee in order to establish it has generated a corporate benefit for itself. Ultimately, the redemption proceeds of the underlying assets (or occasionally the sale proceeds) are used by the SPV to redeem the Securities upon maturity.

Asset finance transactions

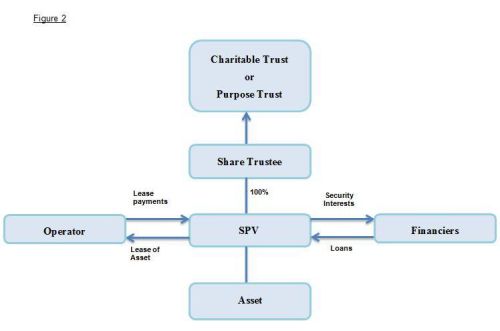

In asset finance transactions, a typical structure involves a SPV being set-up as the owner of the asset which may be aircraft, vessels or machinery. The SPV will fund its purchase of the asset by obtaining loans from commercial banks or funding supported by export credit agencies and will lease the asset to an operator (eg airline or leasing company). The lease rental payments received by the SPV will be utilised to make principal and interest payments on the loans. As security for the loans, the SPV will grant mortgages or charges over the acquired asset and any related contractual rights (eg insurance policies or warranty agreements for the assets) in favour of the financiers. To enhance the financier's position, share security will often be granted by the shareholder(s) of the SPV. The SPV may be structured as either "off-balance sheet" as described below, or "on-balance sheet" where the SPV is set up as a subsidiary of the operator or other parties to the transaction.

Setting up the Off-balance Sheet Structure

The SPV will typically be an 'orphan' company to ensure the assets of the SPV will not appear on the balance sheet of any party to the transaction. This is accomplished by issuing the shares in the SPV to a Cayman Islands' trust company to be held in its capacity as trustee of a Cayman Islands' trust (the "Share Trustee"). The trust is typically a charitable or purpose trust created pursuant to a declaration of trust executed by the Share Trustee. The assets of the trust (ie the right to receive the ultimate surplus on the winding-up of the SPV by way of distribution from the SPV) will be held by the Share Trustee on behalf of the charities in the case of a charitable trust, or the beneficiaries or specified purpose in the case of a purpose trust.

The Share Trustee administers the trust and holds the legal title to the trust assets (principally the issued share capital of the SPV). Typical powers or discretions included in a Cayman Islands' SPV charitable or purpose trust would restrict the Share Trustee from disposing of shares in the SPV or winding up the SPV for the duration of the transaction.

As an alternative to using a charitable trust, a statutory purpose trust can be used (known as a 'STAR trust'). This can be for pure purposes or a mix of purposes and beneficiaries. The rights of beneficiaries under common law trusts are given to an 'enforcer' by statute and an interested counterparty to the transaction may act as the enforcer of the trust, or a third party enforcer, unrelated to the transaction could be approved.

Upon the expiration of the transaction, the trust will terminate and the trust property (namely the net asset value of the SPV, which will be the issued share capital and any transaction fees earned by the SPV net of its expenses) will be distributed by the Share Trustee to the beneficiaries.

SPV Management

In a typical transaction, the SPV will enter into an administration or management agreement with the trust company to provide administrative services for the SPV. This agreement will set out the services to be provided by the administrator to the SPV, which usually includes the provision of the directors and officers (such as a secretary) of the SPV and the services of the Share Trustee to the charitable or purpose trust.

In certain circumstances, the agent and trustee of the Securities issued by the SPV in structured finance transaction (the "Note Trustee") or the agent and trustee under the loan in an asset finance transaction (the "Security Trustee") may be a party to the administration agreement and will take covenants from the administrator in respect of the business and management of the SPV, which the Note Trustee or Security Trustee can enforce directly. The administration agreement will provide that the administrator will carry out all necessary day-to-day administration of the SPV to ensure that it complies with all applicable rules and regulations of the Cayman Islands. The Share Trustee will be required (in its capacity as the registered holder of the issued shares of the SPV) to give covenants to the Note Trustee or the Security Trustee to ensure the trust conforms to the transaction, for example, that the Share Trustee does not give any directions to the directors of the SPV (other than as required to carry out the day-to-day administration referred to above) or to take any other steps to increase the issued share capital of the SPV, sell, transfer or create a security interest over any of the issued shares in the capital of the SPV (except as may be contemplated by the relevant transaction documents), or amend or vary in any way whatsoever the provisions of the memorandum of association and articles of association of the SPV, without first obtaining the consent in writing of the Note Trustee or the Security Trustee.

The memorandum of association of the SPV may be drafted to restrict the business of the SPV to the activities specifically contemplated by the transaction documents.

Parties to any transaction documentation must be aware that any attempt to assert too much control over the SPV risks undermining the trust structure. The result may be that the SPV is regarded as a nominee or agent of a party to the transaction or as a controlled foreign company of a party to the transaction, under the laws of a foreign jurisdiction. The extent of any involvement should therefore be the subject of legal and tax advice in the relevant jurisdiction so as to ensure that the position of the relevant parties is not prejudiced by the proposed structure.

Advantages of using the Cayman Islands

Flexibility of Relevant Legislation

Cayman Islands' laws are essentially based on the English common law, so the central issues of corporate power, directors' fiduciary duties, corporate personality, limited liability and corporate benefit are substantially the same as the position under English common law.

At the same time, Cayman Islands' commercial legislation benefits from being much less cumbersome in many of the areas that have caused considerable difficulty and uncertainty under the corresponding English statutes, for example:

- The Companies Law (as amended) of the Cayman Islands (the "Companies Law") provides that shares are redeemable not only out of profit but also, subject to some limited solvency tests, from the credit balance on the share premium account enabling an equity instrument to have much of the economic substance of debt.

- Under English law it is unlawful for a company to directly or indirectly provide finance for the acquisition by a third party of its own shares, but financial assistance in the Cayman Islands is not of itself unlawful. However, the directors must simply ensure that the transaction is demonstrably for the material benefit of the company.

- No requirement under the Companies Law to file audited accounts (unless they are required to do so because, for example, they are licensed or registered under legislation governing mutual funds, trust companies, banks, administrators etc.).

Tax issues

It is key in structured finance transactions and asset finance transactions that there is no tax leakage. The size of these transactions means that a small number of basis points of tax can amount to a large tax charge. Tax leakage can arise because there may be corporation tax in the jurisdiction in which an SPV is incorporated or where it is deemed to be doing business. Withholding taxes may be payable on payments made or received by an SPV.

In the Cayman Islands, there are no corporation taxes on any company carrying out either domestic business or offshore business. The use of Cayman Islands' administrators means that SPVs are centrally managed and controlled in the Cayman Islands, which helps onshore tax counsel gain comfort that the SPV will not be taxable in the relevant onshore jurisdiction, except in certain cases where the SPV is designed to be tax resident in a particular taxing jurisdiction.

Additionally, in relation to payments made by an SPV there is no tax withheld by the Cayman Islands' Government on any payment of principal or interest. This is of great benefit in simplifying the basis and structure of any transaction.

Stamp duty arises in the Cayman Islands where the relevant instrument is signed in or physically brought into the Cayman Islands after signing. Accordingly documents are typically executed by power of attorney outside the Cayman Islands.

Other Advantages

The lack of direct taxes in Cayman is only one of the advantages of the Cayman Islands SPV. Others include:

- In structured finance or asset finance context, there are generally no relevant restrictions on the business an SPV can do from the Cayman Islands, for example, it can lend, borrow or issue debt securities without any requirement to become licensed as a bank.

- Setting up an SPV in the Cayman Islands is flexible and quick. A Cayman Islands' SPV can be set up in as little as 24 hours which can be considerably quicker than in other offshore jurisdictions where there can be a need for an 'in principle' consent from the local regulator which can slow down the process.

- The Cayman Islands remain relatively inexpensive and the set up costs for SPVs in the Cayman Islands are still low. Fees payable to the Cayman Islands Government upon incorporation and annually thereafter are based on the SPV's authorised share capital, and currently range from US$854 to US$3,131. In the vast majority of transactions, the SPVs will have an authorised share capital of no more than US$50,000 and therefore the fees payable will be at the bottom end of this range.

- There is no specific regulation of debt issues unless they are listed on the Cayman Islands Stock Exchange.

- There are no foreign exchange controls in the Cayman Islands. As such, money and securities in any currency may be freely transferred to and from the Cayman Islands.

- As a matter of Cayman Islands law, a true sale will remove the underlying asset pool from the originator's bankruptcy estate and it is only in very specific cases that the separate corporate personality of a SPV will be ignored so as to allow creditors access either to the SPV or its shareholders. Most of these cases involve fraud. It is essential to ensure that there are adequate corporate formalities for the SPV, so that there is no risk of it being treated as a sham or an agent of the originator. Essentially this requires that the job of administering the SPV is handled professionally, by competent administrators who understand the commercial rationale and the legal structure of the transaction and that none of the transaction parties attempt to exert an unacceptable level of control over the SPV and its directors.

- It is sometimes a listing requirement for the accounts of the SPV to be audited prior to the listing of Securities on a stock exchange, and thereafter one of the continuing obligations of the SPV will be to perform an annual audit. To this end, the major accounting firms are well represented in the Cayman Islands, offering full auditing services and are all experienced in acting for SPVs in such circumstances.

- The Securities issued pursuant to any of the transactions outlined above are often rated by the leading international rating agencies to increase their marketability. The rating of a transaction will usually fall to the weakest link in that transaction and in no event can it exceed the sovereign ceiling of the various jurisdictions where the parties are incorporated. Accordingly, the status of the Cayman Islands as a United Kingdom Overseas Territory means that the sovereign ceiling for the Cayman Islands is high. This is a distinct benefit for transactions using an SPV based in the Cayman Islands.

- Having been recognised as an "approved organisation" by the London Stock Exchange since 1999, the Cayman Islands Stock Exchange ("CSX") was designated as a recognised stock exchange by the board of the UK Inland Revenue. Eurobonds listed on CSX now benefit from the quoted Eurobond exemption for withholding tax purposes. This means that the CSX can compete with stock exchanges such as Luxembourg and London.

- In the context of aircraft financing, the Convention on International Interests in Mobile Equipment and the associated Protocol to the Convention on International Interests in Mobile Equipment on Matters Specific to Aircraft Equipment (collectively, the "Cape Town Convention") came into effect in the Cayman Islands on 1 November 2015, in line with its entry into force in the United Kingdom on the same date. The Cape Town Convention provides for an internationally recognised system of "international interests" to be created and registered, and standard remedies in a default scenario giving creditors certainty as to the likelihood of being able to recover the aircraft, thereby further enhancing the desirability of using a Cayman Islands entity for aviation finance.

The Cayman Islands SPV

Key Features

An SPV is usually incorporated as an exempted company under the Companies Law. As such, the SPV has a number of special features:

- No government authorisation or licences are required to incorporate an SPV.

- The SPV is free from any form of income tax, capital gains tax or corporation tax in the Cayman Islands, and no Cayman Islands' withholding tax is imposed on any of its cash flows.

- SPVs with exempted company status can obtain an undertaking from the Cayman Islands Government that they will remain tax-free for a period of 20 years (which can be extended to 30 years if the particular transaction requires it).

Incorporating a Cayman Islands SPV

The initial filing requirements are straightforward:

- An exempted company must have one or more shareholders and directors (which may be an individual, a corporation or other legal person) and neither is required to be resident in the Cayman Islands.

- The SPV must have a register of shareholders at its registered office or at some other place notified to the Registrar of Companies. It is not available for inspection by the public. Cayman corporate services providers must, however, collect beneficial ownership information on all companies, and such information may be made available where requested by certain domestic and international governmental authorities.

- The SPV must have a registered office in the Cayman Islands, but there is no requirement that it hold any meetings of the directors in the Cayman Islands.

- Other meetings including shareholders' meetings can also be held anywhere in the world and do not have to take place in the Cayman Islands.

- On an on-going basis the annual reporting requirements are also minimal and simply consist of a statement signed by the company secretary or a director that the company has conducted its operations mainly outside the Cayman Islands.

Bankruptcy remoteness – protection against insolvency risks

For Cayman entities, the general criteria applied by rating agencies to ensure sufficient protection against both voluntary and involuntary insolvency risks would be:

- The SPV must be insulated as far as possible from the insolvency of the other transaction parties, particularly the originator.

- The SPV's business must be restricted to activities which ensure a sufficient cash flow to pay the rated securities.

- Non-petition language must be included in agreements between the SPV and its creditors, together with limited recourse language which is effective under Cayman Islands' law in limiting a creditor's right to petition as an unpaid creditor.

- The SPV is usually restricted from amending its memorandum and articles of association without prior written notice to the rating agencies. This ensures that while the rated securities are outstanding, the bankruptcy remote status of the SPV will not be undermined by any merger or consolidation of the SPV. Generally this is dealt with in contractual covenants given by the SPV, rather than the provisions in the SPV's articles of association, but it should be noted that the amendment of the articles of association is within the control of the voting shareholders of the SPV. As a result, in a typical off-balance sheet arrangement, the Share Trustee agrees with the Note Trustee that it will not do anything to cause the SPV to breach its contractual covenants.

- The SPV is usually required to be an independent entity in order to avoid substantive consolidation of the SPV and its assets with those of its parent or other affiliates. In practice, for a wholly off-balance sheet entity which is wholly-owned by a Share Trustee, the rating agencies will accept an opinion from Cayman Islands' counsel that the SPV will not be a beneficially owned subsidiary of the Cayman Islands' trust company and that in any liquidation of the Cayman Islands' Share Trustee the liquidator will have no claim against the property of the SPV.

- The SPV is required to create valid and enforceable security interests over its assets in favour of the Note Trustee or the Security Trustee.

All of the above requirements can be easily satisfied under Cayman Islands law using a SPV.

Granting of Security

In most off-balance sheet financings, security is granted over the underlying asset by the SPV in favour of the Note Trustee or Security Trustee.

In general, no filings are required in respect of mortgages, charges or security interests under the laws of the Cayman Islands in order to ensure the validity or enforceability thereof or to regulate their ranking in point of priority. However, each company is required to maintain its own register of mortgages and charges and is under a statutory obligation to register details of any security granted by it over its assets in such register.

The priority of competing security under Cayman Islands law depends upon the application of the conflict of law rules but, in general terms, these look to the law governing the security agreement and the law of any agreement creating the asset over which the security has been taken or the law of the place where the asset is situated.

Insolvency in the Cayman Islands: A Creditor Friendly Jurisdiction

Cayman Islands' insolvency law is recognised as being creditor-friendly. Some of the factors contributing to this are:

- The Cayman Islands does not have any system of corporate rehabilitation such as the English 'administration' procedure or US Federal Chapter 11 proceedings where a debtor can effectively 'freeze' the rights of creditors including the creditors' rights to enforce security interests.

- There is no concept of automatic stay of proceedings. Cayman Islands' law does not prevent secured creditors enforcing their security in the liquidation of an SPV.

- Liquidators of a Cayman Islands' SPV cannot disclaim onerous contracts - the contractual rights of creditors continue to exist following liquidation.

- Cayman Islands fraudulent preference rules only apply when a disposition is made with a view to preferring one creditor over another. It is not enough that an asset or payment was made in circumstances which resulted in one creditor losing out.

- There is no concept of substance over legal form in the Cayman Islands. This means that heavily subordinated debt, long term, and perpetual debt would continue to be treated as debt and would benefit from the favourable treatment given to creditors rather than being treated as equity. Similarly, participating debt is not regarded as equity for Cayman Islands purposes even though it can have most of the characteristics of equity.

- Netting and set-off arrangements are recognised by express Cayman Islands' statutory provisions and will be enforced both pre and post insolvency, subject to them being effective as a contractual matter under the governing law of the contract in which they are contained.

- Contractual subordination is recognised by express statutory provision subject to it being effective as a contractual matter under the governing law of the contract.

Cayman Islands Steps For Setting Up An Off-Balance Sheet Structure

Step One - Incorporation

Information required:

- Name (and alternate(s) in case first choice not available).

- Authorised and issued share capital.

- Registered office in the Cayman Islands.

Step Two - Set up

Information required:

- Share trustee.

- Names and addresses of directors and officers, if any.

The first board meeting at which the directors are appointed and the shares issued to the share trustee is usually held shortly after the SPV is incorporated.

Step Three - Declaration of Trust and Administration Agreement

The declaration of trust is usually signed several days before the transaction signing date in conjunction and must be signed before any transaction documents are signed, to ensure the SPV is an orphan when the transaction is entered into. The administration agreement can be signed on or before the closing date.

Step Four - Transaction Board Minutes, Power of Attorney and Legal Opinion

Once drafts of the transaction documentation have been received, drafts of the board minutes, any necessary power of attorney and opinion (if required) can be produced. The board meeting of the SPV is held, the minutes signed and the power of attorney issued, generally before the closing date.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.