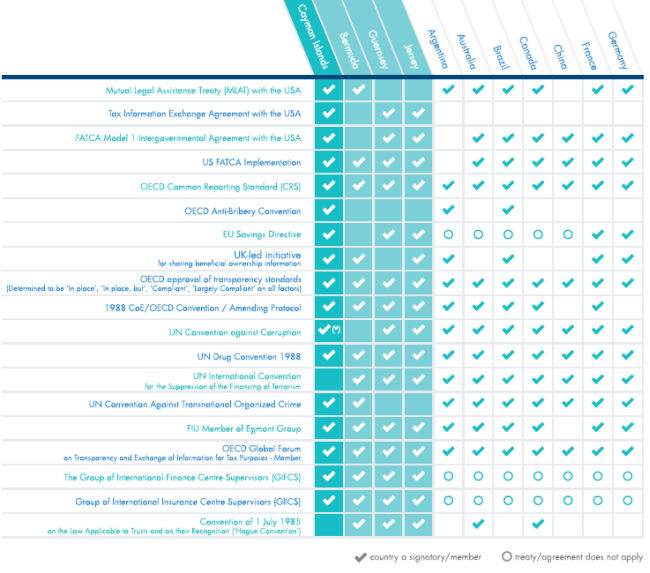

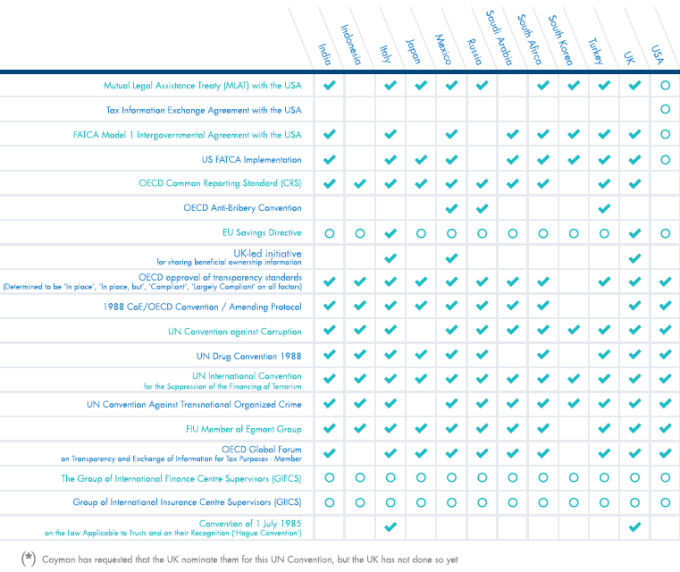

The Cayman Islands is a premier global financial hub, connecting law-abiding users and providers of capital and financing around the world - benefitting both developed and developing countries. Both the jurisdiction, and our financial services industry, have been recognised for decades as a strong international partner in combatting corruption, money-laundering, terrorism financing and tax evasion. The Cayman Islands has gained the reputation of a transparent jurisdiction by meeting or exceeding all globally-accepted standards for transparency and cross border cooperation with law enforcement. The chart below shows Cayman's adherence to the highest global standards compared with those of G20 members and other top IFC's (together the "G20 Plus"). G20 Plus includes G20 countries (The Cayman Islands, Bermuda, Jersey and Guernsey) plus the top international financial centres that adhere to the highest globally implemented standards for transparency and cross border cooperation. They are pivotal in benefitting the global economy by being tremendous extenders of value for G20 economies across the world. Cayman has adopted at least as many global standards as any G20 country – and more, when agreements specific to International Financial Centers (IFCs) and UK Overseas Territories are included. But in a global financial system, a single jurisdiction's leadership on transparency is not enough. Combatting global financial crime requires a unified legal, social and law enforcement approach by all G20 countries and IFCs together. Cayman Finance hopes all jurisdictions will adopt the full range of globally-accepted standards for transparency and cross border cooperation with law enforcement. As new standards are considered, it is critical that they apply to all jurisdictions as well.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.