Recent years have seen the appearance of a new category of Internet-based businesses — often referred to as the "sharing economy" — engaged in a range of different activities but operating according to certain common principles. When we refer to the sharing economy, we mean a system of economic activity with the following characteristics:

- The activity is arranged through a typically Internet-based platform, such as a website or smartphone application, operated by a party not directly involved in the underlying activities (the "platform provider")

- The platform connects individuals with goods or services to provide ("suppliers") with other individuals interested in such goods or services ("customers")

- The platform allows the suppliers and customers to transact with each other.

(Elsewhere, the term "sharing economy" is sometimes also used more broadly to describe transactions done through online marketplaces or involving shared access to goods.)

Here is a hypothetical example to demonstrate how a traditional form of business organization may translate into the sharing economy:

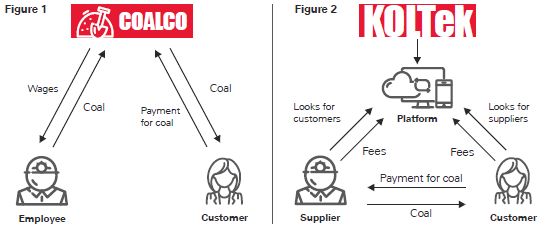

Figure 1 shows the operations of CoalCo, a corporation engaged in mining coal in a traditional way. CoalCo hires individual miner employees, those employees mine coal for CoalCo, which CoalCo sells to customers.

Figure 2 illustrates how such coal mining activities could be carried on through a sharing economy structure. CoalCo is replaced by KOLTek, a corporation which, instead of mining, operates an Internet-based platform — in this case, a website/smartphone "app". Potential individual suppliers and customers of coal would access the platform and be automatically matched with each other, with the platform then facilitating the entry into a contract directly between the supplier and customer for the sale of coal.

TECHNOLOGY & DATA SECURITY

Enabling Technologies

The growth of the sharing economy has been largely enabled by technology. The widespread use of mobile devices, mobile apps, and mobile payment methods allows people to access and use sharing economy platforms anywhere and anytime. Increased capabilities to manage "big data" allow sharing economy platforms to aggregate and analyze large data sets in order to deliver an efficient and effective platform for their customers. Absent such developments, managing the distributed legal relationships in a KOLTek-style structure may not have been practical.

Going forward, we expect that technological change will continue to be a major driver of development in the sharing economy, as platforms seek to leverage newer technologies, such as artificial intelligence (AI) and blockchain, to target new markets, explore new applications, develop faster, more accurate, and more relevant service offerings, and expand their reach. Such technologies and applications may be developed in-house by internal resources, or they may be procured from technology companies that service or partner with platform providers.

Data Security

Data security is an essential component of any sharing economy platform, particularly as the size and number of such businesses continue to grow, along with the amount of data that is stored in and processed through each platform. The nature of sharing economy businesses makes it particularly easy for them to collect and store sensitive information from their users (i.e., suppliers and customers), which may include certain personal information (name, email address, phone number), payment information (credit/debit card number), location information (based on the location of a user's mobile device), and other information regarding personal preferences, transactional history, contacts, searches, etc.

Any unauthorized disclosure of or access to user information, whether as a result of a cyber-attack or otherwise, could have a devastating impact on a sharing economy platform and its users, including users' loss of confidence in that business; financial losses (particularly if payment information is compromised); identity theft of affected users; and claims (whether in the form of a class action or otherwise) against the platform provider and potentially others.

Employment Relationships

Sharing economy arrangements continue to challenge traditional business models, including traditional employment and independent contractor relationships. There has been much media and academic scrutiny over whether the sharing economy positively or negatively impacts job security, as well as the broader societal consequences.

Platform providers like KOLTek do not generally consider suppliers to be employees because, among other things, the platforms they operate allow suppliers and customers to directly connect and contract with each other, without services being provided to the platform. This model helps KOLTek to reduce administrative complexity and costs associated with traditional employee models and provide services in a more flexible way.

Similarly, workers are drawn to the sharing economy because it provides flexibility and access to markets that would have been previously inaccessible on the same scale.

Risks of Misclassification

The emergence and growth of the sharing economy is being examined by Canadian courts and legislators. In this context, it is certainly possible that the law surrounding misclassification of employees — and both the frequency of and mechanisms for enforcement of misclassification claims — may change in the near and long term.

Employee misclassification was a key area of focus during the recent review of Ontario's Employment Standards Act, 2000 (ESA). The Changing Workplaces Review – Final Report (Report), which served as the basis for certain proposed amendments to the ESA, specifically commented on the rise of the sharing economy and the common characterization of suppliers as independent contractors in sharing economy structures.

The Report recommended that where there is a dispute over a worker's classification, the company or organization receiving the worker's services should have the burden of proving that the worker is not an employee covered by the ESA. This reverse onus recommendation was accepted and implemented into the ESA in January 2018.

While there have been relatively few employment or misclassification-related class proceedings in Canada to date, to the extent that there is a continued proliferation of the use of independent contractors across Canada, we can anticipate that such proceedings may become more common.

Comments made by Canadian courts in the context of recent misclassification cases (although not specific to the sharing economy) suggest that a shift in the traditional legal analysis may be forthcoming. As a result, sharing economy providers should be prepared to confront challenges to their business model in the coming years.

CLASS ACTION RISK & EXPOSURE

Challenging the Contractual Nexus

Sharing economy platform providers have started to face class action lawsuits from classes of customers and suppliers of goods and services. These plaintiffs either take issue with aspects of the platform itself or attempt to assert claims premised on a direct legal relationship with the platform provider. For example, suppliers have asserted employment relationships with the platform provider.

In the U.S., where the sharing economy is more established, platform providers have faced a wide variety of class action lawsuits, including claims of interference with property rights, improper background checks, racial discrimination by suppliers, and violation of employment and other regulations. In these cases, the class action risk to the platform provider is often mitigated through the use of carefully drafted customer and supplier agreements that include dispute resolution terms, often culminating in private arbitration.

There have been relatively few Canadian class actions against sharing economy platform providers to date and the cases remain at preliminary stages, but as the popularity of the sharing economy model grows in Canada, litigation challenges — including class actions — can be expected to increase. The extent to which Canadian courts will accept that dispute resolution terms in customer agreements provide acceptable alternatives to class proceedings remains to be seen.

Mitigating Litigation and Class Action Risks

The digital nature of sharing economy platforms makes it easier to present both customers and suppliers with detailed agreements. Platform providers can help reduce litigation and class action exposure through the inclusion of agreement terms that clarify the relationship between the parties, impose clear limitations or exclusions of liability, and establish comprehensive dispute resolution processes that allow customers and suppliers to effectively address complaints before resorting to litigation.

Tax Implications

Sharing economy structures can have significantly different tax implications for participants compared to the traditional economy. This can be particularly the case in Canada due to the Canadian tax system's focus on legal form over economic substance.

For example, to take our prototypical examples of CoalCo and KOLTek — while both corporations earn income that ultimately economically derives from the same types of underlying mining activities, legally KOLTek is not directly engaged in mining and is, rather, earning income from essentially providing IT services over the Internet to customers and suppliers.

Being considered to earn income from IT services instead of mining would expose KOLTek to different tax rules from CoalCo with potentially very different consequences. For example, one significant change is that KOLTek's income is likely to be much more "mobile" than CoalCo's, enabling KOLTek to situate the income in a favourable tax jurisdiction, independent of where physical mining occurs.

Because of its novelty, businesses in the sharing economy are often not well accommodated by existing tax rules, which may be ambiguous or unworkable when applied in the new context. However, tax authorities have sought to catch up with new developments through changes to tax legislation and administrative policies. Examples of recent proposed or implemented tax changes include:

- Recent Canadian changes to ensure the application of GST/HST to sharing economy transportation services, similar to how GST/HST already applied to taxis

- Proposed amendments in Quebec to impose obligations on certain non-resident platform providers and non-resident digital service providers to register and collect Quebec sales tax on the underlying economic activity in the province

- International proposals to expand the basis of taxation with gross-revenue taxes and/or a broadened "permanent establishment" concept, which would make it more difficult for platform providers to avoid tax liabilities in jurisdictions where the underlying economic activity is occurring

KEY TAKEAWAYS FOR PLATFORM PROVIDERS

Technology & Data Security

- Consider whether any new technologies may enhance the sharing economy platform, and whether such new technologies can be developed in-house or should be procured from one or more technology companies

- Obtain best-in-class security measures to protect against any unauthorized disclosure of or access to the confidential information stored by their platforms, and engage leading security experts to effectively implement such security measures

Employment Relationships

- Examine existing relationships, as a whole, to determine accurate worker classification

- Utilize best practices in drafting contracts with suppliers and customers

- Plan for future misclassification challenges

Class Action Risk & Exposure

- Dispute resolution should be a multi-step process: Arbitration or court proceedings should be the last resort for resolving disputes with customers and suppliers. Building intermediate steps, such as effective internal complaint processes and mandatory mediation into dispute resolution terms, will create opportunities to address complaints before they escalate into litigation — ideally preventing class proceedings before they start.

- Avoid a one-jurisdiction-fits-all mentality: Local laws, regulations and case law can affect the enforceability of agreement terms, including dispute resolution provisions, such as arbitration clauses. As sharing economy platforms become more prevalent, case law will develop and individual jurisdictions may impose new, targeted regulations. Vigilance in tracking these changes and customizing agreement terms to account for regional variations will help to guard against claims premised on non-compliance.

- Review and revise often: The digital nature of sharing economy platforms makes updating agreements easy so long as there are clauses permitting unilateral amendment of the terms. Platform providers should continuously review their customer and supplier agreements to address ambiguities, loopholes, and other issues in their existing contracts whenever they become apparent.

Tax Implications

- Carefully review tax situations to identify any particular opportunities or challenges arising from sharing economy operations

- Be prepared for future tax law changes with potentially significant effects on the business

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.