The Election Finances Act (Ontario) (the "Act") has been amended, effective as of January 1, 2017, to include, among other measures, new rules governing contributions to political constituents and restrictions applicable to political fundraising events.

The main features of the new rules are highlighted below.

Contributions

Only Individuals May Make Political Contributions

Individuals who are residents of Ontario may make contributions to political parties, constituency associations, candidate campaigns and leadership contestants registered in Ontario, and as of July 1, 2017 to nomination contestants.

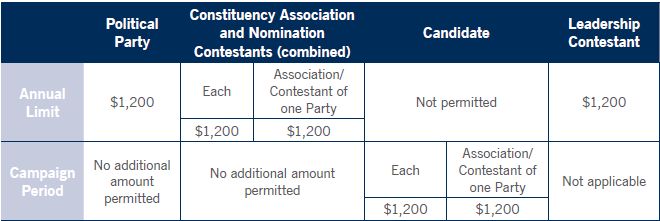

The contribution amount made by an individual is subject to annual limits, which vary based on the type of constituent and whether such contribution is made during a campaign period. The Act reduces the total amount an individual may donate to a maximum of $3,600 in a given year. The individual contribution limits are highlighted below:

Pursuant to the new rules, a guarantee provided by an individual pursuant to a loan is considered a contribution and is subject to the same limits described above. The amount of the guarantee provided by the individual is applied to such individual's annual contribution limits.

Corporations and Trade Unions Cannot Make Political Contributions

Corporations and trade unions are no longer permitted from making contributions to political parties, constituency associations, nomination contestants, candidates, or leadership contestants. Given that guarantees are considered contributions, corporations and trade unions are prohibited from acting as guarantors under any loans provided or modified as of January 1, 2017.

Fundraising

Reporting Requirements

All parties that maintain electronic databases or websites must post certain information relating to the fundraising event, including, but not limited to, the date of the event, the location of the event, the amount of the entry charge, and the identity of the recipient or recipients of the funds to be raised. This information must be posted at least seven days prior to the date of the event, or in the case of an event taking place during the period commencing with the issue of a writ for an election and terminating on election day, at least three days prior to the date of the event.

Further, the Act requires greater detail about the income generated at fundraising events. In particular, the gross income generate from the fundraising event must be recorded and reported to the Chief Electoral Officer by the chief financial officer of the political party, constituency association, nomination contestant, candidate or leadership contestant.

Politicians Can No Longer Attend Fundraisers

The following individuals are prohibited from attending fundraising events where the amount of the cover charge includes a political contribution:

- A member of the Assembly

- The leader of a registered party

- A registered nomination contestant, candidate or leadership contestant

- Any person employed in the Office of the Premier

- The Chief of Staff of a Minister of the Crown, or a person holding an equivalent position for a Minister of the Crown, regardless of title

- Any person employed as a member of the staff of the leader of a recognized party

It is important to note that if the cover charge is limited solely to the cost of hosting the event, and does not form part of a political contribution, a candidate is permitted to attend the fundraising event. Further, if there is no cover charge, the candidate is permitted to attend the fundraising event.

Limit on Contributions

The total contribution made with respect to a single fundraising event by a contributor may not exceed $1,200, subject to an indexation factor determined under the Act.

Loans

The Act modifies the rules governing loans made to political parties, constituency associations, nomination contestants, candidates or leadership contestants.

Namely, the new rules require loans obtained after January 1, 2017 (or loans modified after January 1, 2017) to be repaid in full within two years.

As described in the 'Contribution' section, a guarantee provided in connection with the loan is considered a contribution and is applied toward an individual's annual contribution limit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.