The recent overhaul of Alberta's Employment Pension Plans Act (EPPA) and Employment Pension Plans Regulation (EPPR) effective September 1, 2014, has resulted in amendments being required to Alberta-registered pension plans, and to pension plans registered in jurisdictions other than Alberta with plan members employed in Alberta, to be filed by December 31, 2014. The Office of the Alberta Superintendent of Pensions (the Superintendent) recently announced that an extension of the filing deadline for plan amendments will be granted to March 31, 2015, upon written request.

Included among the changes to the EPPA and EPPR that took effect on September 1, 2014, are:

- Immediate vesting of members' benefits;

- Pre-retirement death benefit of 100 percent of the commuted value of a member's benefit for all service;

- Changes to unlocking provisions, including the removal of the surviving spouse unlocking option under the 50-percent unlocking rule and under the shortened life expectancy unlocking provision;

- Inclusion in the plan text document of any defined terms in the EPPA that apply to the plan; and

- Forced portability for defined contribution (DC) plans, at the plan administrator's option.

Other changes include changes to disclosure statements as of December 31, 2014:

- New information to be included in plan summaries, as well as in annual, termination, retirement and death benefit statements; and

- New required communications, including an annual statement to retired members and a statement notifying members of changes to contributions or benefits.

What's Next for Alberta-registered Pension Plans?

For the first time ever in any Canadian jurisdiction, all Alberta-registered pension plans must put in place a formal written governance policy, and all defined benefit and target benefit Alberta-registered pension plans must have a formal written funding policy,1 by August 31, 2015.

Governance Policy

Plan administrators in Alberta must ensure that a written governance policy is established for all pension plan types, including both defined benefit (DB) and defined contribution (DC) pension plans. The EPPA requires that a pension plan be administered in accordance with its governance policy. The governance policy is not required to be filed with the Superintendent, but must be made available upon request.

The governance policy is intended to define the responsibilities of various parties to a pension plan including the plan sponsor, participating employers, and the plan administrator. The following table summarizes the specific information that must be included in a governance policy.

| Governance Policy Topics | Information that must be Included |

|---|---|

| Structures and Processes |

|

| Decision-Makers |

|

| Performance |

|

| Access to Information |

|

| Educational Requirements |

|

| Code of Conduct Policy |

|

| Conflict of Interest Policy |

|

| Material Risks |

|

| Dispute Resolution Process |

|

Funding Policy

Administrators of DB and target benefit Alberta-registered pension plans must ensure that a formal written funding policy is established for the plan. A pension plan must be administered in accordance with its funding policy. Alberta and New Brunswick (the latter with respect to shared risk plans only) are the only jurisdictions in Canada to require a pension plan funding policy. The funding policy is not required to be filed with the Superintendent, but must be made available upon request.

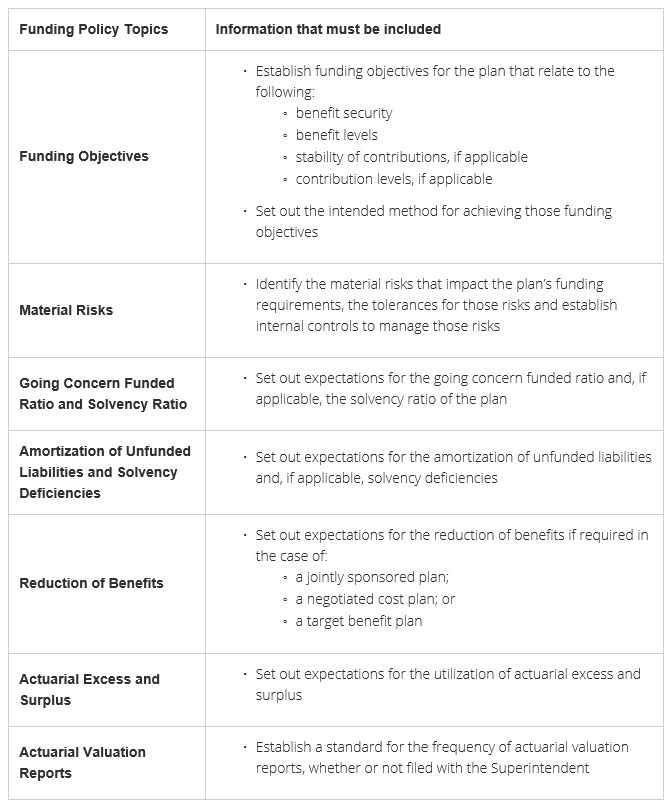

The following table summarizes the specific information that must be included in a funding policy.

How will the Plan Administrator Ensure Compliance with the Governance Policy and/or the Funding Policy?

A plan administrator will now be required to conduct an annual review of a pension plan, including a review of a plan's operation, governance and general administration, and prepare a written report on its findings. This report must be provided to the Superintendent upon request.

This annual assessment must be done to ensure that the plan is being administered, funded and invested in accordance with the governance policy, funding policy and other pension plan documentation. The first annual assessment review and report must be prepared by the end of 2016 and annually thereafter.

Who can Access the Governance Policy and Funding Policy?

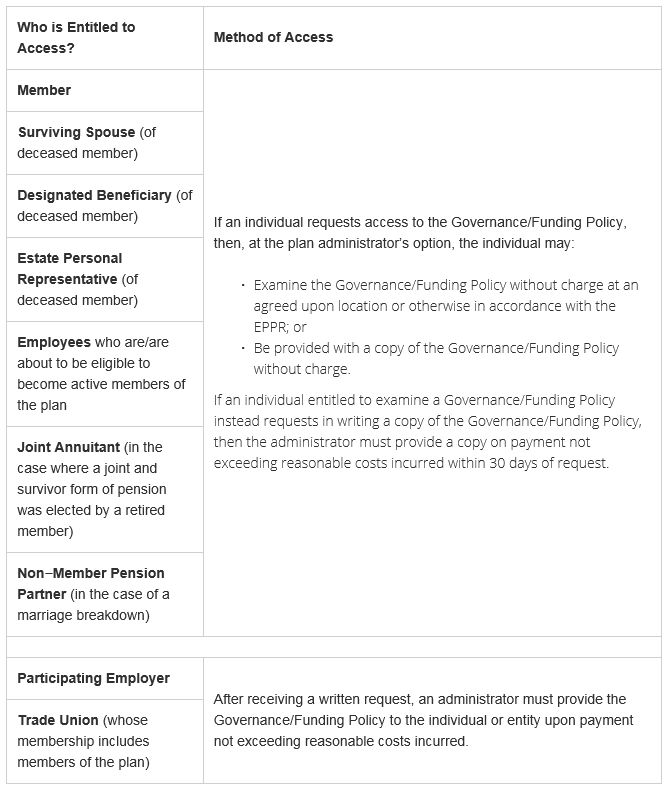

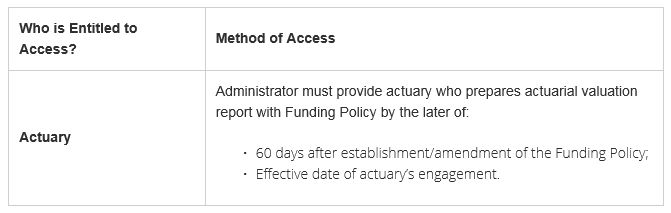

The following table illustrates who can access the governance policy and/or the funding policy for the plan.

Access to Both Governance Policy and Funding Policy

Access to Funding Policy Alone

Next Steps for Plan Administrators

What are the next steps for plan administrators?

For Pension Plans with an existing Governance Policy or Funding Policy:

Review your existing governance policy and funding policy by August 31, 2015 in order to ensure that they comply with the requirements of the new EPPA and EPPR. Revise the policies as necessary.

For Pension Plans without a Governance Policy or a Funding Policy (if required):

Ensure that you establish a governance policy and a funding policy (if required) that meet the requirements of the EPPA and the EPPR by no later than August 31, 2015.

If you require assistance with the preparation or review of your Governance Policy or Funding Policy, or with respect to any other compliance matters as a result of the new Alberta pension legislation, please contact your Bennett Jones Advisor. We would be happy to assist you.

1 The New Brunswick Pension Benefits Act currently requires a funding policy for shared risk plans only but not for any other pension plan type.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.