On July 30, the Ontario Securities Commission initiated a public consultation seeking to address the underrepresentation of women on boards and in positions of senior management of TSX-listed issuers. The OSC's consultation process follows a request by the Ontario government tabled in the Ontario budget last May for the OSC to recommend ways to move forward with enhanced gender diversity. We originally wrote about this process in August of 2013 when OSC Consultation Paper 58-401 was first released, and we now take the opportunity to review that process, including comments received on the Consultation Paper. Below, we also look at how these Canadian initiatives compare to those being undertaken by various regulators around the globe.

The fact that Canadian company boards lag behind those of other countries in terms of gender diversity comes as no surprise to most. This has been corroborated by studies undertaken by the likes of Catalyst, TD Economics and the Canadian Board Diversity Council. Moreover, there has been no identifiable increase in recent years of female representation in senior management or on public company boards. This has resulted in high-levels of media attention and scrutiny by both the federal and provincial levels of government.

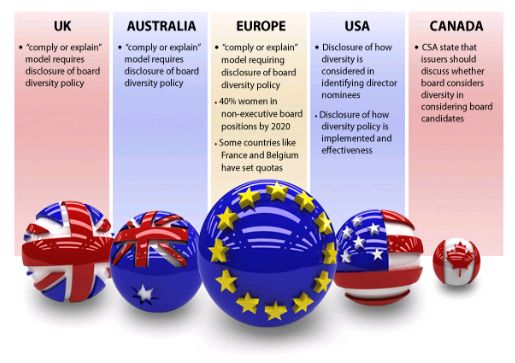

As we review in detail in this article, in comparison to certain other countries, Canada currently has no mandated quotas or targets for female board representation (although Quebec has enshrined in law the objective of gender parity for the boards of Quebec Crown corporations). Meanwhile, diversity is not explicitly addressed in the disclosure requirements for public companies in Canada. That said, public companies in Canada are required to disclose the board nomination process, and the Canadian Securities Administrators have suggested that issuers should, but are not required to, discuss whether the board considers diversity when considering a candidate for appointment to the board.

Below, we consider: (i) recent gender diversity initiatives in Canada focussing mainly on the initiative by the Ontario Securities Commission; (ii) recent diversity developments in the United States; and (iii) a summary of certain international diversity practices.

Canadian Initiatives

Government and OSC Initiatives

In April 2013, the Canadian federal government established an advisory council comprised of business leaders to advance the participation of women on corporate boards. Meanwhile, in May 2013, the Ontario government indicated that it would formally pursue initiatives aimed at gender diversity at major businesses, not-for-profits and other large organizations. The Ontario government subsequently requested that the OSC undertake a public consultation process regarding disclosure requirements for gender diversity, which resulted in the release earlier this year of a consultation paper for comment entitled Disclosure Requirements Regarding Women on Board and in Senior Management.

The stated purpose of the OSC consultation paper was to seek feedback on advancing the representation of women on boards and within senior management of public companies generally. To that end, the paper proposed the implementation of a "comply or explain" disclosure regime regarding gender diversity that would require TSX-listed issuers to disclose the following:

- Whether a company has a gender diversity policy regarding

female representation on the board and in senior management. If so,

issuers would have to disclose the policy's key terms,

including any measurable objectives and progress versus those

objectives. If not, a company would be required to explain why

not and identify any risks or opportunity costs associated with

this decision.

- Whether a company considers representation of women on the

board in its nominating process and if it does not, it would be

required to explain why not and identify any risks or opportunity

costs associated with this decision.

- If a board has a policy regarding gender diversity, how

adherence to the policy, or the achievement of objectives, are

assessed in the board evaluation process.

- The proportion (in percentage terms) of female employees in the whole organization, in senior executive positions and on the board.

The comment period for the OSC consultation paper was open from July 30, 2013 to October 4, 2013 and substantially all of the comments received were supportive of the OSC initiative. Some of the more common substantive comments included the following themes:

- "Comply or explain" is not enough and issuers should be required to set targets or the OSC should mandate quotas.

- What will the OSC propose if the "comply or explain" model achieves limited results? Some suggested quotas may be necessary and some suggested terms limits and/or retirement ages may be necessary.

- The OSC should recommend or require issuers to adopt a gender diversity policy which possibly includes targets.

- Quotas should not be introduced.

- A broader definition of diversity, such as age, ethnicity and national original should be considered not just gender.

Given the support received to date, it is expected that the OSC proposal will be adopted in some form.

Governance Groups/Institutional Investors

Certain institutional shareholders and governance groups, including IA Clarington and MEDAC, have recently submitted shareholder proposals to companies with respect to diversity. In particular, MEDAC has submitted proposals requesting that companies reach a parity of women on boards within ten years and/or parity within senior management within five years. In 2013, a handful of large cap TSX issuers received such proposals and shareholders were generally not supportive with the highest support being 21% of shareholders.

Meanwhile, the CCGG recently amended its publication "Building High Performance Boards" to add a statement regarding gender diversity and the need to "refresh" boards periodically. According to the updated publication, boards are expected to be diverse, and should "set reasonable, measurable targets for themselves to build a more diverse board." Most institutional investors and governance groups, also make specific statements in their voting policies about supporting diversity however to date these voting policies do not indicate that votes will be withheld or voted against (e.g., against members of the nominating committee) if certain thresholds of diversity are not met at a particular company.

Current Practices of Canadian Issuers

Following a high-level review of the disclosure of certain large cap Canadian issuers we noted that there are certain large cap issuers, including a number of the Canadian banks, which have adopted board and gender diversity policies. Some have set objectives of at least 25% or 33% of directors being women, others are striving for "parity between men and women on the board" and have set objectives that "half of the nominees appointed to fill Board vacancies be women" and one of the banks has set a target that greater than 40% of new hires to the VP+ pool should be women.

U.S. Developments

The U.S. enhanced its proxy disclosure regime in 2009 to require disclosure of whether, and if so how, a nominating committee considers diversity in identifying director nominees. Further, if a nominating committee has a policy respecting the consideration of diversity in identifying director nominees, SEC rules now require disclosure of how the policy is implemented and how the nominating committee assesses the policy's effectiveness.

Ultimately, the 2009 rule amendments were implemented in order to assist investors in making more informed voting and investment decisions. Further, according to SEC Commissioner Luis A. Aguilar, the changes represent "an important first step in providing investors with the diversity disclosure that they have been requesting."

Whether the new disclosure rules have resulted in improved gender representation on U.S. boards, however, remains to be seen. Since 2009, the percentage of female directors on U.S. public company boards has risen less than 2%, with women now accounting for only 11.7% of directors. The Canadian percentage is 13.1%. Meanwhile, in 2012, only 18 women served as CEOs of Fortune 500 companies.

International Practices

The OSC consultation paper also outlined certain international practices respecting diversity, some of which are summarized below.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.