Offshore financial services businesses operating in Australia brace for further changes as submissions close on the latest ASIC consultation paper.

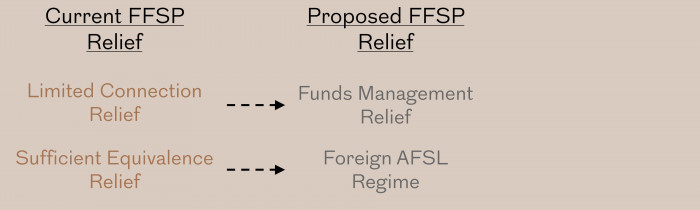

On 3 July 2019, ASIC released Consultation Paper 315: Foreign financial services provider: Further consultations (CP 315), consulting on further proposed changes to the Australian Financial Services Licence (AFSL) regime for foreign financial service providers (FFSPs). The consultation paper is a follow up to ASIC's Consultation Paper 301: Foreign financial services providers (CP 301) released last year, and seeks consultation on the proposal to vary the Australian financial services (AFS) licencing relief for FFSPs.

In particular, ASIC is seeking to introduce a new 'funds management' exemption to replace the 'limited connection' exemption from March 2020.

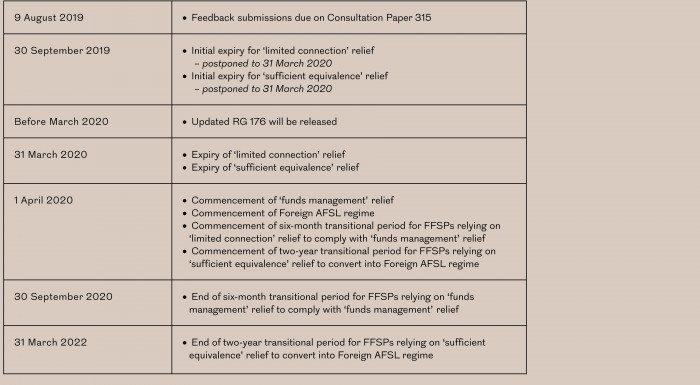

ASIC is requesting submissions on CP315 until 9th August 2019.

CURRENT AFSL REGIME FOR FFSPS

Previously, an FFSP that satisfied either of the following exemptions may have been granted relief from the requirement to hold an AFSL under section 911A of the Corporations Act providing financial services in Australia:

- The 'sufficient equivalence' exemption;

- The 'limited connection' exemption

The' sufficient equivalence' exemption provides that, an FFSP belonging to a jurisdiction with sufficiently equivalent regulatory regimes to Australia, is conditionally exempt from holding an AFSL when providing financial services in Australia. Among others, sufficiently equivalent jurisdictions include the US, UK, Singapore and Hong Kong – FFSPs from these jurisdictions may provide financial services in Australia without an AFSL by relying on the 'sufficient equivalence' exemption. In addition, an FFSP whose primary business is located overseas but only provides financial services to limited Australian clients is also conditionally exempt via the 'limited connection' exemption.

In CP 301, ASIC proposed to repeal both the above exemptions. The 'sufficient equivalence' relief will be replaced with a special "Foreign AFSL" for FFSPs regulated under sufficiently equivalent jurisdictions. The Foreign AFSL will impose only parts of the standard AFSL obligations and requirements on qualified FFSPs. For example, Foreign AFS licensees will be exempt from certain provisions in Chapter 7 of the Corporations Act, given that these FFSPs would already be subject to similar regulatory requirements under their home jurisdictions.

Overall, in implementing changes to the AFSL regime for FFSPs, ASIC aims to 'strike an appropriate balance between cross-border financial services facilitation, market integrity and investor protection.'

WHAT ARE THE PROPOSED CHANGES UNDER CP 315?

Funds management relief

ASIC now aims to replace the 'limited connection' relief with the 'funds management' relief. ASIC's rationale is that the 'limited connection' exemption has been too broadly relied upon by FFSPs. Thus, in revoking the 'limited connection' relief and replacing it with the 'funds management' relief, the scope of financial services operations and clientele available to offshore FFSPs is substantially limited.

Under the proposed relief instrument, an offshore FFSP may be conditionally exempt from holding an AFSL if it provides 'funds management financial services' in Australia subject to a cap on the scale of those services and other conditions. ASIC suggests that 'funds management financial services' are to be provided to only select professional investors in Australia and limited to the following activities:

- Dealing in interests of a foreign managed investment scheme (Scheme) or securities of an offshore incorporated investment entity (Body);

- Providing financial product advice in relation to the interests or securities of the Scheme or Body;

- Making a market in relation to the interests or securities of the Scheme or Body;

- Portfolio management services to 'eligible Australian users' (specifically, a superannuation fund, an approved deposit fund, a pooled superannuation trust, or a public sector superannuation fund within the meaning of the Superannuation Industry (Supervision) Act and with net assets of at least A$10 million).

Foreign AFSL guidelines

ASIC has provided guidelines for the proposed Foreign AFSL regime under its previous CP 301 but provides greater clarification on the regime under the present CP 315. Particularly, ASIC has provided a draft updated Regulatory Guidance 1761 (RG 176) that will implement a streamlined application process for qualified FFSPs.

Updated RG 176 will be released before March next year. ASIC will also withdraw its Information Sheet 1572 Foreign financial services providers: Practical guidance (INFO 157) following the release of the updated RG 176.

New expiry date on 'limited connection' exemption

ASIC has extended the expiry date for the 'limited connection' relief instrument for a further six months (31 March 2020) from an initial expiry date of 30 September 2019. ASIC further seeks to commence the new 'funds management' relief on 1 April 2020. FFSPs relying on the 'limited connection' relief will have a six-month transitional period (1 April 2020 to 30 September 2020) to facilitate compliance with the new 'funds management' relief conditions. The updated RG 176 will provide information on how the 'funds management' relief will be applied (see draft1 at RG 176.116 – 176.131).

New expiry date on 'sufficient equivalence' exemption

ASIC has also extended the expiry date for the 'sufficient equivalence' relief to a further six months (31 March 2020) from an initial expiry date of 30 September 2019. Subsequently, ASIC seeks to commence the new Foreign AFSL regime on 1 April 2020. FFSPs relying on the 'sufficient equivalence' relief will have a two-year transitional period (1 April 2020 to 31 March 2022) to apply for Foreign AFSL and implement the necessary compliance arrangements to meet the Foreign AFSL requirements.

SUMMARY OF KEY DATES

NEXT STEPS FOR FFSPS

Given that both relief instruments for FFSPs will expire in under a year, time is of the essence for FFSPs to immediately evaluate and undertake the relevant arrangements best fit for business in order to continue providing financial services in Australia.

Footnotes

1Regulatory Guide 176

2Information Sheet 157

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.