Queensland landlords with commercial leases, and their tenants, should be reviewing outgoings and land tax recovery clauses in leases, following the decision in Vikpro Pty Ltd v Wyuna Court Pty Ltd [2016] QCA 225.

The Queensland Court of Appeal shot down the tenant's argument which sought to preserve the prohibition on this type of recovery in section 44A of the 1915 Land Tax Act, even after its repeal.

Queensland landlords' rights to recover land tax from tenants

Landlords' rights to recover land tax from tenants had been in suspense under section 44A of the 1915 Act which made land tax recovery provisions in leases entered into after 1 January 1992 unenforceable.

In 2009, section 44A was repealed to allow recovery of land tax in new leases, but a saving provision was added to preserve its operation for existing leases. The rewrite of the Land Tax Act in 2010 repealed the 1915 Act, including the saving provision. However, the 2010 Act did not expressly say that section 44A continued to apply to existing leases.

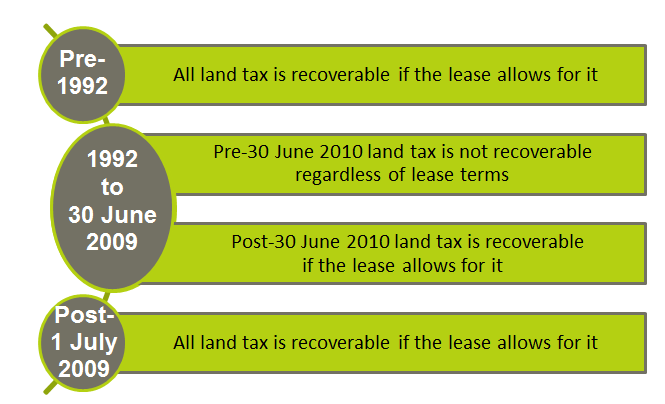

The Court of Appeal has now confirmed that tenants lost their immunity from recovery of land tax under existing commercial leases from 30 June 2010 . This means that, provided the lease allows it, landlords can recover post-30 June 2010 land tax from tenants even though recovery was not lawful at the time the lease was entered into.

Date of entry into the lease - land tax recovery position

The land tax recovery position for different commercial leases will depend on the date of entry into the lease:

NB: Each lease category includes options entered into under those leases.

How does this affect me?

Landlords will be entitled to recover land tax assessed on or after 30 June 2010 under commercial leases entered into before 1 July 2009 if those leases allow it. Recovery is still prohibited in residential leases and retail shop leases regulated by the Retail Shop Leases Act 1994.

What should I do?

Landlords and tenants under Queensland commercial leases entered into between 1 January 1992 and 30 June 2010 should check their lease to ensure they are aware of their rights and obligations.

This is particularly important for long-term leases. Outgoings and land tax recovery clauses in leases which span the relevant dates (ie. entered into on or after 1 January 1992 and before 1 July 2009) should be checked. This includes assigned leases and option terms under those leases.

Landlords seeking to recover land tax should do so promptly - if they don't, tenants could run waiver or estoppel arguments based on any delay.

Clayton Utz communications are intended to provide commentary and general information. They should not be relied upon as legal advice. Formal legal advice should be sought in particular transactions or on matters of interest arising from this bulletin. Persons listed may not be admitted in all states and territories.