The taxation of trusts and beneficiaries of trusts continues to be an ever-evolving practice.

On 3 July 2014 the ATO released a fact sheet outlining its views on an anti-avoidance rule (already in existence for over thirty years) and indicated that the rule may have broader application than many will have assumed.

Whilst representatives of the tax profession have been consulted on the fact sheet, it is fair to say that its contents will be contentious.

Set out below is some background on the issue followed by an outline of the key points arising from the fact sheet.

Background

Section 100A was introduced in 1979 specifically to overcome certain "trust stripping" arrangements that were designed to enable trust profits. This section was introduced to escape tax, but has always had the potential for broader application than its intended purpose due to the general wording of the section.

The measure was introduced to counter arrangements referred to as "reimbursement agreements". The typical arrangement at which the measure was directed was one whereby a non-taxable beneficiary (e.g. a charity) was introduced as a beneficiary of a trust and was made entitled to trust income, but the relevant funds were not ultimately paid to that beneficiary and were instead enjoyed by another beneficiary or related party of the trust in a tax free form.

If applicable, section 100A deems the beneficiary to which the trust income was distributed not to be presently entitled and for the income to be treated as accumulated in the trust. The result is severe in that the relevant taxable income would not be assessed to the beneficiary that was entitled to it; rather the taxable income would be assessable to the trustee at the top marginal rate of tax. The other penal aspect of section 100A is that the Commissioner can review assessments indefinitely in order to apply it – section 100A is outside the normal timing limits on the Commissioner's amendment powers.

One key (although vaguely worded) exclusion from this anti-avoidance measure is that an "ordinary family or commercial dealing" is not affected.

Whilst many tax practitioners were of the view that this measure should be reserved for more glaring cases of tax avoidance, it is now publicly evident that the ATO's view of section 100A is much wider than this.

What is the ATO's view as per the fact sheet?

It is abundantly clear that the ATO regard section 100A as being potentially relevant to a broad range of circumstances where trust income is distributed but not paid to a beneficiary, not just more aggressive arrangements involving exempt charities.

The fact sheet gives a number of insightful examples as to when section 100A would not ordinarily be applied (based on the ATO view), when section 100A is likely to apply and also some indication on scenarios where section 100A may or may not apply, depending on the facts.

What scenarios would section 100A not apply to?

Based on the examples and commentary in the fact sheet, it is understood that the ATO would not generally (the ATO are very careful in their fact sheet to leave themselves "wiggle room") seek to apply section 100A in the following scenarios:

Example 1:

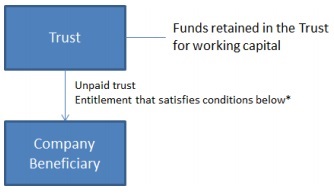

* Unpaid trust entitlement converted to complying Division 7A loan terms 1 or 1 placed on complying Division 7A sub-trust terms according to the Commissioner's Practice Statement. The ATO has also stated that they would not be looking to undertake active compliance resources to pre-16 December 2009 UPEs in this circumstance.

Example 2:

What scenarios would section 100A apply to?

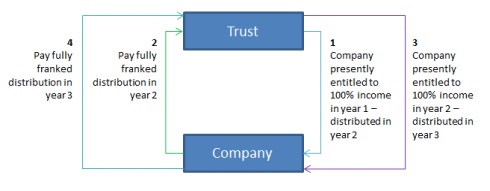

It is clear from the fact sheet that the ATO does not like circular arrangements where a trust distributes income to a company beneficiary that is owned by the trust with the company paying dividends subsequently and repeating the arrangement annually, with the result that the funds are, in substance, accumulated within the trust, but only suffering tax at the corporate rate (not the higher rate applicable to income accumulations within a trust). The following diagram is reproduced from the ATO Fact sheet:

Example 3:

What other scenarios may be "in the mix"?

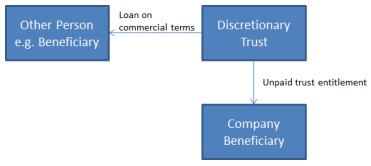

- Interest free loans?

Consider Example 1 where the loan from the trust to "Other Person e.g. Beneficiary" is not on commercial terms. In these circumstances, whether section 100A might apply becomes less clear and, according to the ATO, will depend on the facts and whether the arrangement was entered into as part of "an ordinary family or commercial dealing". Whilst there may be some comfort in the vagueness of this condition, equally there is uncertainty. The ATO make the comment that the fact that a loan may not bear interest will not necessarily mean that it is not part of "an ordinary family or commercial dealing". This will depend on the full factual background to be determined in each case. However, it is implied in the fact sheet that, at the minimum, the ATO would need to be satisfied that the loan was made on a bona fide basis with the intention of repayment.

- Grandfathered loans from trusts?

There may be a number of trust structures with longstanding unpaid entitlement balances due to beneficiaries on one side of the balance sheet with loans out to other related parties on non-commercial terms that predate (and therefore remain unaffected by) Division 7A rules that affect more recent arrangements. These have not been carved out from consideration, according to the views expressed in the ATO's fact sheet

- Grandfathered pre-16 December 2009 unpaid entitlements owing to company beneficiaries

As noted under Example 1, the ATO is evidently not specifically targeting pre-16 December unpaid trust entitlements owing to company beneficiaries, provided that the funds have been retained as "working capital" in the trust. However, in the event that such funds may have been otherwise applied, these arrangements will potentially be up for consideration.

What action should be taken?

It is desirable to revisit existing structures and arrangements to ensure that you are well placed to respond to any questions that are raised in relation to section 100A. Careful consideration should be given to the full factual background and the applicability of the "ordinary family or commercial dealing" exception in this context and, where appropriate, how this can be best evidenced.

Footnotes

1 Or placed on complying Division 7A sub-trust terms according to the Commissioner's Practice Statement

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.