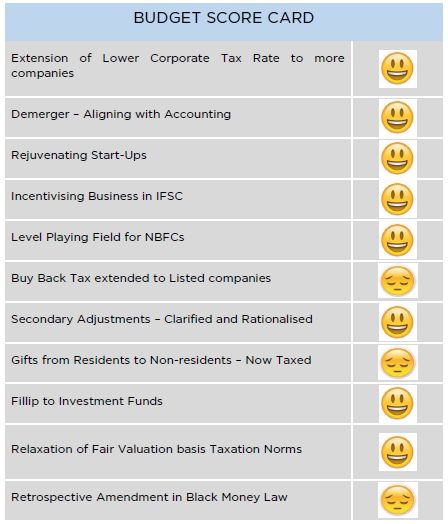

A snapshot of the key Direct Tax proposals

TAX RATES

The tax rates and income slabs under the Income-tax Act, 1961 (IT Act) remain the same, other than the following proposed changes

Big or Small, All Fish in Same Pond!

Currently, the general corporate tax rate for domestic companies is 30%. However, domestic companies with a turnover of up to INR 2,500 Mn in Financial Year (FY) 2017-18 are taxed at a lower rate of 25%.

The Finance (No.2) Bill, 2019 (Bill) proposes to increase this threshold from INR 2,500 Mn to INR 4,000 Mn and as such, more companies will benefit from the reduced corporate tax rate of 25%.

This amendment is proposed to be effective for FY 2019-20.

(Ab) Kaun Banega Crorepati! (Who wants to be a Millionaire?)

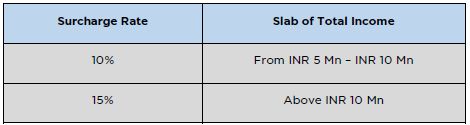

Currently, tax payable by individuals, Hindu Undivided Family (HUF), association of persons and body of individuals is increased by a surcharge (applied on the base tax rate):

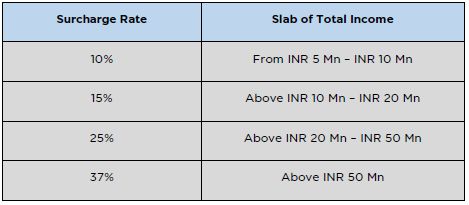

The Bill proposes the following increase in the surcharge rate:

This increased surcharge pushes the highest effective tax rate to 43% from the current effective rate of 36%.

In keeping with its promise of reducing the corporate tax rate in a phased manner, is the Central Government making up the revenue deficit from HNIs and other non-corporate taxpayers? It needs to be seen if any relief will be granted for additional interest arising on account of delay in depositing advance tax for the first quarter of FY 2019-20 that has lapsed.

This amendment is proposed to be effective for FY 2019-20.

MORE GIFTS TO GIFT CITY (IFSC)

Currently, the IT Act provides for several incentives to units set up in an International Financial Services Centre (IFSC). The key benefits include (i) tax holiday in relation to 100% profits for the first five years and 50% profits for subsequent five years; (ii) exemption from Dividend Distribution Tax (DDT) on distribution of current income; and (iii) reduced rate of Minimum Alternate Tax (MAT).

The Bill proposes to extend the following additional concessions to units set up in an IFSC:

- Effective FY 2019-20 onwards

-

- Exemption to non-residents in relation to any interest income on loans extended to units set up in IFSC;

- Tax holiday in relation to 100% profits for a period of any ten consecutive years out of the first fifteen-year period; and

- Exemption currently available to non-residents on transfer of certain securities such as derivatives, Global Depository Receipts etc on a recognized stock exchange set up in an IFSC shall be extended to Category III Alternate Investment Funds (AIF) (which are not fiscally transparent entities and thus, could not benefit from the exemption) having non-resident investors and earning income solely in convertible foreign exchange. Additionally, the list of securities currently eligible for this exemption is proposed to be expanded by the Central Government.

- Effective from 1 September 2019

-

- Exemption from DDT extended to accumulated income earned after 1 April 2017 for IFSC units deriving income solely in convertible foreign exchange. Presently, such exemption is available on income distributed from such unit's current income alone; and

- Exemption from tax on income distributed by a mutual fund located in an IFSC, if (i) such income is derived from transactions undertaken on a recognized stock exchange situated in an IFSC; (ii) all the units of such mutual fund are held by non-residents; and (iii) such mutual fund derives income solely in convertible foreign exchange.

The proposed amendments aim to provide a fillip to the development of IFSCs in India. Importantly, this opportunity provided to non-resident lenders to earn tax-free interest from moneys lent to units in an IFSC, shall incentivise the lenders to provide such units financing to set-up and expand their businesses. Additionally, exemption provided to Category III AIFs set up in an IFSC on transfer of certain securities should provide the necessary boost for the funds industry to set up shop in IFSCs. All in all, a welcome move!

NAMASTE NON-RESIDENTS

No Free Lunches | Gift to Non-residents under Tax Net

Currently, under the IT Act, any sum of money or property received by a person (unless exempt), without consideration or for inadequate consideration, is taxable in the hands of the recipient and is a deemed gift tax of sorts.

It was noted in the explanatory memorandum to the Bill (Memorandum) that, receipts of money or property by persons outside India are claimed not to be taxable in India on the premise that such receipt of money or property does not accrue or arise in India (i.e. such receipt is not sourced in India).

The Bill proposes to tax any sum of money paid or property situated in India and received by a person outside India on or after 5 July 2019 from an Indian resident, deeming such receipt to be sourced in India.

The above is subject to relief, if any, under the tax treaty between India and the country of residence of the recipient and applicable exclusions under the current deemed gift tax provision.

This amendment is proposed to be effective FY 2019-20 onwards.

Pay Tax and Relax? Relaxing the Rigours of Withholding Tax

Currently, under the IT Act any person making certain payments to a resident or non-resident is required to withhold tax and undertake related compliances. In case the applicable tax is not withheld, the payer is considered to be an 'assessee in default' pursuant to which the following consequences arise:

- The tax authorities can recover the entire tax amount along with interest from the payer;

- Penalty could also be levied by the tax authorities; and

- The payer is not allowed tax deduction on such payment (30% of payment in case of resident payments) while computing its taxable income.

However, in case of payment to residents, the payer is not required to pay the aforesaid withholding tax if the resident payee offers such receipt when filing its return of income and pays income-tax thereon. Further, tax deduction for such payment which is otherwise not available to the payer on such amount (to the extent of 30%) is also allowed if the resident payee satisfies the above conditions. However, while there are judicial precedents in support of applying a similar principle in case of payments to non-residents, there is no express relief under the IT Act in this regard.

The Bill proposes to extend this relaxation from payment of withholding tax in relation to payments to non-residents as well, so long as the non-resident has offered such income when filing its tax return and has paid tax thereon. Consequent changes have also been proposed to allow for deduction of tax to the payer in case of such payment to a non-resident provided the non-resident undertakes the abovementioned compliances.

That said, as the amendment regarding exemption from payment of tax deduction at source is proposed to be effective from 1 September 2019 and the amendment regarding relaxation of tax deduction is proposed to be effective FY 2019-20 onwards, any anomaly arising therefrom would need to be carefully evaluated.

Beyond Borders | Assistance in Tax Recovery

Currently, provisions of the IT Act specifies the mechanism for mutual assistance in the recovery of taxes amongst countries with which India has entered into an agreement. The basis for availing as well as providing assistance in such tax recovery matters is the requesting country's knowledge of the existence of assets of a taxpayer in the country whose assistance is sought.

The Bill proposes to address practical situations where the location of assets owned by a person is unknown, but his tax residency is known. In such a case, request for assistance for collection of taxes can be made to the country of residence of such person. Similarly, a foreign country can request India for assistance under the agreement in relation to the Indian resident.

This amendment is proposed to be effective from 1 September 2019.

Extra Masala at no Tax Cost

Currently, the IT Act provides a concessional withholding tax rate @ 5% in relation to interest payable on offshore rupee denominated bonds (Masala Bonds), issued before 1 July 2020.

With a view to augment foreign exchange inflows, the Central Government vide a press release dated 17 September 2018 had announced that interest payable on Masala Bonds which are issued between 17 September 2018 and 31 March 2019 shall be exempt from tax in the hands of the non-resident lender.

The Bill proposes to codify this announcement.

While this is a welcome move, a timely amendment would have provided more certainty to bond issuances within the prescribed time period. Better late than never, as interest payments on such bonds shall be tax exempt.

While the Bill is silent on the effective date, the Memorandum mentions that this amendment is proposed to be effective retrospectively from FY 2018-19 onwards.

PURSUIT OF

HAPPYNESS CAPITAL

Guardian 'Angel' for AIFs

Currently, the IT Act provides that when shares are issued by a venture capital undertaking to a venture capital fund (a sub-category of Category I Alternate Investment Fund), such issuance is exempt from any Angel Tax (i.e. tax payable on excess premium received by a company on issuance of its shares to Indian residents).

The Bill proposes to extend this tax exemption if shares are issued to a Category II AIF as well. This proposal strikes off an item on the wish list of the investment funds industry.

This amendment is proposed to be effective FY 2019-20 onwards.

Losses made Transparent

Currently, income (other than business income) earned by a Category I AIF and Category II AIF (Investment Funds) is taxable in the hands of the investors on a pass-through basis, as if the investments by the Investment Fund were directly made by the investor. However, such pass-through treatment is not available in relation to unabsorbed losses of the Investment Fund (not absorbed by current year income), which are to be carried forward and set off at the Investment Fund level.

The Bill proposes to remove this disparity between the treatment of losses vis-a-vis profits in the hands of the investors, except for the following losses:

- Unabsorbed business losses of the Investment Fund, which shall be allowed to be carried forward and set off at the Investment Fund level; and

- Unabsorbed losses other than business losses in case of those investors who hold units of the Investment Fund for less than 12 months.

Additionally, to enable investors to claim similar treatment for past losses as well, it is proposed that losses (other than business losses) accumulated at the Investment Fund level as on 31 March 2019, shall be deemed to be the loss of the investor as on the said date and shall be allowed to be set-off and carried forward, as if such investment was made directly by the investor.

This is an eagerly anticipated proposal, since the inability of investors to claim losses suffered by the Investment Fund was a long-standing grievance of the investment funds industry. In relation to the treatment of losses (other than business losses) in a situation where units are held by the investor for a period of less than 12 months and denied to the investor, the proposal does not mention whether the Investment Fund shall be entitled to carry forward such losses. One hopes that this uncertainty gets addressed when the Bill is enacted.

This amendment is proposed to be effective FY 2019-20 onwards.

START-UP SPA| Some R & R

Rejuvenating Start-ups

Recognising the scale at which the start-up eco-system is growing in India, the Bill proposes to both liberalise and streamline the start-up tax regime.

Easy Money

Currently, if an individual or HUF transfers residential property held for more than two years and reinvests the net consideration received on transferring such residential property, then the gains arising from such transfer are tax exempt if:

- The net consideration is reinvested in an eligible start-up where, as a result of the reinvestment the individual or HUF owns more than 50% of the share capital or voting rights of such start-up;

- The transfer of the residential property takes place on or prior to 31 March 2019; and

- Certain assets acquired by the start-up are not disposed of within a period of five years from the date of its acquisition.

The Bill proposes to relax these conditions as follows:

- The sunset clause shall be extended to 31 March 2021;

- Minimum shareholding requirement is reduced to 25% from more than 50%; and

- The five-year lock in period is reduced to three years in case the asset acquired by the eligible start-up comprises computers or computer software.

Cut your Cake and Eat it too

Currently, certain eligible start-ups can carry forward and set-off past tax losses so long as all the shareholders holding shares carrying voting power continue to hold such shares on the last day of the FY or FYs in which the loss was incurred and last day of the FY in which set off of the loss is claimed.

The Bill proposes to allow such eligible start-ups to carry forward and set-off past losses even if its shareholders holding shares carrying only 51% voting power on last day of the FY or FYs in which the loss was incurred, continue to hold such shares on the last day of the FY in which set off of the loss is being claimed.

This amendment is proposed to be effective FY 2019-20 onwards.

Angel turns Devil

Currently, under the IT Act, excess premium received by a closely held company on the issuance of shares to an Indian resident is taxable in the hands of the company (Angel Tax). Currently, a tax exemption has been provided to start-ups that fulfil certain prescribed conditions.

The Bill proposes that if a start-up fails to comply with any of the prescribed conditions, then the tax exemption shall be revoked and any consideration received in excess of face value of shares of the start-up shall be taxed in the hands of such start-up in the year of such non-compliance.

This amendment is proposed to be effective FY 2019-20 onwards.

Additionally, a historic tax issue in relation to excess premium received by a company, relates to establishing the source of funds and identity of the investor, on failure of which premium received by the company may be considered as taxable income of the company.

The Budget Speech of the Hon'ble Finance Minister mentioned that start-ups and investors who file requisite declarations and provide information in their tax returns would not be subject to any kind of scrutiny for valuation of share premium. Additionally, the issue of establishing the identity of the investor and source of funds is to be resolved by instituting an e-verification mechanism. Given the procedural nature of these proposals, it is expected that necessary Government notifications shall be issued in due course.

PRESCRIPTION FOR NBFCs

Level Playing Field with Banks

Currently, the IT Act provides that any interest income in relation to some bad or doubtful debts incurred by public financial institutions, scheduled banks and certain other categories of institutions, is taxed in (earlier of) the year in which such income is credited to the institution's profit and loss account or when such income is actually received by the said institution, as opposed to being taxed on an accrual basis.

This departure from accrual based taxation is made since these taxpayers are required to recognise interest income arising from bad or doubtful debts only when there is a reasonable certainty of collection of such debts which is in line with the principle that tax is payable only on real income.

The Bill proposes to extend this incentive to deposit-taking Non-Banking Financial Companies (NBFCs) as well as systematically important NBFCs.

A related amendment has been proposed in the IT Act where any deduction of interest shall be available to a taxpayer with respect to any loan taken from the above categories of NBFCs only upon paying the interest income.

The proposed amendments provide some respite to NBFCs by according them a level playing field with their banking counterparts.

These amendments are proposed to be effective FY 2019-20 onwards.

DE-STRESSING DISTRESSED COMPANIES

Triumph in Loss

Currently, the IT Act provides that the carry forward of past tax loss of closely held companies would lapse if their shareholding changes by more than 49% as compared to the year in which the loss was incurred. Certain relaxations are allowed in this regard to eligible start-ups as well as companies whose shareholding changes pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 (IBC), subject to fulfilment of certain conditions.

The Bill provides for certain additional reliefs to start-ups, as well as, proposes to exempt another category of distressed companies from the denial of carry forward of tax loss. Notably, this exemption is provided to a company, its subsidiary as well the step-down subsidiary of such company, where:

- The Board of Directors of the company is suspended, and new directors are appointed by the Central Government through the National Company Law Tribunal (NCLT) in accordance with the Companies Act, 2013 (CA, 2013); and

- A change in the shareholding of such company, its subsidiary and the step-down subsidiary of such company, has taken place in a previous year pursuant to a resolution plan approved by the NCLT under the CA, 2013, subject to conditions.

Relief from Book Profit Based Taxation

Currently, a domestic company is required to pay MAT based on its book profits, where tax payable under normal provisions of the IT Act is less than MAT. In case of companies with past losses, book profit is to be computed after reducing, inter alia, the lower of brought forward loss and unabsorbed depreciation, as per the books of accounts. Thus, no amount is to be adjusted from the book profits, if either business loss or depreciation is nil.

Concession is allowed to companies against whom an application for corporate resolution process has been admitted by the NCLT under the IBC, whereby the aggregate of brought forward loss and unabsorbed depreciation is allowed to be reduced for computation of book profit for the purposes of MAT.

The Bill proposes to extend such relief of aggregating the brought forward loss and unabsorbed depreciation for computing book profit for purposes of MAT to the new class of distressed companies discussed above in the context of carry forward of losses.

The above amendments are proposed to be effective FY 2019-20 onwards.

GETTING THE HOUSE IN ORDER

Tarred with the Same Brush? Listed Companies Subject to Buy-back Tax

Currently, the IT Act taxes distributed income on account of buy-back of shares by an unlisted company @ 20% (exclusive of surcharge and cess), also known as "Buy-back tax". Such tax is levied on the distributing company. Any resulting income arising in the hands of shareholders is exempt from tax. However, the buy-back tax only applies to buy-back by unlisted companies. Whereas, in case of listed companies, the shareholders are taxed (instead of the company), at a rate that could be as low as 10%.

The buy-back tax was introduced in 2013 with an attempt to curb the practice of widespread abuse whereby unlisted companies resorted to buy-back of shares instead of payment of dividends which are subject to a DDT (as the tax rate for capitals gains is lower than the rate of DDT).

The Bill proposes to include listed companies into the fold of buy-back tax whereby the said tax shall apply to all companies including companies listed on a recognised stock exchange. Correspondingly, the Bill also proposes an exemption for shareholders of the listed company, where the buy-back tax has been paid by the such company on distribution of income.

These changes seek to curb any tax arbitrage in case of shares where listed companies indulge in the buy-back of shares, instead of payment of dividends. However, genuine corporate re-organisations entailing buy-back of shares by listed companies shall now be caught in the tax net. Necessary valuation rules should be included in the Income-tax Rules, 1962 (Rule 40BB) to enable the calculation of distributed income for listed shares.

This amendment is proposed to be effective from 5 July 2019 onwards.

Stepping into a Cashless Economy | Cash withdrawals to be dearer!

The Bill proposes a withholding tax @ 2% on aggregate cash withdrawals in excess of INR 10 Mn in a FY. The withholding tax obligation shall be cast on banks, banking co-operative societies and post offices, on cash withdrawals from accounts maintained with them by taxpayers. Exemptions have been proposed where the taxpayer is the Government, banking companies, ATM operators etc.

Imposing a deterrent cost should enable the Government to move a few steps closer to a cashless economy.

This amendment is proposed to be effective from 1 September 2019.

Penalty Loophole Plugged Just in Time!

Currently, the IT Act levies a penalty for the under-reporting and mis-reporting of income. Penalty is levied on the quantum of income that the tax authorities allege to have been under-reported or mis-reported, based on the adjustments that are made during assessment proceedings.

However, the provision does not specify that penalty shall be levied if the taxpayer files no return of income but reports income for the first time in response to a reassessment notice issued by the tax authorities.

The Bill proposes to specify the manner in which penalty shall be computed where the taxpayer has unreported income and has furnishes his return of income for the first time pursuant to reassessment proceedings. Such unreported income shall now be subject to penalty under the IT Act.

This amendment is proposed to take retrospective effect from FY 2016-17 onwards

Taxing Beyond Borders?

Currently, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BMA) applies only to taxpayers who are ordinarily resident in India (as defined under the IT Act).

The Bill proposes to retrospectively extend its applicability to a person who may currently be a non-resident or not ordinarily resident in India but was a 'resident of India' in the year in which undisclosed foreign income or foreign asset (as expressly defined under BMA) was earned or acquired.

This retrospective amendment may pose legal issues and repercussions for individuals who may have attained the status of a non-resident.

This amendment will be effective retrospective from 1 July 2015 (the date of entry into force of BMA).

Additional Powers to Appellate Authorities

Currently, under the BMA, Commissioner of Income Tax (Appeals) (the first appellate authority) has powers to either confirm or cancel penalties levied under the BMA.

The Bill proposes to allow the Commissioners of Income Tax (Appeals) with powers to enhance or reduce penalties levied under the BMA in addition to the existing powers of confirmation or cancellation of penalties.

ALL'S WELL THAT ENDS WELL

Secondary Adjustment: Repatriation v. Additional Tax

In 2017, transfer pricing provisions under the IT Act were amended to provide that, if a primary transfer pricing adjustment is made, which is accepted by the taxpayer or determined pursuant an 'advance pricing agreement' or safe harbour rules or as a result of mutual agreement procedure, the taxpayer is required to make a 'secondary adjustment'.

Further, if as a result of such primary adjustment, there is an increase in the total income or reduction in the loss of a taxpayer, the excess money (Adjusted Amount), being the difference in the arm's length price determined by the tax authorities and the price at which the transaction is undertaken, available with the associated enterprise is to be repatriated to India within a period of ninety days.

Non-repatriation deems such Adjusted Amount to be an advance by the taxpayer on which interest is computed in the prescribed manner.

Under the IT Act, such secondary adjustment is not required to be carried out if (a) the amount of transfer pricing adjustment in an FY does not exceed INR 10 Mn (Adjustment Threshold) and; (b) the transfer pricing adjustment is made with respect to an FY prior to 1 April 2015 (Adjustment Date).

The Bill proposes that the secondary adjustment would not apply when either of the above (a) or (b) conditions are met as against both the said conditions being met.

The Bill also proposes that such Adjusted Amount can be repatriated from any of the non-resident associated enterprise of the taxpayer and not merely from the associated enterprise in relation to whom the primary adjustment was originally made.

This amendment is proposed to be effective FY 2017-18 onwards.

Alternatively, the Bill proposes to offer an option to the taxpayer to pay additional income tax at the rate of 18% (plus 12% surcharge thereon) on such Adjusted Amount in addition to imputation of interest up to the date of payment of tax and in such cases secondary adjustment would not apply.

This amendment is proposed to be effective from 1 September 2019.

Demerger, Uninterrupted

One of the conditions for achieving a tax neutral demerger is that the transfer of properties and liabilities of the undertaking which has been demerged must be at book value. Notably, under Indian Accounting Standards (IND AS), in certain circumstances the resulting company is in fact mandated to record the property and liabilities at a value different from such book value (i.e., essentially fair value).

The Bill proposes that tax neutrality shall not be denied to Ind-AS compliant companies which records the properties and liabilities at fair value as against book value.

Indian corporates shall now receive the much-needed respite when undertaking this oft utilised route of business restructuring.

This amendment is proposed to be effective FY 2019-20 onwards.

Fair Not Lovely | Relaxing Valuation Norms

Presently, transfer of unquoted shares at a price below its tax Fair Market Value (FMV) triggers tax in the hands of the transferor. The FMV is deemed to be the sale consideration for the purposes of calculating capital gains tax. Additionally, the IT Act also taxes the receipt of shares transferred at a discounted value above the de minimis of INR 0.05 Mn as ordinary income of the recipient (subject to exceptions). There are prescribed valuation rules in this regard to calculate the FMV for tax purposes.

The Bill proposes to exclude transfers where the consideration for shares has been approved by authorities and where the determination of such value is beyond the taxpayer's control.

This enabling provision (to prescribe exclusions) is proposed to be effective FY 2019-20 onwards. While the intent is laudable, one hopes that the exclusions are prescribed soon.

Affordable Housing for All | Roti, Kapda and Makaan for All?

Currently, the IT Act provides for a full deduction on profits derived from the business of developing and building affordable housing projects.

The Bill proposes to amend the definition of affordable housing for projects approved on or after 1 September 2019, by including specific conditions that find mention under the Goods and Services Tax laws. Such conditions include:

- Existing conditions relating to the size of a plot of land, carpet area of residential unit as well as floor area ratio as applicable to Chennai, Delhi, Kolkata and Mumbai have now been extended to Hyderabad, Delhi NCR, Bengaluru;

- The carpet area of the residential units should not exceed 60 square meters for the above specified cities and 90 square meters in other cities; and

- The stamp duty value of a residential unit in the project should not exceed INR 4.5 Mn.

This amendment is proposed to be effective FY 2019-20 onwards.

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com