The countdown begins now for a successful implementation of the new lease standard, Accounting Standards Codification (ASC) 842. The overriding message from public company adopters across all industries is to not underestimate the time and resources needed. The effect on each entity will vary depending on the number and variety of lease types and extent of change from existing industry practices. The new rules may significantly affect an individual lessee's statement of financial position by increasing lease-related assets and liabilities; this is particularly seen for lessees in the retail, financial services, shipping and other transportation-related industries. Changes may affect compliance with debt covenants and key financial ratios. Impacted entities will face increased disclosure requirements and will need to redraft accounting policies under the new principles and update internal controls.

Finding and reviewing lease and "rental" agreements will be a significant undertaking. This task will require many departments of the entity working together. Implementing the standard likely will require an early start to the process and a clearly defined action plan to comply with the standard's requirements.

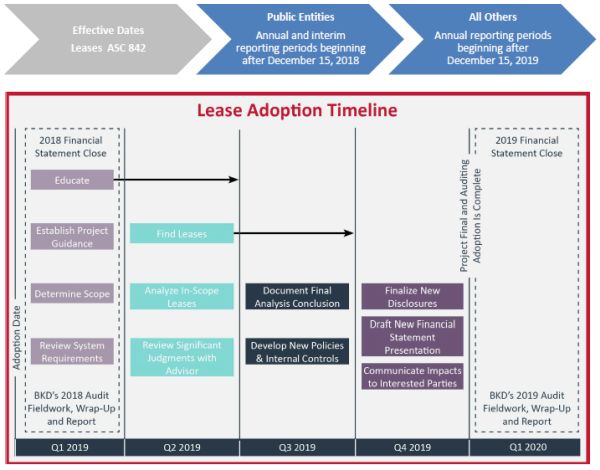

This paper will provide a high-level, quarter-by-quarter action plan to help ensure a smooth, efficient transition. Collaborating early and often with your auditor will help you avoid any unpleasant surprises. Schedule regular time to evaluate progress and discuss challenges, judgments and conclusions. Whether or not you are an audit client, BKD can help.

Details for each quarter are included in Appendix A.

Conclusion

The adoption of ASC 842 may be complex and likely will require significant hours to implement correctly. If you would like assistance complying with the lease standard, contact your trusted BKD advisor. BKD has prepared a library of BKD Thoughtware® on lease implementation issues. Visit our website to learn more.

APPENDIX A

First Quarter 2019

Educate

Individuals throughout the organization will need to understand the new lease accounting rules because they represent a fundamental change from current guidance. As highlighted below, finding leases will require cross-functional effort. Certain staff outside the accounting department will need a high-level understanding of the rules to ensure population control.

BKD has many webinars and BKD Thoughtware® articles available at bkd.com, or you can schedule time for BKD to host an education session.

Establish Project Governance

Create a governance and project management structure. Meetings and communications should include representatives from real estate, property management and lease administration, maintenance, logistics, IT, procurement, legal, financial planning and, of course, accounting. Identify a champion or team to lead adoption efforts and work directly with auditors. Some questions to consider in assessing the size and scope of implementation plans include:

- How many different types of lease transactions exist?

- Where are lease contracts stored?

- Is the procurement process centralized or separately performed at each location/company?

- How are details of lease terms maintained and at what level?

- What systems manage lease data?

Develop and document a project timeline, roles and responsibilities for implementation. Consider team bandwidth and competencies and conclude on the level of outside assistance needed. Determine if accounting staff have adequate resources to perform compliance tasks in addition to regular duties or if additional resources or consultants are necessary for the project. As new processes are developed, have training to educate employees on the changes.

Formally kick off the implementation project and timeline. Consider sharing this with your auditor to schedule resources accordingly.

Scoping

Lease Population

First, determine which contracts meet the definition of a lease. At contract inception, entities will need to determine whether a contract is or contains a lease by assessing whether—throughout the period of use—the lessee has the right to direct an asset's use and substantially obtain all the economic benefits from directing its use.

ASC 842's scope is substantially the same as ASC 840. However, entities may exclude short-term leases—those lasting a maximum of 12 months at inception, including any options to extend—from measurement as a right-of-use (ROU) and lease liability if the company elects that practical expedient.

Review scope conclusions with your auditor.

Embedded Leases

Entities regularly enter into contracts that cover both the right to use an asset and paying for the asset's maintenance services. Examples of this include leasing a building and paying for maintenance services, or leasing copiers and paying for print management services or maintenance services, all in one agreement. Identifying and collecting the contracts that may contain embedded leases can be tricky, as these contracts do not use the term "leases." Rather than asking if contracts may contain embedded leases, ask whether any service contracts involve the use of specific assets as part of the service delivery. Discussion with the facilities team and site visits will help uncover these embedded leases. See Appendix B for examples of items to look for.

Lessees have a practical expedient available—by class of underlying assets—to not separate lease and nonlease components. If elected, a lessee is required to account for the lease and nonlease components as a single lease component with special disclosures. The election applies to all leases in a class. While the expedient eliminates the price allocation process, it will increase the total lease liability recorded on the balance sheet.

Lessors have a similar practical expedient; however, it is limited to circumstances in which both:

- The timing and pattern of revenue recognition are the same for the nonlease and related lease component

- The combined single lease component would be classified as an operating lease

If the nonlease component or components associated with the lease component are the predominant component of the combined component, an entity is required to account for the combined component under ASC 606, Revenue from Contracts with Customers. Otherwise, the entity must account for the combined component as an operating lease under ASC 842.

Since almost all leases will be recognized on the balance sheet, an entity's judgment in distinguishing between leases and services becomes more critical under the new guidance.

Practical Expedients

FASB acknowledges the challenge of updating long-standing accounting guidance for organizations with a large lease portfolio. The initial standard and subsequent amendments provide substantial relief. Reviewing and incorporating available relief early in the planning process will save considerable time and effort.

| Optional Relief | |

| Transition Elections | Accounting Policy Elections |

| Expedient package – Identification, classification, initial direct costs* (Accounting Standards Update (ASU) 2016-02) | Separation of lease and nonlease components for both lessee (ASU 2016-02) and lessor (ASU 2018-11) |

| Hindsight (ASU 2016-02) | Portfolio approach (ASU 2016-02) |

| Land easements (ASU 2018-02) | Short-term leases (ASU 2016-02) |

| Prior period presentation (ASU 2018-11) | Discount rate (nonpublic business entities only) (ASU 2016-02) |

| Presentation of taxes (ASU 2018-20) | |

| *Must be elected as a package | |

Disclosures

Additional data will need to be collected, and additional monitoring and record-keeping will be required. Developing a work plan upfront can avoid duplication of efforts and make data gathering more efficient. For more information, see BKD articles Lease Presentation & Disclosure Requirements: Lessee and Lessor Presentation & Disclosure Requirements.

Review System Requirements

Current lease IT systems primarily focus on lease management rather than accounting and usually handle real estate leases. Today, many entities use spreadsheets to track leases and prepare required disclosure and accounting evaluation. Given the comprehensive accounting and disclosure requirements of the new standard, entities likely will need to supplement their current IT systems or implement new IT systems to address ASC 842 requirements.

Entities with a small lease portfolio may be able to leverage their existing manual processes or IT systems; however, a large portfolio of leases may require significant technology investment. In addition to the initial implementation, consider the effect of ongoing disclosure and remeasurement requirements. For some entities, a hybrid approach may be the best option—selecting a leasing system for a significant portfolio of real estate and property leases and executing a manual process for an insignificant amount of equipment leases. Several public companies regretted their initial conclusion to go it alone and incurred additional time and expense by later overhauling or purchasing IT systems.

This decision should be re-evaluated after the review of in-scope leases.

To view this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.