Foreign Direct Investment (FDI) in Malta

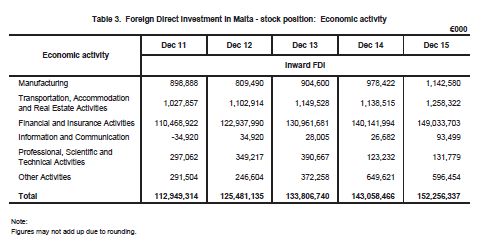

As at December 2015, the position of foreign direct investment in Malta was estimated at €152.3 billion, an increase of €9.2 billion over the corresponding month in 2014. Financial and insurance activities contributed €149.0 billion or 97.9 percent to the total foreign direct investment position in Malta (Table 3).

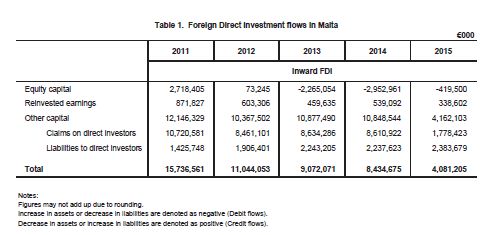

In terms of fl ows, there was a net increase of €4.1 billion in FDI during 2015, compared to an increase of €8.4 billion in 2014. This increase in FDI fl ows was mainly driven by increases registered under other capital (Table 1). As for fl ows classifi ed by economic activity, the largest increase of FDI was registered in fi nancial and insurance activities by €3.7 billion in 2015 (Table 2).

Direct Investment abroad

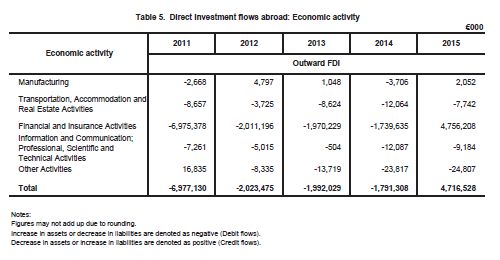

During 2015, direct investment fl ows abroad decreased by €4.7 billion, compared to an increase of €1.8 billion during the previous year. This was mainly the result of decreases in claims on direct investors of €5.6 billion (Table 4).

In terms of stock position, as at December 2015 direct investment abroad by resident entities was recorded at €61.6 billion. Entities offering fi nancial and insurance activities accounted for 99.4 percent of the total direct investment abroad (Table 6)

Methodological Notes

- The collection, compilation and presentation of both the International Investment Position (IIP) and the Balance of Payments (BoP) statements of Malta fall under the responsibility of the National Statistics Office (NSO), with the co-operation of the Central Bank of Malta (CBM). Direct Investment is extracted from both statements, compiled in accordance with the international guidelines set out in the sixth manual of the International Monetary Fund (BPM6).

However, the Direct Investment news release is presented on a directional basis, ie. inward and outward, rather than on an asset and liability basis. The statement incorporates data relating to special purpose entities which are classified under financial service activities.

- Direct Investment is defined as

"a category of cross-border investment associated with a

resident in one economy having control or a significant degree of

influence on the management of an enterprise that is resident in

another economy." (BPM6).

a. Direct investment is sub-divided into two categories:

- Foreign Direct Investment (FDI) in Malta – where a foreign investor owns 10% or more of the ordinary shares (or voting power) of an enterprise in Malta; and

- Direct Investment Abroad – where a Maltese resident entity (or an individual, government or association) owns 10% or more of the ordinary shares of an enterprise in another economy. These companies can be subsidiaries, affiliates or branches.

b. Direct Investment is made up of three basic components:

- Equity Capital - comprising equity investment in subsidiaries, associates and branches. Capital contributions (e.g. provisions of machinery) and purchase of immovable property are also classified under equity capital.

- Reinvested Earnings - consisting of the direct investor's share of earnings not distributed as dividends by subsidiaries and associates; and earnings that branches do not remit to the direct investor. Losses are regarded as negative reinvested earnings.

- Other Capital - including inter-company transactions such as borrowing and lending of funds; and trade debits and credits between direct investors and direct investment enterprises. Transactions between enterprises in different economies that share the same direct investor are also considered as direct investment and included under other capital.

- Direct Investment flows include transactions occurring during a particular period. Besides accumulated flows, the Direct Investment Stock Position takes into account any market value revaluations, reclassifications and exchange rate changes prevailing at the end of the reporting period.

- The type of data collection system used to compile the Direct Investment is a composite system based on monthly, quarterly and annual direct reporting (DR) enterprise surveys, as well as various other sources that are identified from time to time by the BoP compilers. No major sectors of the economy are excluded from the aggregate data. The data for all components are compiled from these surveys. Where not directly available, preliminary figures on reinvested earnings are estimates based on an average of the previous four years. The final data on reinvested earnings are then compiled from the annual DR survey. Foreign Direct Investment (FDI) in Malta – where a foreign investor owns 10% or more of the ordinary shares (or voting power) of an enterprise in Malta; and Direct Investment Abroad – where a Maltese resident entity (or an individual, government or association) owns 10% or more of the ordinary shares of an enterprise in another economy. These companies can be subsidiaries, affiliates or branches.

- The classification used for economic activity is NACE Rev. 2, which corresponds to the Statistical Classification of EconomicActivities in the European Community. Both the data on direct investment abroad and foreign direct investment in Malta areclassified on the basis of the industrial activity of the resident direct investment enterprises. Due to confidentiality issues,aggregate economic activities are grouped as follows:

- Data are to be considered provisional.

- More information relating to this news release may be accessed at: Statistical Concepts: http://nso.gov.mt/metadata/concepts.aspx Metadata: http://nso.gov.mt/metadata/reports.aspx?id=6

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.