On 17 November 2014, Shanghai-Hong Kong Stock Connect (the "Stock Connect"), a pilot programme for establishing stock market trading links between Shanghai and Hong Kong, was launched following its in-principle approval by the China Securities Regulatory Commission ("CSRC") and the Securities and Futures Commission of Hong Kong ("SFC") on 10 April 2014. The programme marks an important two-way opening up of the Shanghai and Hong Kong capital markets. Further, it aims to enhance the competitiveness of Shanghai and Hong Kong and paves the way to internationalization of RMB.

The Stock Connect comprises a Northbound Trading Link and a Southbound Trading Link. For the first time, Hong Kong and overseas investors may trade shares listed on a Mainland exchange, while Mainland investors are allowed to trade foreign-listed shares. Some of the key features of the programme are set out below:

Trading Links and Clearing Links

The Stock Connect is jointly operated by the Shanghai Stock Exchange ("SSE"), The Stock Exchange of Hong Kong Limited ("SEHK"), China Securities Depository and Clearing Corporation Limited ("ChinaClear") and Hong Kong Securities Clearing Company Limited ("HKSCC") under a four-party agreement signed on 4 September 2014.

Pursuant to the agreement:

- SSE and SEHK will provide mutual order-routing connectivity and related technical infrastructure to enable investors in their respective markets to trade shares listed on the other's market; and

- ChinaClear and HKSCC will provide arrangements for the clearing and settlement of trades and the provision of depository, nominee and other related services to investors in Mainland China and Hong Kong.

Applicable Trading, Clearing and Listing Rules

Listed issuers in Shanghai and Hong Kong will continue to be subject only to the listing and other rules and regulations of the market where their shares are listed. Trading and clearing arrangements will also be subject to the regulations and operational rules of the market where trading and clearing take place.

Eligible Shares

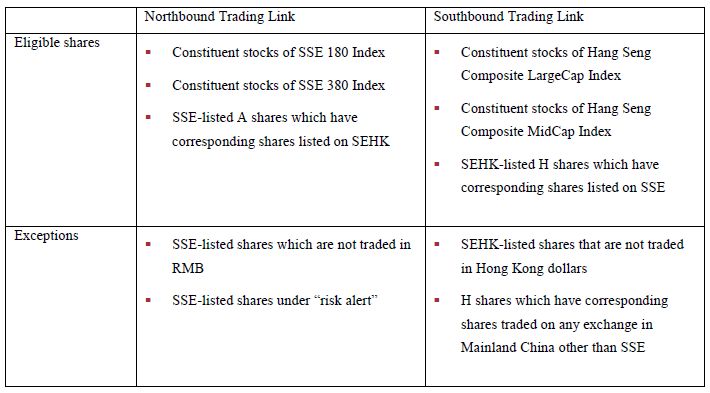

Only eligible shares are accepted for trading through the Stock Connect:

As at 31 December 2014, a total of 273 SEHK-listed shares were eligible for trading through the Southbound Trading Link and a total of 569 SSE-listed shares were eligible for trading through the Northbound Trading Link.

Investor Eligibility

Northbound trading of SSE-listed shares is open to all Hong Kong and overseas investors including institutional and individual investors. For Southbound trading, only institutional investors and those individual investors who hold an aggregate balance of not less than RMB 500,000 in their securities and cash accounts will be accepted for Southbound trading.

Quotas

As a pilot programme, quota controls have been set up for the initial phase of operation of the Stock Connect:

The above quotas are applied on a "net buy" basis. Under this principle, no new buy orders will be accepted once the quota is used up but investors will always be allowed to sell their shares regardless of the quota balance.

Currencies

Hong Kong and overseas investors will trade and settle SSE-listed shares in RMB only. Mainland investors will trade SEHK-listed shares quoted in Hong Kong dollars only and settle the trades with ChinaClear or its clearing participants in RMB.

Enforcement Cooperation

The CSRC and the SFC have strengthened their cross-boundary cooperation regarding any misconduct in connection with trades under the Stock Connect. On 17 October 2014, the CSRC and the SFC signed a "Memorandum of Understanding between the CSRC and the SFC on Strengthening of Regulatory and Enforcement Cooperation under Shanghai-Hong Kong Stock Connect" which sets out enhanced cooperation arrangements on identification, notification and investigation of cross-boundary market misconduct, including disclosure of misleading information, insider dealing, market manipulation and other fraudulent activities.

According to statistics released by SEHK, the average daily turnover in Northbound trading was RMB 5.84 billion and the average daily turnover in Southbound trading was RMB 757 million for the first 20 trading days from 17 November 2014. On average, 25.3% of the Northbound daily quota and 4.5% of the Southbound daily quota were used during the same period. While some market participants have commented that the trading volumes have failed to live up to market expectation, the Stock Connect represents a major move in the opening up of capital markets in China. The infrastructure linking the two markets is likely to add momentum to the long-term development of the Hong Kong capital market, and increase the attractiveness of Hong Kong as a listing venue of choice for international companies targeting the Mainland market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.