So-called Private Funds ('PFs') are attracting considerable interest as platforms to hold a wide variety of assets, both for wealthy families and small groups of "club" investors.

Originating from ideas developed in the institutional fund space, PFs are typically bespoke structures with minimal or no fund regulatory status. There is no legal definition of a PF, which can be structured as legal entities as varied as limited partnerships, trusts and cellular companies.

A GLOBAL TREND

There are a number of reasons for the increased interest in PFs, including the following:

- A single platform for family offices to manage clients' wealth - with the ability to hold higher-risk assets (which might otherwise cause fiduciary risk concerns for trustees with duties to beneficiaries)

- The ability for families and club investors to pool their assets and seek enhanced investment opportunities - also for greater economies of scale

- The ability to 'unitise' specific assets to facilitate joint ownership e.g. an aircraft, paintings, real estate

- Independent calculation of the Net Asset Value ("NAV") and external audit of a PF if required provides reassurance to investors

- A PF may offer a more straightforward concept for some clients compared to trusts - particularly for clients in civil law countries

- The opportunity to undertake basic succession planning, where interests can be gifted to other family members over time

- Trends since the late 2000s for some UHNW private clients to "go it alone" and make direct target company investments, instead of using private equity funds

- A vehicle to hold a new business venture - with the ability to "lock in" investors, providing certainty and long-term commitment between them

- Potential taxation benefits depending on the investors' country(s) of tax residence

EXAMPLES OF PRIVATE FUND STRUCTURES

Limited Partnership

In this structure, a General Partner ('GP') needs to be appointed to manage the partnership - this might be the client or the family office. As the GP typically has unlimited liability, this function will often be structured as an SPV.

The Limited Partners will sign 'Adherence Agreements' to set out how they interact with the partnership.

For a family LP, at the outset the principal client might start by holding 100% of the LP interests, and then periodically gift further interests to family members

PROTECTED CELL COMPANY

A PCC consists of one or more cells, each of which may be owned by separate clients. There is no co-mingling of assets and liabilities between each cell.

The cells are managed by the directors who can also contract externally for administrative and accounting functions to be provided to each cell.

Costs are reduced when compared to SPV vehicles or individual trusts as overheads can be shared by allocation to cells on a pro-rata basis.

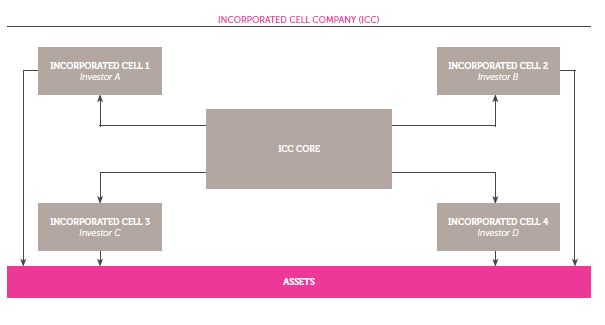

INCORPORATED CELL COMPANY

This is very similar to a PCC, except that each cell is separately incorporated, with its own Directors and Articles of Incorporation.

This is advantageous in certain situations e.g. where the clients may wish to dispose of a cell which holds a property, target company or other asset and separate it from the wider structure.

KEY REGULATORY ISSUES

Whilst there are differences between the regulatory regimes of international finance centres, PFs are often not subject to collective investment scheme legislation where:

- There is a small, defined and closely-linked group of investors

- The investors are "sophisticated" by their wealth / expertise

- The "spread of assets" (number of holdings in the PF) is limited

Meeting these criteria frequently ensures that a PF is considered a fiduciary structure, rather than a regulated fund entity. As such, it will be subject to no fund regulatory requirements (or light regulations only).

Where the number of investors and spread of assets grows and exceeds local exemption rules or practice, then regulatory consents may well be required. Consent from the regulator may also be needed in relation to the entity undertaking investment decisions.

ROLE OF THE ADMINISTRATOR

The responsibilities of the Administrator (be it a Trust or Fund Company) will typically include the following:

- Calculation of the Net Asset Value (NAV) - including the calculation of the PF's income and expense accruals and the pricing of securities at current market value

- Investment administration - Settlement of asset purchases and sales, collection of dividends and interests, regular reporting / valuations

- Accounting and Audit - Maintaining bookkeeping and accounting records, reconciliation of holdings with custody and broker records, producing annual financial statements, supporting annual audit and onsite auditor visit

- General administration - Payment of PF expenses, dealing with any administration e.g. insurance for real estate

- Transfer agency – unit registration e.g. initial allocation, after rebalancing etc.

SOME ADVISORY NOTES

- Administration costs – typically these are levied on the value of assets held, as per market practice for regulated funds

- Liquidity - will there be sufficient realisable assets to buy out an investor who wishes to exit? (this can sometimes be achieved with leverage)

- Asset protection and succession planning - clients' PF holdings are still treated as personal assets. However, overlying trusts and foundations can be established to hold PF interests for long-term planning.

- GP / Investment Adviser role - which family members(s) or business associates will be responsible for this role? This function is often structured via an SPV, due to the risks, but smooth devolution of these shares also needs to be considered (e.g. foundation, purpose trust). A third party investment advisor / manager may also be appointed by the GP

CONCLUSION

Interest in PFs continues to grow as they offer a very useful tool for private wealth structuring. Family members and groups of investors can benefit hugely from pooling their assets to maximise benefits. The ability to unitise specific assets such as real estate, aircraft, artwork is also very useful. The legal concept of a PF structure can be more straightforward for clients compared to trusts and foundations, as the different investors hold specified units and will have some voting rights.

Independent reassurance is provided by the Administrator, who will calculate the NAV, and external auditors can also be appointed if desired.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.