This article summarizes the new regulatory capital requirements and the issues most relevant for U.S. community banks.

When the U.S. federal banking agencies adopted the final Basel III capital requirements applicable to all U.S. banking organizations, the agencies were careful to provide certain relief for banks with less than $15 billion in assets. This article summarizes the new regulatory capital requirements and the issues most relevant for U.S. community banks.

Background

In December 2010 and June 2011, the Basel Committee on Banking Supervision, composed of banking supervisory authorities, published Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems ("Basel III").1 Basel III is intended to improve both the quality and quantity of banking organizations' capital, as well as to strengthen various aspects of the international capital standards for calculating regulatory capital.2 Basel III enhances the international risk-based capital framework established before the recent financial crisis by raising minimum capital requirements, defining capital and creating prescribed approaches to calculating risk-weighted assets ("RWAs").

In June 2012, the Federal Reserve Board ("FRB"), Office of the Comptroller of the Currency ("OCC"), and Federal Deposit Insurance Corporation ("FDIC") (collectively, the "Banking Agencies") published notices of proposed rulemaking to seek comment on the implementation of the Basel III regulatory capital framework (the "Proposed Capital Rules").3 The Proposed Capital Rules reflected many provisions from the Banking Agencies' old general risk-based capital rules4 (the "Old Capital Rules"), the Basel III regulatory capital framework and changes to the Banking Agencies' regulatory capital requirements required by the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank").5

In July 2013, the Banking Agencies adopted final rules relating to Basel III, including minimum regulatory capital, prompt corrective action, capital adequacy, standardized approach for RWAs and transition provisions, as well as implementing Dodd-Frank capital requirements for U.S. banking organizations (the "Final Capital Rules").6 The Final Capital Rules apply to U.S. banking organizations currently subject to minimum capital requirements, including national banks, state member banks, state non-member banks, state and federal savings associations, and bank holding companies with total consolidated assets of more than $500 million in total assets.7 In response to the comments received on the Proposed Capital Rules, the Banking Agencies made several key changes to minimize the potential impact on community banks. However, the Final Capital Rules contain most of the regulatory capital requirements set forth by Basel III.

MINIMUM REGULATORY CAPITAL

Minimum Capital Requirements

The Final Capital Rules implement minimum regulatory capital requirements and a leverage ratio and capital buffer applicable to all banking organizations, including community banks. The minimum regulatory capital requirements and prescribed definition of common equity tier 1 ("CET1").

are perhaps the most controversial aspects of the Final Capital Rules since there are no exclusions or exemptions for community banks with more than $500 million in total assets. As indicated in the table below, the Final Capital Rules now include minimum CET1 capital to RWAs requirements.

Prompt Corrective Action

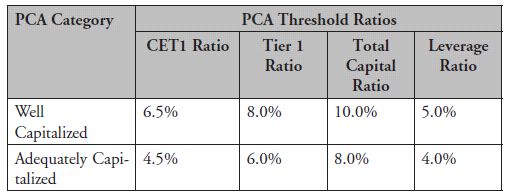

The Final Capital Rules maintain the existing prompt corrective action ("PCA") structure, introduce a new PCA category for CET1, and set the PCA threshold ratios to be consistent with the Basel III minimum regulatory capital requirements.

Capital Conservation Buffer

After a five year phase-in period, community banks will be required to maintain a CET1 capital conservation buffer of at least 2.5 percent above total RWAs to avoid becoming subject to limitations on capital distributions and discretionary bonus payments. If the capital conservation buffer falls below 2.5 percent of total RWAs in any quarter and the bank has negative eligible retained income in such quarter, distributions and discretionary bonus payments during that quarter are limited to a maximum payout amount. The maximum payout amount is determined by the applicable CET1 capital conservation buffer and maximum payout ratio set forth in the table below.

DEFINITION OF CAPITAL

Common Equity Tier 1 Capital

The Old Capital Rules did not define CET1 capital. The Final Capital Rules define CET1 capital and provide that only qualifying minority interests may be included as CET1 as set forth in the table below:

Regulatory adjustments include unrealized gains or losses on cash flow hedges and accumulated other comprehensive income ("AOCI"). AOCI is accumulated unrealized gains and losses on available-for-sale-securities that are reported as equity under GAAP. Under the Old Capital Rules, banking organizations could eliminate (or "filter") certain fair-value mark-to-market adjustments out of shareholders' equity when calculating regulatory capital. The Final Capital Rules require AOCI, as reported under GAAP, to be included in regulatory capital and eliminate the AOCI "filter" for most banking organizations. However, the Banking Agencies provided community banks with a one-time election to opt-out of including filtered AOCI in regulatory capital. The one-time AOCI filter opt-out election under the Final Capital Rules is consistent with the treatment of AOCI under the Old Capital Rules. This election may mitigate volatility in regulatory capital ratios and facilitate more accurate capital planning. Community banks making the AOCI opt out election must report the election on the institution's first Consolidated Reports of Condition and Income or FR Y-9 report filed after January 1, 2015.

Regulatory deductions are made for:

- goodwill;

- gains on any sale of securitized exposures;

- any significant investments in unconsolidated financial institutions ("SIs");

- mortgage servicing assets ("MSAs"); and

- deferred tax assets resulting from temporary differences ("DTAs").

SIs, MSAs, or DTAs are each subject to an individual limit of 10 percent of CET1 and an aggregate limit of 15 percent of CET1. Any excess of SIs, MSAs, or DTAs above the respective 10 percent and 15 percent limits are deducted from CET1.

Additional Tier 1 Capital

The Final Capital Rules define additional tier 1 capital applicable to community banks as follows:

Nonqualifying tier 1 capital includes noncumulative perpetual preferred stock, cumulative perpetual preferred stock, and other instruments that qualified as tier 1 capital under the Small Business Jobs Act of 2010 and under the Emergency Economic Stabilization Act of 2008, but does not include trust preferred securities ("TruPS") and cumulative perpetual preferred stock. However, banks with less than $15 billion in assets as of December 31, 2009, may continue to include TruPS and other nonqualifying capital instruments as additional tier 1 or tier 2 capital, provided that such instruments were included in regulatory capital prior to May 19, 2010. TruPS and cumulative perpetual preferred stock are subject to a limit of 25 percent of tier 1 capital, excluding any nonqualifying capital instruments and applicable regulatory capital deductions and adjustments to tier 1 capital. Banking organizations with greater than $15 billion in total assets as of December 31, 2009, must phase out TruPS and cumulative perpetual preferred stock from regulatory capital completely before January 1, 2022.

Tier 2 Capital

The Final Capital Rules define additional tier 2 capital applicable to community banks as follows:

Subordinated debt, qualifying minority interests and other capital instruments that qualified as tier 2 capital under the Old Capital Rules generally remain unchanged. The Final Capital Rules limit ALLLs to 1.25 percent of a banking organization's total RWAs and describe the required criteria for certain instruments to be included in tier 2 capital.

STANDARDIZED APPROACH TO CALCULATING RISK-WEIGHTED ASSETS

Dodd-Frank requires that Banking Agencies remove any reference to, or reliance on, credit ratings and establish uniform standards of creditworthiness. The Final Capital Rules replace the credit rating methodologies for securitized exposures referred to in the Old Capital Rules with standardized approaches for determining risk weightings based on a new supervisory formula. Banking organizations may assign risk weights to securitized exposures by using an existing gross-up approach or may assign a risk weight of 1250 percent to such exposures. In addition, any excess of SIs, MSAs or DTAs above the respective 10 percent and 15 percent limits on CET1 (that have not been deducted from CET1) will be assigned a 250 percent risk weight.

The risk weights for credit categories most relevant to community banks generally remain unchanged. The risk weight remains 50 percent for prudently underwritten first lien one-to-four-family residential property mortgages that are not past due and 100 percent for all other residential mortgages. The Final Capital Rules increase the risk weight from 100 percent to 150 percent for past due exposures (on the portion of such exposure that is neither guaranteed nor secured), increase credit conversion factors for certain short-term loans to 20 percent and apply a 150 percent risk weight to high volatility commercial real estate ("HVCRE"). HVCRE is any acquisition, development or construction loan facility unless the facility finances:

- one-to-four-family residential properties;

- certain community development projects;

- the purchase or development of agricultural land; or

- a commercial real estate project that meets certain loan-to-value and capital contribution requirements.

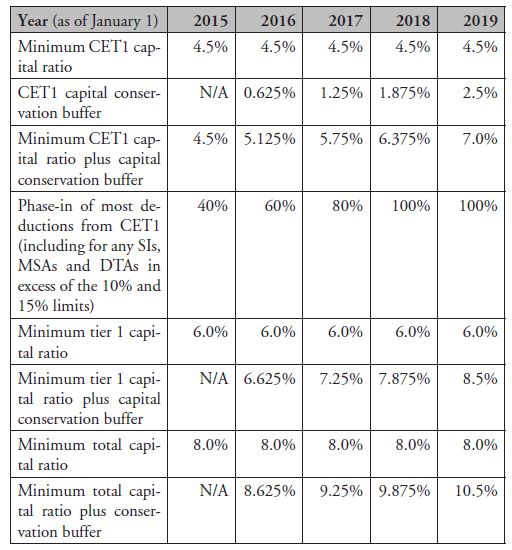

TRANSITION PROVISIONS

The new minimum capital requirements, definitions of capital and riskweighting calculations applicable to community banks go into effect on January 1, 2015. The initial CET1 capital conservation buffer will become effective on January 1, 2016. The table below summarizes the timeline and provisions for the transition period for community banks.

IMPACT ON COMMUNITY BANKS

Despite the new minimum CET1 requirement, narrower definition of capital and changes to calculating certain risk weights, the Banking Agencies were careful not to overly impact community banks. The final version of the Final Capital Rules minimizes the burden on smaller, less complex financial institutions. Community banks will have a transition period over several years to meet the new requirements. The phase-in period for smaller, less complex banking organizations will not begin until January 2015, while the phase-in period for larger institutions began in January 2014.

Furthermore, after the Banking Agencies released the Proposed Capital Rules, the agencies responded to public comment and sought to minimize the potential burden on community banks by making changes to the Proposed Capital Rules in three key areas:8

- Residential Mortgage Exposure: The Proposed Rules required higher risk weights applied to certain residential mortgage exposures. The Final Capital Rules retain a 50 percent risk weight for prudently underwritten first-lien mortgage loans that are not past due, reported as nonaccrual or restructured, and a 100 percent risk weight for all other residential mortgages. Similarly, the Final Capital Rules do not change the current exclusions from the definition of credit-enhancing representations and warranties.

- Accumulated Other Comprehensive Income ("AOCI") Filter: The Proposed Rules included most AOCI components in regulatory capital. In the Final Capital Rules, community banking organizations are given a onetime option to filter certain AOCI components, similar to current treatment. The AOCI opt-out election must be made on the institution's first regulatory report filed after Jan. 1, 2015.

- Grandfathered Capital Instruments and Tier 1 Capital: The Proposed Rules required all banking organizations to phase out of additional tier 1 capital TruPS and cumulative perpetual preferred stock. The Final Capital Rules exempt bank holding companies with less than $15 billion in total consolidated assets as of December 31, 2009, or organized in mutual form as of May 19, 2010, from this requirement. Grandfathered capital instruments, consistent with current treatment, are limited to 25 percent of adjusted tier 1 capital elements.

According to data from March 2013, the FRB indicated that nine out of 10 financial institutions with less than $10 billion in assets would meet the common equity tier 1 minimum plus buffer of seven percent in the Final Capital Rules.9 The FRB of St. Louis estimated that approximately 96 percent of U.S. BHCs and 90 percent of BHCs in the FRB Eighth District immediately met the 4.5 percent CET1 to RWAs ratio required under the Final Capital Rules.10 Additionally, community banking organizations have a five year period to meet the final phase-in requirements.11 Considering the potential impact of the Basel III capital requirements, the Banking Agencies took a thoughtful approach to the Final Capital Rules so that most community banks can keep calm and carry on.

Footnotes

1 Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Capital Adequacy, Transition Provisions, Prompt Corrective Action, Standardized Approach for Risk-Weighted Assets, Market Discipline and Disclosure Requirements, Advanced Approaches Risk-Based Capital Rule, and Market Risk Capital Rule, 78 Fed. Reg. 62,018, 62,020 n.2 (Oct. 11, 2013) (to be codified at 12 C.F.R. pt. 208, 217, 225).

2 See id.

3 Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Minimum Regulatory Capital Ratios, Capital Adequacy, Transition Provisions, and Prompt Corrective Action, 77 Fed. Reg. 52,792, 52,792 (Aug. 30, 2012) (to be codified at 12 C.F.R. pt. 208, 217, 225); Regulatory Capital Rules: Standardized Approach for Risk-Weighted Assets; Market Discipline and Disclosure Requirements, 77 Fed. Reg. 52,888, 52,888 (Aug. 30, 2012) (to be codified at 12 C.F.R. pt. 217); Regulatory Capital Rules: Advanced Approaches Risk-Based Capital Rule; Market Risk Capital Rule, 77 Fed. Reg. 52,978, 52,978 (Aug. 30, 2012) (to be codified at 12 C.F.R. pt. 217).

4 Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Capital Adequacy, Transition Provisions, Prompt Corrective Action, Standardized Approach for Risk-Weighted Assets, Market Discipline and Disclosure Requirements, Advanced Approaches Risk-Based Capital Rule, and Market Risk Capital Rule, 78 Fed. Reg. at 62,020 n.7.

5 Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111- 203, §§ 701–774, 124 Stat. 1376, 1641–1802 (2010) (to be codified in scattered sections of the U.S. Code).

6 Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Capital Adequacy, Transition Provisions, Prompt Corrective Action, Standardized Approach for Risk-Weighted Assets, Market Discipline and Disclosure Requirements, Advanced Approaches Risk-Based Capital Rule, and Market Risk Capital Rule, 78 Fed. Reg. at 62,018, 62,021.

7 Id. at 62,021.

8 Final Basel III Capital Rule–Less Impact on Community Banks, Fed. Res. Bank of St. Louis (Summer 2013), available at httphttp://www.stlouisfed.org/publications/cb/ articles/?id=2415 .

9 Press Release, Board of Governors of the Federal Reserve System, Federal Reserve Board Approves Final Rule to Help Ensure Banks Maintain Strong Capital Positions (July 2, 2013), available at http://www.federalreserve.gov/newsevents/press/ bcreg/20130702a.htm .

10 Final Basel III Capital Rule–Less Impact on Community Banks, supra note 8.

11 Id.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.