INTRODUCTION

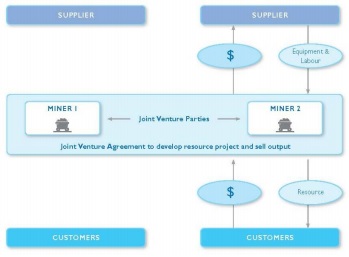

Joint venture structures are frequently used to undertake large resources projects. A joint venture may be used to both develop a project and sell the output from a project.

Such joint ventures often involve agreements between competitors. As such, joint ventures could breach the anti-competitive provisions of the Competition and Consumer Act 2010 (Cth) (Act) such as price fixing, bid rigging, other cartel conduct or exclusionary agreements if they do not fall within the joint venture exception and are not authorised.

This article outlines key competition issues that may arise in the marketing and sale of output from a joint venture project and two ways to mitigate the risk of a breach of the Act.

JOINT PRICING AGREEMENTS

Joint venture parties may wish to discuss and commonly agree the terms on which output will be sold.

This could breach section 45 of the Act, which prohibits competitors from reaching agreements with the purpose or effect of substantially lessening competition.

| In 2009, parties related to Chevron, Mobil and Shell sought approval from the Australian Competition and Consumer Commission (ACCC) to jointly market and sell natural gas from the Gorgon Gas Project to customers in Western Australia. The ACCC approved this agreement for reasons including the following. The Gorgon Project competes with gas sold by other projects including, for example, the North West Shelf joint venture, such that there was a pro-competitive benefit associated with the joint marketing. The lumpy nature of sales in the gas industry (i.e. large volumes in a small number of long term contracts) meant that greater benefit was likely to flow from competition between large projects than from competition between smaller suppliers. |

SELLING TO A SINGLE CUSTOMER

Joint venture parties may wish to sell all output to a single customer or single groups of customers.

This could breach the exclusionary provision prohibitions in the Act, which prohibit competitors from agreeing between themselves not to supply to particular customers.

| In 2006, BHP Billiton Iron Ore and a number of other companies including Mitsui Iron Ore and JFE Steel entered into a joint venture for the mining, processing and sale of iron ore from the Yandi region in Western Australia to purchasers in Japan. BHP Billiton Iron Ore was the sole and exclusive manager of the joint venture and would sell the output to JFE Steel. The parties submitted that the joint venture agreements did not contain exclusionary provisions but nevertheless sought authorisation for any provision of the arrangements that were exclusionary (including a provision with the purpose of restricting supply to particular persons). |

JOINT ADVERTISING

Joint venture parties may wish to jointly advertise their product in order to achieve synergies from the joint venture.

This could breach the price fixing provisions of the Act, which prohibit competitors from agreeing to fix, control or maintain the price of a product. Specifically, joint advertising is likely to result in both parties selling product at the jointly advertised price.

| In 2010, a joint venture comprising Benaris International, Origin Energy Resources and Woodside Energy obtained ACCC authorisation to engage in joint marketing of Liquid Petroleum Gas (LPG) from the Otway Gas Project. This joint marketing provided benefits including reducing transaction costs which may otherwise have been incurred in transferring LPG between the joint venture parties. Further, the ACCC considered the public detriment was limited for reasons including that the quantity of LPG jointly marketed was less than five percent of the quantity produced in the relevant market. |

MITIGATING THE RISK OF A BREACH

A limited exception from the cartel provisions in the Act applies for joint ventures in certain circumstances. That exception will not apply unless:

- the cartel provision is recorded in a contract, or the parties intended and reasonably believed that it was in a contract;

- the cartel provision is for the purposes of a joint venture; and

- the joint venture is carried on jointly by the parties to the contract.

Authorisation can remove any risk of a breach. Authorisation is available if the public benefit flowing from the conduct outweighs the public detriment constituted by any lessening of competition.

LOOK OUT FOR

Look out for our future update on 'Competition issues arising from exclusivity in supply chains.'

Click here for our related update on 'Competition issues in sharing infrastructure.'

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com