One of the first things that business owners and executives who are thinking about selling their company (or a division thereof) consider is who might be the right buyer for their company; where to find them; and how to get them engaged in meaningful discussions.

While it’s usually not possible to determine the single “right” buyer for a company, there are certain characteristics that make certain prospective buyers better than others.

Buyer Characteristics

- Strategic fit

- Decision-maker involvement

- Financial capacity to transact

- Relative size

- Experience at completing transactions

Strategic fit.

The seller should determine how their company fits with the buyer’s longer-term strategy and objectives. This is accomplished through a combination of research and a dialogue with the buyer’s representatives. Lack of a strategic fit will reduce the likelihood the buyer will be motivated to consummate a transaction, or that they will only do so at a low value. Conversely, a strong strategic fit will help the buyer in justifying a higher price and more attractive terms. In some cases, the buyer will reveal specific synergies that it expects to realize as a result of the transaction, which can help the seller in highlighting those benefits. Ideally, synergies should be in the form of incremental revenues rather than purely cost savings. As a general rule, buyers tend to be more amenable to paying a premium for revenue-based synergies.

Decision-maker involvement.

If a buyer is committed to acquiring a company, they should be involving key decision-makers at a relatively early stage of the sale process, including during the course of management presentations and negotiations with the seller. This helps ensure that the proposed acquisition has the necessary internal support, and avoids a situation where those negotiating the deal are unable to influence senior management about the merits of the transaction. While it’s often necessary for the buyer’s representatives to obtain support from their senior management team or board of directors, the seller should be satisfied that those involved in the discussions have the necessary authority to recommend the transaction and influence the ultimate decision-makers.

Financial capacity to transact.

Buyers should be able to demonstrate that they have the ability to consummate a transaction with available cash or credit facilities. A transaction that is contingent upon the buyer’s ability to obtain financing adds further risk to the seller that the deal may not close. Alternatively, a buyer that is not able to raise adequate financing may look for deferred payment mechanisms such as promissory notes and earn-out arrangements, which make the transaction less attractive to the seller from an economic value standpoint. If the seller is unsure about a buyer’s ability to finance a transaction (e.g. the buyer is a relatively small private company), the seller should request a comfort letter or similar documentation from the buyer’s financing sources prior to executing a letter of intent.

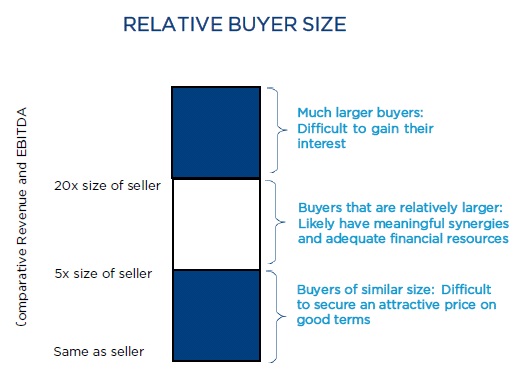

Relative size.

As a general guideline, the right buyer for a particular company is one that is between about 5x and 20x larger than the seller’s company, in terms of revenues and EBITDA (earnings before interest, taxes, depreciation and amortization). Where the buyer is not much larger than the seller, it can be difficult for them to raise sufficient capital to consummate the transaction without relying on promissory notes or other deferred forms of consideration. Further, a buyer may perceive a relatively large acquisition as being high-risk, which could reduce the likelihood that they will transact, or that they will look for a lower price to compensate for that risk. On the other hand, a buyer that is much larger than the seller’s company may lose interest because the seller’s financial results will not "move the needle" for the buyer on a consolidated basis, absent there being a highly strategic reason for undertaking the transaction (e.g. the seller’s company has proprietary technology that the buyer can significantly leverage in its existing operations).

Experience at completing transactions.

It’s usually preferable to deal with a buyer that has a track-record of completed transactions. This is because buyers that have consummated one or more transactions in the past will have better established procedures and a better idea of what to expect. Conversely, a buyer that is looking at their first transaction will have a greater learning curve, which could cause delays and place the closing at greater risk.

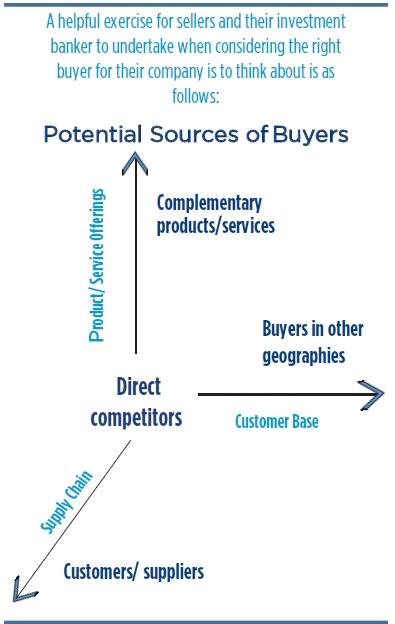

Where to Find the Right Buyer

There are numerous possibilities for where the right buyer may be found. While direct competitors are obvious choices, they are often not the right buyer. This is because direct competitors normally focus on cost-reduction type synergies, which they are less likely to pay for. Furthermore, dealing with direct competitors provides them with access to sensitive information about the seller’s operations. While a non-disclosure agreement might protect the seller against blatant misuse of confidential information, there is still a risk that some confidential information may be exploited in more subtle ways (e.g. where it influences the buyer’s pricing strategy for common customers).

More often, the right buyer is one that views the seller’s employees, customers, or product and service offerings (e.g. brand name; technology; and so on) as a platform for revenue growth (so-called “platform buyers”.) Platform buyers are more likely to retain the seller’s employees, and possibly offer them greater opportunities for career and personal advancement. This can facilitate the transition of the business and reduce the risk for both the buyer and the seller.

Complementary product and service offerings that offer cross-selling opportunities are a good example of revenue-type synergies that a platform buyer might perceive. From the buyer’s perspective, the ability to cross-sell can help entrench their relationship with both existing customers and new customers by offering a more diverse product or service selection.

In other cases, a platform buyer is attracted to the seller’s company because it offers geographic expansion, which can provide the buyer with both revenue growth and diversification (i.e. risk reduction). The ability to attract a buyer from another geographic region varies depending on the size and nature of the business. As a practical matter, most Canadian companies are sold to Canadian buyers (or a subsidiary of a foreign entity that has an existing presence in Canada). Given Canada’s vast geography, many buyers that have an established presence in one region of the country find that corporate acquisitions are the best means of inter- provincial expansion.

Not surprisingly, the most common foreign buyers for Canadian companies are those based in the U.S., who find that Canada is a natural extension to their U.S. presence. Attracting buyers from Europe, Asia or other regions outside of North America (who do not have existing operations in Canada) typically is more challenging. In most cases, buyers from these regions are only interested where the seller’s company is a sizable entity or possesses proprietary technology or other assets that can be leveraged on a global basis. Furthermore, the seller should anticipate that buyers from far-reaching regions will proceed more slowly than those based in North America, due to the learning curve, internal logistics and possible cultural differences.

Finally, consideration should be afforded to platform buyers that are existing customers or suppliers of the company that may be looking to expand through vertical integration (sometimes referred to as “supply chain analysis”). Caution is warranted however to approach these parties carefully, so as not to disrupt the seller’s existing business relationship.

Engaging the Right Buyer

Engaging the right buyer for a company is somewhat of an art. Rarely are these organizations attracted by general mass media solicitations (e.g. email blasts). Rather, for each buyer, the seller and their investment banker need to consider why that buyer might be interested in acquiring the company (i.e. the strategic fit and possible synergies). Advanced research is required in this regard, which includes publicly available information (e.g. the buyer’s website and news releases) as well as an analysis of previous transactions those buyers have undertaken.

Before approaching prospective buyers, it is important for the seller to ensure that their company is ready for sale, and that it represents an attractive acquisition target. Sellers only have one chance to make a good first impression. It is difficult (and the seller is in a less favourable negotiating position) where the seller must retract from the sale process to clean up their organization, and reengage a prospective buyer at a later date.

It is also important to approach the right individual(s) within the prospective buyers’ organization. This should be an individual(s) who understands the strategic direction of their company, can champion the potential acquisition and who has the authority within their organization to consummate (or at least recommend) the transaction.

Finally, the seller and their investment banker must closely manage the sale process to ensure that the right prospective buyers remain engaged, and to convey information in a manner that will help the buyer realize the strategic value of the acquisition opportunity.